Highlights

- The gross domestic product (GDP) of the UK grew by 1.3% in the third quarter of 2021.

- Hospitality was the largest contributor of the GDP in the quarter because of further ease in lockdown restrictions and reopening of the economy.

The gross domestic product (GDP) growth of the UK stood at 1.3% in the third quarter of 2021, as per the latest data released by the Office for National Statistics (ONS). GDP, which measures the market value of all goods and services consumed within the country in a specific time duration, is an important metric to gauge economic progress and compare it with other nations.

The GDP growth was though below the forecast of 1.5%. As per market experts, the sluggish growth in GDP was mainly due to the supply chain crisis faced by multiple industrial and service sector companies during the quarter.

Q3 GDP growth slows: Should you bet on hospitality stocks?

During the third quarter, the highest contribution to GDP came from hospitality, arts and recreation, and health segments. Amongst these segments, hospitality was the largest contributor following further ease in lockdown restrictions and reopening of the economy.

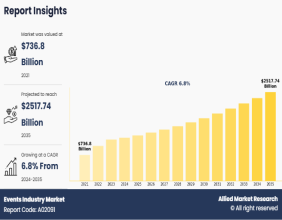

The hospitality industry is a broad category that includes multiple sub-segments like travel and tourism service, restaurants, theme parks, food and drinks service and many other segments. The overall industry was significantly impacted by the Covid-19, leading to the closure of businesses and job losses in the sector.

Let us look at 3 FTSE listed hotels and resorts stocks that is one of the key sub-segments within the hospitality industry:

Intercontinental Hotels Group Plc (LON: IHG)

The company owns and manages a chain of hotels, restaurants, resorts in the UK and other European and Asian countries. It operates over 5900 hotels across 100 countries.

The company reported an excellent recovery in its business after the Covid-19 pandemic. At present, the hotel business is operating at close to 60% occupancy rate, and further growth is expected due to pent up travel demand and ease in travel restrictions. Also, the company is planning to add additional rooms by opening new hotels to cater to rising demands from travellers. The company’s stocks can be considered for investment as the overall sector is witnessing a revival in demand, and hence the company is expected to benefit from the rebound in the sector.

Intercontinental Hotels Group Plc currently trades at GBX 5,162, up by 0.16% on 11 November 2021 at 10:30 am GMT+1 with a market cap of £9,442 million. In the last one year, the stock has given an 11.52% return to its shareholders.

Whitbread Plc (LON: WTB)

FTSE100 listed company operates over 850 hotels in the UK and European countries under the Premier Inn, Whitbread Inns, and other brands.

The company reported revenue of £661.6 million in the 26 weeks ended 26 August 2021. It witnessed significant business recovery across its different brands. The company expects to reach full recovery by 2022 and is confident of returning to higher profit margins in the UK due to a pickup in demand and occupancy rate.

Whitbread Plc currently trades at GBX 3,329, down by 0.7% on 11 November 2021 at 10:30 am GMT+1 with a market cap of £6,742.6 million. In the last one year, the stock has given a 23.69% return to its shareholders.

PPHE Hotel Group Limited (LON: PPH)

The company owns and manage full-service hotels in the UK and European countries. It operates its hotels under various brand names like Arena Campsites, the Park Plaza, and many more.

The company reported total revenue of £75.7 million, a rise of 142.2% in the third quarter ended 30 September 2021, while its occupancy rate was at 54.3% during the period. The growth in revenue was possible due to long term focused growth strategy through property repositioning and portfolio expansion. The company has a positive outlook for the fourth quarter supported by high hotel booking momentum, demand for corporate meetings and events.

PPHE Hotel Group Limited currently trades at GBX 1,338, on 11 November 2021 at 10:30 am GMT+1 with a market cap of £569.18 million. In the last one year, the stock has given a 2.92% return to its shareholders.