Highlights

- For six months ended 31 July 2021, Saga’s profit before tax was £0.7 million, representing a 101% year-on-year increase.

- TUI recorded revenue of €649.7 million for Q3 2021 compared to €71.8 million in Q3 2020.

The year 2020 was disastrous for travel stocks, and many of these companies registered unprecedented losses due to restrictions imposed by the pandemic. However, with increasing vaccination rates, reopening of the economy, and changes in COVID-19 related restrictions, travel has begun to reopen. The current market conditions present an optimistic outlook for the travel industry.

(Data source: Refinitiv)

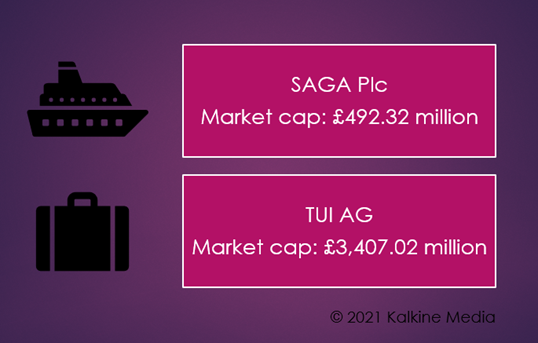

Here we conduct a detailed review of 2 FTSE travel stocks – SAGA and TUI.

SAGA Plc (LON: SAGA)

Saga is a UK-based company that specialises in products and services for people aged 50 years and above. The shares of SAGA are currently trading at GBX 344.60, down by 1.94% at 10:02 AM BST on 22 September 2021. The market capitalisation of the company is £492.32 million.

The group is registering a strong demand for departures over 2022-23, with revenue and passenger days growing by 58.9% and 39.6%, respectively. The company recorded 18% revenue growth in tour operations bookings for the new financial year compared to pre-pandemic levels.

For six months ended 31 July 2021, Saga’s profit before tax was £0.7 million, representing a 101% year-on-year increase compared to a £55.5 million loss in the same period in 2020. It recorded an available cash balance of £175.3 million in H1 2021 compared to £28.8 million in H1 2020.

TUI AG (LON: TUI)

TUI is global leisure, and travel and tourism firm. In July 2021, TUI sold its minority stake in a property portfolio to the Riu family. The shares of TUI are currently trading at GBX 312.40, up by 0.81% at 10:06 AM BST on 22 September 2021. The market capitalisation of the company is £3,407.02 million.

For Q3 2021, the company recorded 876k customers departures compared to 159k in Q2 2021.

For Q3 2021 ended 30 June 2021, TUI recorded revenue of €649.7 million compared to €71.8 million in Q3 2020. Its available liquidity reached €3.1 billion as of 9 August 2021.

Conclusion:

As travel companies register recovery in bookings and profits post the COVID-19 pandemic, investors are being attracted by travel stocks. These stocks can prove to be a valuable addition to an investor’s portfolio as there is a lot of pent-up demand in the sector after the reopening.

.jpg)