Highlights

- Reabold Resources is an upstream oil & gas investment company focused on low-risk and high-return projects.

- Reabold’s investment is focused on projects with low-drilling risk and a near-term work program supported by clear exit opportunities.

- The company’s oil & gas assets are located in Europe and the USA.

- Reabold’s share price has tripled from the December 2021 lows.

Crude oil prices are on firm footing this year. Brent crude is trading well above US$110/bbl, and some market experts are of the view that it could rise further as the world is going through a massive overhaul in the energy supply chain. The Russia-Ukraine conflict has exposed how Europe is dependent on Russian oil and gas supplies.

Europe is currently dependent on imports of LNG from the USA. The local supplies are not enough to meet requirements, and renewables, as the world has come to see, are not reliable to bank on.

Given this backdrop, market participants are looking for companies that can support Europe’s energy security given the current energy crisis. A strong energy price has also helped companies operating in this segment to further solidify their financials.

LSE-listed Reabold Resources’ shares on the rise

Reabold Resources PLC (LON:RBD), an upstream oil & gas investment company, focused on low-risk and high-return projects, is committed to developing oil and gas assets in Europe to ease the import dependency of the region. Reabold’s shares have seen strong momentum since December 2021. From a low of GBP0.001, the stock has risen to GBP0.0035, up 3.5x. Even on a YTD basis, Reabold shares have performed well.

Reabold Resources- a focused player

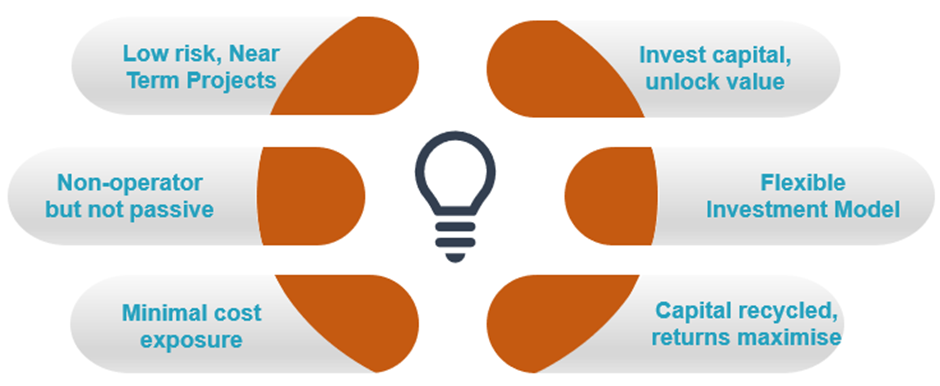

Reabold does not operate petroleum projects, rather invests in high-quality opportunities to unlock value and create significant value for its investors.

Reabold Resources’ strategy

Data source: Company website

Reabold maintains significant exposure to oil and gas projects located in the UK, Romania and the USA. The company recently announced that it is progressing the sale of its investee company, Corallian Energy, the 100% owner of the strategically attractive Victory gas field in the North Sea. Additionally, Reaold had entered into a Sale and Purchase Agreement (SPA) to acquire Corallian’s non-Victory licences, for GBP250,000. Many of these licences have opportunities similar to Victory and provide Reabold with the ability to continue executing its business strategy.

Reabold owns 49.99% of Corallian. The GBP250,000 deal is expected to proceed to completion at the time that the issued share capital of Corallian is acquired by a ‘potential buyer’.

Related read: Reabold’s (LSE:RBD) subsidiary Corallian receives acquisition offer

Following are the key aspects that keep the momentum going for Reabold:

- Geography

Reabold operates projects in Tier-1 markets, including, the UK, the USA and Romania. The European region is struggling to secure a reliable energy supply. Production from the assets located in the European region are likely to fetch higher prices as it lowers supply risks for European buyers.

- Project economics

Reabold invests in projects that have extremely attractive returns at current and lower commodity price levels. The Company evaluates projects on the basis of lower capital expenditure and low geopolitical risks.

- Crude oil price

As stated earlier, crude oil prices have been on fire since the second half of 2021. The ongoing conflict in Eastern Europe has ensured that the prices remain higher in the near term. An embargo on Russian energy exports could affect the prices in the long term as it will be not an easier task to replace a 10MMbbl per day (before the war) of production coming in from Russia.

- Exit Policy

Exit timing from a particular project is of critical importance. Timing the exit decision optimally is what helps Reabold to achieve scale and deploy more capital over time.

- Strong Management

Reabold’s Board and management consist of highly experienced and skilled individuals. Board members have extensive experience in finance and investing as well as in the oil and gas sector. The management has been channelling all its resources towards steering Reabold on a high-growth path.

Related read: Reabold (LON:RBD) bolsters its management by appointing a new Chief Financial Officer

Reabold’s investments are in operating companies whose key value driver is their energy asset. The company aims to run a low-cost, non-operator business model where monetisation versus the entry price of the energy projects determines the value.

.png)