Summary

- FirstGroup reported revenue of £7,754.6 million in FY2020, which increased by 8.8 percent year on year. First Student and First Transit business divisions supported revenue growth.

- The operating profit was £256.8 million, and the covid-19 impact was £53.5 million in FY2020.

- Stagecoach's revenue declined by 24.6 percent year on year in FY2020 following the end of two rail contracts.

- Operating profit declined by £61.2 million to £119.7 million in FY2020.

FirstGroup PLC (LON:FGP) and Stagecoach Group PLC (LON:SGC) are providers of essential services in the UK. The revenue of FGP & SGC grew at a CAGR of 10.41 percent and -22.21 percent, respectively between FY2016 and FY2020. Shares of FGP and SGC were up by around 18.91 percent and 1.72 percent, respectively from the last closing price (as on 7 September 2020, before the market close at 10:00 AM GMT+1)

FirstGroup PLC (LON:FGP) - Focussed on sale of North American business

FirstGroup PLC is a UK based group that provides transport services. The Group has an operation in the UK and North America, and it employs close to 100,000 employees. FirstGroup is included on the FTSE 250 index.

FY2020 results (ended 31 March 2020) as reported on 8 July 2020

(Source: Group website)

In FY20, FirstGroup reported revenue of £7,754.6 million, which increased by 8.8 percent year on year from £7,126.9 million in FY19. The adjusted EBITDA increased to £1,108.9 million in FY20 from £670.3 million in FY19. The operating profit was £256.8 million in FY20 that fell by 20.1 percent year on year from £314.8 million in FY19. Covid-19 had a negative impact of £53.5 million in FY20. The Group reported adjusted profit before tax of £109.9 million and adjusted earnings per share of 6.8 pence in FY20. As on 31 March 2020, it had net debt of £3,278.1 million. The business in FY20 was supported by the strong performance of First Student and First Transit, but it was partly offset by the insurance and labour costs.

Performance by Business Division in FY2020

In FY20, First Student segment reported revenue of £1,940.4 million, which increased by 2.2 percent year on year. The operating profit was £158.8 million for First Student that reflects an operating margin of 8.2 percent in FY20. First Transit generated revenue of £1,171.4 million in FY20 that was up by 5.6 percent year on year, and the operating profit was £28.3 million with an operating margin of 2.4 percent. The reported revenue for Greyhound and First Bus business division declined by 9.4 percent and 4.6 percent year on year to £603.2 million and £835.9 million, respectively. First Rail reported revenue of £3,185.9 million, which increased by 19.5 percent year on year from £2,666.7 million in FY19. First Rail generated an operating profit of £68.8 million with an operating margin of 2.2 percent.

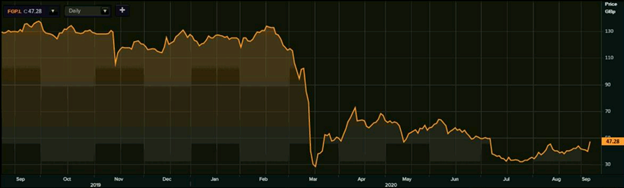

Share Price Performance Analysis

1-Year Chart as on September-7-2020, before the market close (Source: Refinitiv, Thomson Reuters)

FirstGroup PLC's shares were trading at GBX 47.28 and were up by close to 18.91 percent against the previous closing price (as on 7 September 2020, before the market close at 10:00 AM GMT+1). FGP's 52-week High and Low were GBX 138.80 and GBX 25.00, respectively. FirstGroup had a market capitalization of around £485.32 million.

Business Outlook

The pandemic weighed down on the Group's business as the travel volumes declined significantly. The travel volume is expected to remain low in the near future due to social distancing and safety norms. Transportation is an essential service, and thus the long-term outlook of the Group remains resilient. FirstGroup is considering the sale of the North American business. It has withdrawn the financial guidance for FY21.

Stagecoach Group PLC (LON:SGC) - Shortlisted for bus contract bids in Dubai and Sweden

Stagecoach Group PLC is a UK based group that provides public transport services. The Group operates in England, Scotland and Wales and runs bus, coach and trams. It operates close to 8,400 buses and coaches and employs around 24,000 people.

FY2020 results (ended 2 May 2020) as reported on 7 August 2020

(Source: Group website)

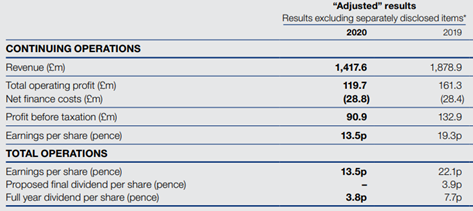

In FY20, Stagecoach Group reported revenue of £1,417.6 million, which declined by 24.6 percent year on year from £1,878.9 million in FY19. Rail division revenue was impacted in FY20 as the contract for East Midlands rail franchise finished in August 2019. The contract for West Coast rail franchise ended in December 2019 that was run under joint venture Virgin Rail Group. The covid-19 impacted bus revenue. The operating profit was £119.7 million in FY20 that fell from £161.3 million a year ago. The earnings per share declined from 19.3 pence in FY19 to 13.5 pence in FY20. As on 20 July 2020, Stagecoach had cash of £434.0 million, and the total liquidity headroom was £840.0 million, including cash and undrawn credit facilities. The Group paid the interim dividend per share of 3.8 pence, and no final dividend was announced for FY20. Post-lockdown the commercial sales in England, Scotland and Wales have improved slightly, and the Group has also ramped up the vehicle mileage. Currently, it is operating at a limited seat capacity due to social distancing norms.

Performance by Class and Segment in FY2020

Based on Class, Bus operations generated revenue of £1,258.1 million in FY20, which declined from £1,296.1 million in FY19. The regional bus revenue was improving pre-covid, and on like for like basis it grew by 2.7 percent year on year in 14-weeks ended 1 February 2020 that was halted due to the pandemic. The UK Rail reported revenue of £161.1 million in FY20 that fell from £589.5 million in FY19. By segment, Commercial passenger revenue was £761.8 million, Concessionary revenue was £256.6 million, Tendered & School revenue and Contract & Other revenue were £104.4 million and £294.8 million, respectively.

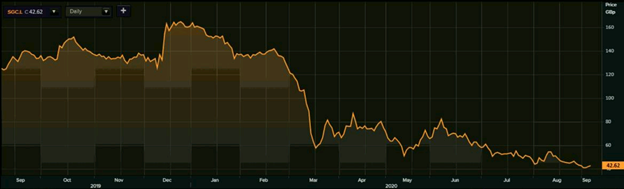

Share Price Performance Analysis

1-Year Chart as on September-7-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Stagecoach Group PLC's shares were trading at GBX 42.62 and were up by close to 1.72 percent against the previous closing price (as on 7 September 2020, before the market close at 10:00 AM GMT+1). SGC's 52-week High and Low were GBX 166.80 and GBX 39.78, respectively. Stagecoach Group had a market capitalization of around £230.68 million.

Business Outlook

The Group highlighted that the trading conditions remain challenging in the short-term; however, the long-term outlook of the business is promising. The government policies in the UK are supportive of Public transport, and the government is looking at the investments in improving the Public transport infrastructure. The Group is actively taking measures in reducing the discretionary expenses, and it has cut the capital expenditure for FY21 to £74.0 million, from the previous target of £143.0 million. The Group is growing its portfolio and operational markets, and it is shortlisted for two bus contract bids in Dubai, in addition to four bus and one rail contract bids in Sweden.