One of the key names of UK hospitality with over 2,000 shops has emerged as a leader in the last couple of years. The company has aptly demonstrated the resilience of the business model as well as the potential for longer-term growth. Greggs Plc has transformed from a simple bakery chain to food-on-the-go in the last eight years.

FTSE250 listed bakery chain operator Greggs Plc (LON: GRG) recently appointed Roisin Currie as its new Chief Executive. He will succeed Roger Whiteside, who has run the company’s operation for the last nine years but decided to retire from the company in 2022. The company’s stock performed exceptionally well under Roger Whiteside management, rising from GBX 4.7 in February 2013 to GBX 3,280 as of 06 January 2021.

What does the latest business update say about the health of the company?

The company in its fourth-quarter business update stated that the total sales across its 2,181 shops were at £1,230 million, for the financial period till 1 January 2022, a rise of 5.3% compared to the 2019 period.

The company witnessed strong demand for its different products and sold 6.7 million shop-baked mince pies during the festival season. The sales growth was achieved despite multiple operational challenges faced by the company, like disruption due to staff shortage and supply chain issues.

The company recently launched a new vegan bake product to evolve according to consumer tastes and dietary choices. Moreover, 131 new stores were opened to bring the total stores count to 2,181 across Britain. The home delivery service of its bakery products is now available across 1,000 shops through its delivery partner Just Eat.

Greggs’ Financial position

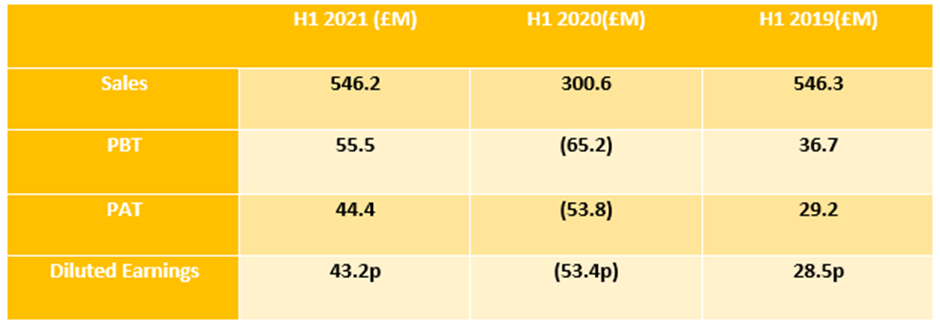

For the 26 weeks ended 3 July 2021, the company reported a sales decline of 9.2 per cent on a like-for-like two-year basis, though the company still managed to post growth for the second quarter. Most importantly, the company posted a profit before tax of £55.5 million for the reported period.

There has not been much margin pressure on the company when compared to H1 2019 levels, albeit Greggs has managed to reduce administrative expenses to 6 per cent in H1 2021 from 6.9 per cent in H1 2019, which mainly came through lower incentive charges and almost £1 million of structural savings.

Greggs had a robust cash position of £118 million cash as of 3 July 2021, other than that it held £100 million of undrawn RCF. The company ended 2021 with a cash position of £198 million.

(Data Source-Company Release)

Recent stock performance

(Image Source: Refinitiv)

The company’s stock continues to outperform in line with excellent business performance. In the last one year, the stock has given around 55% return to its shareholders (as of 10 January 2022) driven by the positive sentiments around the business after an ease in the Covid-19 restriction resulting in most of its stores being open for customers. The company’s current market cap stands at £3,120.09 million with a dividend yield of 1%, as of 10 January 2022.

Bottom line:

Greggs Plc currently has a robust financial position and is actively looking to invest in an attractive business opportunity. The company plans to open 150 net new stores in 2022 and anticipates the full-year outcome to be slightly ahead of previous market expectations. Its latest shop format supports digital order collection, which goes down well with its significant investment to strengthen digital capabilities to strengthen and propel the business.

As a result, the company plans to distribute additional dividends to its shareholders if business outcomes continue to be in line with expectations. Greggs is targeting full-year ordinary dividend around two-times covered by earnings. It will report the full year result for 2021 on 8 March 2022.