Summary

- The Office for National Statistics reported that the UK's net borrowing was £127.9 billion between April 2020 to June 2020.

- As per the industry experts, the UK's grocery sale increased by 14.6 percent year on year in the four weeks to 12 July 2020.

- Codemasters Group entered a partnership with WRC Promoter GmbH for five years exclusive rights of FIA World Rally Championship videogames and esports tournaments.

- Codemasters Group has a strong pipeline for the new game launch in FY2021.

- Gaming Realms partnered with 888casino.com to launch Slingo Originals.

- Gaming Realm's licensing revenue increased by 90 percent year on year in Q1 FY2020

Given the above market conditions, we would discuss two gaming stocks - Codemasters Group Holdings PLC (LON:CDM) & Gaming Realms PLC (LON:GMR). As on 21 July 2020 (before the market close at 2.12 PM GMT+1), CDM was down by 0.01 and GMR was down by 4.69 percent against the previous day closing. Let's walk through their financial and operational updates to understand the stock better.

Codemasters Group Holdings PLC (LON:CDM) – Launched F1 2020 game for PC, Xbox, and Google Stadia

Codemasters Group Holdings PLC is a UK based Company that makes video games. The Company has five gaming studios, three in the UK, one in Kuala Lumpur, Malaysia and one in Pune, India. In 2019, the Company acquired Singapore based Gaming Company, Slightly Mad Studios. Codemasters Group was listed on the London Stock Exchange in 2018, and it is included in the FTSE AIM 100 index.

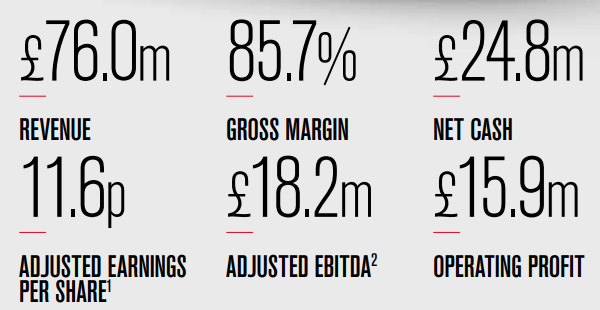

FY2020 Annual results (ended 31 March 2020) as reported on 22 June 2020

The Company reported revenue of £76.0 million in FY20, which increased by 6.8 percent year on year from £71.2 million in FY19. The boxed revenue declined from £29.1 million in FY19 to £24.6 million in FY20. The digital revenue was £43.5 million in FY20 that contributed 67.7 percent of the total revenue; the digital revenue was £30.7 million in FY19. The gross profit was up by 4.5 percent year on year to £65.2 million in FY20, reflecting a gross margin of 85.7 percent. In FY20, adjusted earnings per share were 11.6 pence. The Company launched two games, GRID and F1 2019. The Company extended the Formula contract with Formula One Management (FOM) from 2021 till 2025, with a two-year extension option. In November 2019, the Company acquired Slightly Mad Studios (SMS). As on 31 March 2020, the Company had cash of £25.6 million and debt of £0.8 million.

Recent Events

- On 10 July 2020, the Company launched F1 2020 for PC, Xbox and Google Stadia. The game was launched with new features.

- On 1 June 2020, the Company signed an agreement with WRC Promoter GmbH for five years exclusive rights of FIA World Rally Championship videogames and esports tournaments. The deal would allow Codemasters Group to launch games on console, PC and mobile platform from 2023 to 2027.

FY2020 Key Financial Highlights

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-21-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Codemasters Group Holdings PLC's shares last traded at GBX 369.35 (as on 21 July 2020, before the market close at 2:20 PM GMT+1). Stock 52-week High and Low were GBX 390.00 and GBX 190.00, respectively. The Group had a market capitalization of £556.95 million.

Business Outlook

The gaming sector is undergoing a transition and shifting to a digital mode; the industry was mostly unaffected by the pandemic and provided a route for escapism during the tough times. The digital gaming is strengthened by the launch of gaming consoles by Sony and Microsoft. The Company is well-placed to take advantage of the growing gaming sector through a diverse portfolio and critical partnerships. In FY21, Slightly Mad Studios would launch three games including CARS 3, CARS GO and Fast & Furious Crossroads.

Gaming Realms PLC (LON:GMR) – The revenue in Q1 FY2020 supported by the launch of new games

Gaming Realms PLC is a UK based developer and licensor of several digital gaming brands. The Company operates through original game content & intellectual property development. The Company license the gaming content and Slingo brand to online real money gaming operators, social publishing operators and land-based gambling games manufacturers. The Company has a mobile game studio in Victoria, Canada and Colchester, UK. Gaming Realms is included in the FTSE AIM All-Share index.

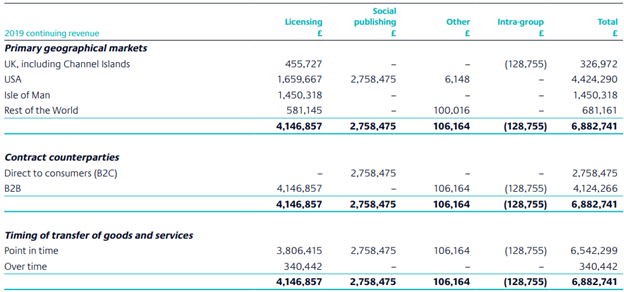

FY2019 Annual results (ended 31 December 2019) as reported on 28 April 2020

In FY19, the Company generated revenue of £6.9 million, which increased by 11.5 percent year on year. The licensing segment contributed 84 percent of the total revenue, and it was £4.1 million, whereas social publishing segment revenue was £2.8 million. The adjusted EBITDA loss widened to £0.3 million in FY19 from loss of £0.1 million a year ago. The loss from the continued activities was £4.6 million. In July 2019, the Company sold B2C real money game business for £11.5 million to River iGaming PLC. After the settlement of the liabilities, the Company received £7.0 million in cash, and £1.5 million is due by the end of 2020. The sale was part of the strategy to focus on content development and international licensing of the Slingo brand. In FY19, the Company engaged with 14 new partners for Slingo content to go live.

Trading update for five months (ended 31 May 2020) as reported on 2 June 2020

In Q1 FY20, the licensing revenue was £1.3 million, which was up by 90 percent from £0.7 million a year ago. The licensing segment performed well in April and May, and for a five-month period in FY20, the licensing revenue increased by 80 percent year on year. The social segment revenue was up by 15 percent for the same period year on year; the overall performance was supported by the launch of new games and critical partnerships. The Company launched games, such as Sky Betting & Gaming in the UK, Caliente in Mexico and Draftkings in New Jersey. On 5 May 2020, the Company partnered with 888casino.com to launch Slingo Originals.

FY2019 Revenue Breakup

(Source: Company Website)

Share Price Performance Analysis

1-Year Chart as on July-21-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Gaming Realms PLC's shares last traded at GBX 16.97 (as on 21 July 2020, before the market close at 2:12 PM GMT+1). Stock 52-week High and Low were GBX 19.68 and GBX 4.40, respectively. The Group had a market capitalization of £50.63 million.

Business Outlook

The Company is focused on creating and developing mobile intensive gaming content under Slingo intellectual property. The Company aims to expand internationally and reduce dependence on the UK market. Gaming Realms is currently operating in New Jersey, US and has applied for a license in Pennsylvania, US with further plans of expansion. The Company would apply for permits as states regulate online casino in the US.