Summary

- TUI AG catered to 1.4 million customers for a holiday between mid-June and August 2020.

- Booking cancellation increased due to the recent changes in the government's travel-related policies.

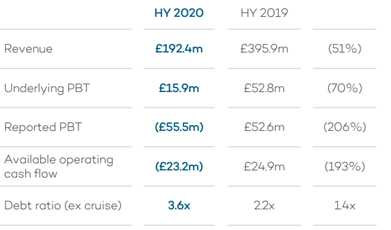

- Saga PLC generated revenue of £192.4 million in HY 20, which fell by 51.4 percent year on year.

- The revenue was impacted by shut down of travel business and lower sale of travel insurance policies.

TUI AG (LON:TUI) and Saga PLC (LON:SAGA) are two FTSE-listed travel and leisure stocks. Covid-19 has severely impacted the travel business and based on 1-year performance, shares of TUI and SAGA were down by around 67.46 percent and 73.54 percent, respectively. Shares of TUI were up by nearly 0.70 percent, whereas shares of SAGA were down by close to 2.10 percent from their previous closing price (as on 22 September 2020, before the market close at 11:50 AM GMT+1). In the trading update released on 22 September 2020, TUI stated that 8,000 jobs would be redundant as per its global realignment programme.

TUI AG (LON:TUI) - Q4 FY2020 cash flow is as per expectation

TUI AG is a Germany based tourism group, and it covers the entire tourism value chain as it has 1,600 travel agencies, 150 aircraft, 400 hotels and 17 cruise ships. It categorizes the business under Holiday Experiences and Markets & Airlines. TUI is listed on the FTSE-250 index.

TUI's Integrated Business Model

(Source: Group website)

Trading update for FY20 (ending 30 September 2020) as reported on 22 September 2020

TUI highlighted that January 2020 was the best month in terms of bookings in the Group's history. The onset of the covid-19 disrupted the business activity, and it has operated business in line with government guidelines. Given the lower travel demand and strict travel guidelines, it has adjusted the operating capacity. The bookings for summer 2020 were down by 83 percent year on year, and the average selling price was down by 15 percent. The summer bookings were around 15 percent of the originally planned programme of the Group as a majority of the bookings have been cancelled since March 2020. TUI reopened 157 hotels & resorts by the end of August 2020, and it started operating TUI Cruises and Hapag-Lloyd Cruises on short-haul European trips. The destination experiences have also restarted from mid-June. Since the restart of business from mid-June until the end of August 2020, TUI took 1.4 million customers on the trip. The Group has started generating cash flow from new customer bookings, and the booking refund obligations have gone down. TUI completed the disposal of Hapag-Lloyd Cruises to TUI Cruises joint venture in August 2020.

Liquidity position

The Group reached an agreement with the German Federal Government for the financial help of €1.2 billion, which includes KfW tranche of €1.05 billion and convertible bond of €150 million. The stabilization package is subject to pre-conditions. As on 20 September, TUI had a liquidity headroom of €2.0 billion.

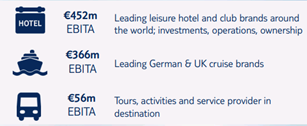

Performance by business division in H1 FY2020

Holiday Experiences Markets & Airlines

Share Price Performance Analysis

1-Year Chart as on September-22-2020, before the market close (Source: Refinitiv, Thomson Reuters)

TUI AG's shares were trading at GBX 272.90 and were up by close to 0.70 percent against the previous closing price (as on 22 September 2020, before the market close at 11:50 AM GMT+1). TUI's 52-week High and Low were GBX 1,090.00 and GBX 218.00, respectively. TUI had a market capitalization of around £1.60 billion.

Business Outlook

The Group stated that leisure travel is expected to resume earlier than business travel, and it is well poised to serve the customers through its travel value-chain. The travel activity picked up since June 2020, but due to the recent policy on travel guidance, there have been cancellations. The Group has reduced the travel capacity by almost 40 percent for the winter 20/21 programme, of which 30 percent is sold. TUI expects to operate at 80 percent of its normal capacity in summer 2021, and the bookings are up by 84 percent, and average selling price is up by 10 percent for the same period year on year. In Q1 FY21, TUI expects the lower working capital, and it anticipates monthly cash flow in between low-to-middle single-digit hundreds million per month.

Saga PLC (LON:SAGA) - Expects the travel business to recover in 2021

Saga PLC is a UK based company that is engaged in the travel and insurance business. The Company provides insurance cover for travel, home and motor. It also operates cruises and tour operation business. Saga is listed on the FTSE All-Share index.

Six months results (ended 31 July 2020) as reported on 10 September 2020

(Source: Company website)

The Company reported revenue of £192.4 million in HY 20, which fell by 51.4 percent year on year from £395.9 million in HY 19. The revenue was impacted due to the suspension of the travel business following the pandemic and lower retail broking revenue due to a fall in travel insurance policies. The underlying profit before tax was £15.9 million in HY 20 that was £52.8 million in HY 19. The Company reported a loss before tax of £55.5 million in HY 20 against profit before tax of £52.6 million in HY 19. The loss per share was 5.1 pence in HY 20. The earnings in HY 20 were impacted due to the restructuring costs and impairment of travel goodwill related to cruise business and travel operations. As on 31 July 2020, Saga had net debt of £646.0 million.

Operational Performance

The Company sold 900,000 policies in HY 20, which declined by 4.4 percent year on year due to lower sales of travel insurance policies. The sale of motor and home insurance policies increased by 2.5 percent year on year to 831,000 due to higher retention rate of 80 percent. The motor and home insurance had margins of £71 per policy after the marketing costs. The performance of the underwriting business was above the Company's expectation, and there were fewer claims since March 2020 onwards as lower miles were driven during the lockdown. The travel business was severely impacted due to the pandemic; however, Saga plans to start the Cruise business in 2020 and tour operation business from April 2021. Saga highlights that it has strong loyalty of customers as 65 percent of the customers still hold their bookings.

Performance by segment

The Company generated revenue of £133.7 million from the Insurance business in HY 20, which was lower than £161.6 million generated in HY 19. The profit before tax from the Insurance business was £70 million. Travel business generated revenue of £49.3 million HY 20, which fell from £219.0 million a year ago, and it reported a loss before tax of £43.6 million in HY 20.

Five priorities of Saga

(Source: Company website)

Share Price Performance Analysis

1-Year Chart as on September-22-2020, before the market close (Source: Refinitiv, Thomson Reuters)

Saga PLC's shares were trading at GBX 12.14 and were down by close to 2.10 percent against the previous closing price (as on 22 September 2020, before the market close at 11:50 AM GMT+1). Saga's 52-week High and Low were GBX 54.64 and GBX 11.39, respectively. Saga had a market capitalization of around £216.42 million.

Business Outlook

The Company stated that it has confidence in the insurance business and resurgence of the travel business in 2021. The outstanding debt is expected to decline due to the £150 million capital raise with Sir Roger De Haan as the lead investor. The digital channel and relaunch of the brand are expected to bring significant positive change from 2021.