Summary

- Cities Direct becomes the latest travel company to cease trading due to the impact of Covid-19 crisis

- End of furlough scheme next month coupled with the ongoing slump in travel bookings could lead to collapse of more businesses within the sector

- The abrupt drop in the confidence of the travellers has made it very difficult for the business to get the revenue through the doors.

The impact of coronavirus pandemic travel restrictions has been devastating on the Travel & Tourism industry. Most of the businesses in this sector witnessed several job redundancies and are struggling to remain afloat in the current environment.

After a journey of around 20 years, travel company, Cities Direct ceased trading on 7 September 2020. Though, all the bookings made in advance were protected by the Civil Aviation Authority, which means the money was safe.

The Travel & Tourism sector has been among the most noticeably hit segments during this exceptional emergency prompted by the Covid-19 pandemic. As the countries over the globe went through lockdown, travel limitations were forced to contain the spread of the lethal infection. The sector saw significant job losses during the heightened crisis. The businesses are facing further headwinds from refund seeking customers.

The abrupt drop in the confidence of the travellers has made it very difficult for the business to get the revenue through the doors. This could lead to shutdown of well-established businesses in the sector. It could take much longer than anticipated to recuperate from the devastation brought about by the Covid-19 pandemic.

There has been a lot of confusion amongst travellers with regards to the UK’s quarantine regime. Most of the Britons plan holidays during this time of the year and France, and Spain has been amongst the popular holiday destinations for Britons. However, with a sudden rise in the coronavirus infections these two countries were added in the list of UK quarantine countries.

Billions of pounds have been wiped out of businesses which thrived upon incoming passengers since the travel restrictions were imposed on domestic and international travel.

In this article, we would put our lens through two LSE listed travel and leisure stocks: CCL and TUI.

- Carnival Plc

Since the beginning of 2020, Carnival Plc (LON:CCL) has lost a significant amount of market capitalisation, which could have resulted in its exclusion from the Footsie, London’s broader equity benchmark index. None of Carnival’s cruise lines have commenced journeys due to the coronavirus pandemic since March. Moreover, the UK based employees of the company would undergo a 20 per cent reduction in wages until November.

The company has raised £5 billion by issuing fresh debt and equity in April. The company also accessed a £25 million loan under Covid-19 Corporate Financing Facility (CCFF) launched by the British government.

Carnival is into losses with its revenue being reported at US$ 5,529 million, down by almost 50 per cent during the first half of 2020. Movements in the foreign currency exchange rates will affect the company's financial statements. The Company is anticipating a negative impact on its financial results and liquidity due to the outbreak of the Coronavirus pandemic. Carnival has postponed its voyages until March 2021.

However, the long-term prospects of the Carnival Group remain strong as the company’s total revenue grew by approximately 7.29 per cent on a CAGR basis; from USD 15,714.00 million in FY2015 to USD 20,825.00 million in FY2019. Costa has become the first cruise company to obtain RINA Biosafety Trust Certification and has introduced Covid-19 tests for its guests.

Carnival (LON:CCL) has taken several corrective actions to boost liquidity; such as a reduction in non-priority operating expenses and planned capital expenditure, while pursuing additional financing options to remain afloat during this storm. During the three weeks ending 26 January 2020, Carnival reported a strong start of season with stronger booking volumes in comparison to last year. Moreover, Carnival has a decent business model, which could sustain the development of the company and could also drive the growth for the company in the future.

1 Year Share Price Chart On LSE: CCL

(Source: Refinitiv, Thomson Reuters)

On 11 September 2020, at the time of writing, GMT+1 09:10 AM, CCL shares were trading at GBX 1,131.50, up by 0.18 per cent against the previous day closing price.

TUI AG

Germany-based tourism group, TUI AG’s all three Cruise operations remained suspended throughout the quarter; the operations were suspended following the advisory issued by both UK and German government. TUI AG (LON:TUI) reported a slump of 98 per cent in group revenue for third quarter of 2020.

The business of the company has come to a standstill for most of the quarter with partial operations successfully resumed from mid-May, the Group revenue slumped to €75 million in the third quarter ended June 2020. The operations were suspended for most of the quarter, impairments triggered by COVID-19 and net costs arising from ineffective hedging contracts resulted in an underlying EBIT loss of €1.1 billion in the third quarter of 2020. Recent additional stabilisation package received from the German Federal Government will help the Company to improve its financial position and provide sufficient working capital.

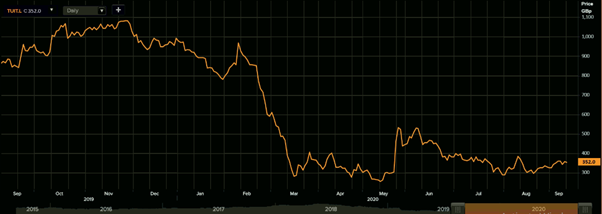

1 Year Share Price Chart On LSE: TUI

(Source: Refinitiv, Thomson Reuters)

On 11 September 2020, at the time of writing, GMT+1 09:19 AM, TUI shares were trading at GBX 352.30, down by 1.29 per cent against the previous day closing price.

A lot of people usually plan holidays during this time of the year, and it is considered the peak season which businesses look forward to. Policy inconsistency in terms of adding several nations to the quarantine lists would certainly deter the confidence of the battered industry. Moreover, the government as per its initial plan could end furlough scheme next month, which coupled with the ongoing slump in travel bookings could lead to collapse of more businesses within the sector. Things look a bit gloomy for the Travel & Tourism sector in the near term.

Also Read- Travel woes during the pandemic: UK to lose £22 billion as international travel dips