Highlights

- Lookers’ revenue was £2,153.2 million for the H1 ended 30 June 2021 compared to £1,570.6 million in H1 2020.

- Pendragon increased its underlying profit before tax guidance for the year ended 31 December 2021 from £55.0 million - £60.0 million to £70.0 million.

According to the Society of Motor Manufacturers and Traders (SMMT), only 106,265 new car registrations were recorded in the UK in October 2021, which represents a 24.6% decline year-on-year. This is the industry’s record low October performance since 1991.

The association revised its forecast for new car registration for the year by 8.8%, on the back of supply chain issues and a poor economic outlook. Battery electric vehicle registrations in the UK rose by 73.1% in October, and demand for plug-in hybrids increased by 7.5% in the same month. Plug-in vehicles accounted for 16.6% of the total registrations this year. Supply chain issues could result in buyers waiting for over 6-12 months for the delivery of their new cars.

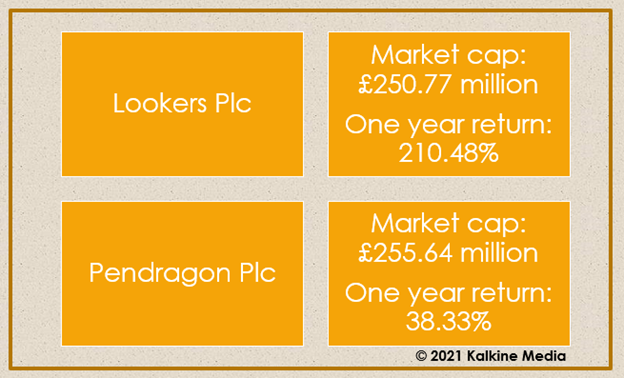

Below is a detailed review of the investment prospect in two auto dealer stocks - Lookers and Pendragon, who, despite considerable uncertainty, are upbeat on the growth prospects and have raised their profit guidance.

(Data source: Refinitiv)

Lookers Plc (LON: LOOK)

Lookers is a UK-based car dealership. The company is engaged in retail sales of motor vehicles and their aftersales service. The company’s like-for-like used unit sales declined by 16.9% in Q3 ended 30 September 2021. Its aftersales revenues during the period were 3.5% lower than last year.

For the H1 ended 30 June 2021, Lookers’ revenue was £2,153.2 million compared to £1,570.6 million in H1 2020. Its underlying profit before tax was £50.3 million in H1 2021 compared to an underlying loss before tax of £36.5 million in H1 2020. The company’s new vehicle sales represented 43.5% of the total sales in H1 2021 compared to 41.5% in H1 2020 in terms of total revenue and 25.8% in terms of gross profit. The company had said that it would comfortably beat the profit expectations for the final quarter despite so much of uncertainty in the sector.

The shares of Lookers closed at GBX 65.20, up by 1.88% on Thursday, 4 November 2021, with a market capitalisation of £250.77 million. In the last one year, the shares of Lookers gave a return of 210.48% to shareholders.

Pendragon Plc (LON: PDG)

Pendragon is one of the leading FTSE listed motor retailers in Britain. Recently, Hedin Group AB increased its stake in Pendragon to 23.2%. Yesterday, the dealer also officially announced the appointment of Ian Filby as the company’s new non-executive chairman.

Pendragon had increased its underlying profit before tax guidance for the year ended 31 December 2021 from £55.0 million - £60.0 million to £70.0 million.

Pendragon recorded a strong underlying profit before tax in H1 2021 of £35.1 million, up from a loss of £31.0 million in the same period in 2020. The company’s revenue stood at £1,815.6 million in H1 2021 compared to £1,218.3 million in H1 2020, representing an increase of 49% year-on-year.

The shares of Pendragon closed at GBX 18.68, up by 2.05% on Thursday, 4 November 2021, with a market capitalisation of £255.64 million. In the last one year, the shares of Pendragon gave a return of 38.33% to shareholders.