Tullow Oil Plc

Tullow Oil Plc (LON:TLW) is an oil and gas company based out of London, United Kingdom and its major business is the exploration and extraction of oil and gas through its assets located in Ghana, Gabon, Uganda as well as Kenya.

TLW Latest News

On 2nd January 2020, the company issued a press release to report results from the Carapa-1 well. The company reported that Carapa-1, which is located in offshore Guyana, on preliminary examination had encountered four meters of net oil pay. Preliminary tests that have been conducted have resulted in the finding of oil in Upper Cretaceous age sandstone reservoirs.

TLW Share Price Performance

As on 3rd January 2020, at 11:00 A.M GMT, by the time of writing, Tullow Oil Plcâs share price was reported to have been trading at GBX 60.96 per share on the London Stock Exchange, an increase in the value of 2.18 per cent or GBX 1.30 per share, in comparison to the previous dayâs closing price, which was reported at GBX 59.66 per share.

The beta of the stock of the company has been reported to be at a value of 1.38; it signifies that the movement in the price of the stock of Tullow Oil Plc, is more volatile, as opposed to the movement of the comparative benchmark index in the previous one year.

Premier Oil Plc

Premier Oil Plc (LON:PMO) is a London, the United Kingdom incorporated oil and gas producing company that was admitted to the London Stock Exchange in the year 1973. The companyâs primary business activity includes the upstream oil and gas exploration as well as extraction through its various assets in North Sea, South East Asia, the Falkland Islands, and Latin America.

PMO Latest News

On 2nd December 2019, the company reported that it had achieved First Gas from the project that it operates called Bison, Iguana and Gajah Puteri (BIG-P) project in the Natuna Sea Block A offshore Indonesia. The company also highlighted the fact that this project was delivered within the scheduled time and remained below the fixed budget.

PMO Share Price Performance

As on 3rd January 2020, at 11:03 A.M GMT, by the time of writing, Premier Oil Plcâs share price was reported to have been trading at GBX 102.85 per share on the London Stock Exchange, an increase in the value of 3.27 per cent or GBX 3.25 per share, in comparison to the previous dayâs closing price, which was reported at GBX 99.60 per share.

The beta of the stock of the company has been reported to be at a value of 3.45; it signifies that the movement in the price of the stock of Premier Oil Plc, is significantly more volatile, as opposed to the movement of the comparative benchmark index in the previous one year.

Bovis Homes Group Plc

Bovis Homes Group Plc (LON:BVS) is a West Malling, United Kingdom based home construction company and its primary business is the development and construction of residential apartments and buildings, providing a wide range and styles of apartments available.

BVS Latest News

On 3rd January 2020, the company issued a press release to announce the acquisition of the Linden Homes as well as Partnerships and regeneration business of Galliford Try Plc. As per the CEO of Bovis Homes, this acquisition will make the company one of the top 5 residential developers in the United Kingdom. The company also reported that the new combined entity will be named Vistry Group Plc and on 3rd January 2020, the company is expected to submit the application for the change in name.

BVS Share Price Performance

As on 3rd January 2020, at 11:07 A.M GMT, by the time of writing, Bovis Homes Group Plcâs share price was reported to have been trading at GBX 1305.64 per share on the London Stock Exchange, a decline in the value of 5.46 per cent or GBX 75.37 per share, in comparison to the previous dayâs closing price, which was reported at GBX 1381.00 per share.

The beta of the stock of the company has been reported to be at a value of 1.01; it signifies that the movement in the price of the stock of Bovis Homes Group Plc, is more volatile, as opposed to the movement of the comparative benchmark index in the previous one year.

GVC Holdings Plc

GVC Holdings Plc (LON:GVC) is a Douglas, Isle of Man based gaming and gambling company that provides its customers with sports betting services as well gambling activities such as casino and poker through its online platform as well as through its retail stores spread across UK.

GVC Latest News

On 11th December 2019, the company published a press release to announce the appointment of Jette Nygaard-Andersen as an Independent Non-Executive Director, that was effective as of the same day. The company reported that Mr. Jette had around 20 yearsâ worth of experience in various leadership as well as operational roles.

GVC Share Price Performance

As on 3rd January 2020, at 11:10 A.M GMT, by the time of writing, GVC Holdings Plcâs share price was reported to have been trading at GBX 899.60 per share on the London Stock Exchange, a decline in the value of 2.11 per cent or GBX 19.40 per share, in comparison to the previous dayâs closing price, which was reported at GBX 919.00 per share.

The beta of the stock of the company has been reported to be at a value of 0.57; Â it signifies that the movement in the price of the stock of GVC Holdings Plc, is less volatile, as opposed to the movement of the comparative benchmark index in the previous one year.

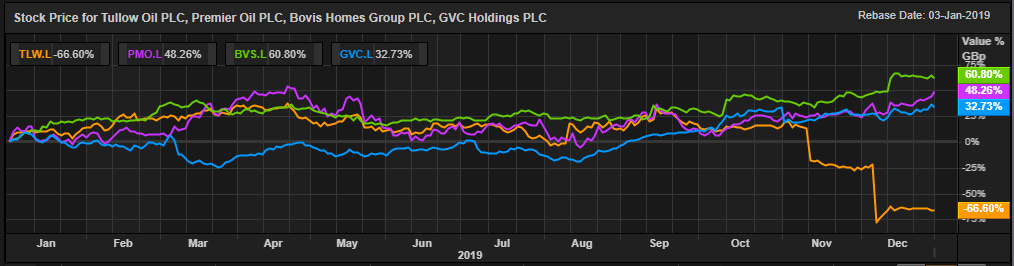

Comparative share price chart of TLW, PMO, BVS and GVC

(Source: Thomson Reuters) Daily Chart as on 03-January-20, prior to the closing of the London Stock Exchange

Cairn Energy Plc

Cairn Energy Plc (LON:CNE) is an Oil and Gas producer based out of London, United Kingdom and is responsible for the development of various oil and gas assets located mainly in North West Europe, the Atlantic Margin and the Mediterranean.

CNE Latest News

On 27th November 2019, the company announced that it had sold one of its subsidiaries based in Norway, Capricorn Norge AS, to Solveig Gas Norway AS for a consideration of US $100 million-plus adjustments of working capital.

CNE Share Price Performance

As on 3rd January 2020, at 11:15 A.M GMT, by the time of writing, Cairn Energy Plcâs share price was reported to have been trading at GBX 206.80 per share on the London Stock Exchange, an increase in the value of 1.37 per cent or GBX 2.80 per share, in comparison to the previous dayâs closing price, which was reported at GBX 204.00 per share.

The beta of the stock of the company has been reported to be at a value of 1.60; it signifies that the movement in the price of the stock of Cairn Energy Plc, is more volatile, as opposed to the movement of the comparative benchmark index in the previous one year.

Monks Investment Trust Plc

Monks Investment Trust Plc (LON:MNKS) is an investment trust which is a part of the Baillie Gifford Group, based out of Edinburgh, United Kingdom, whoâs primary objective is the achievement of long term capital growth above income.

MNKS Latest News

On 4th December 2019, the company announced its half-year results for the six months ended 31st October 2019. The company highlighted that the net return on ordinary activities after taxation for the period stood at £7.79 million, while Earnings per share for the period stood at GBX 3.56 per share, both depicting a year on year growth.

MNKS Share Price Performance

As on 3rd January 2020, at 11:18 A.M GMT, by the time of writing, Monks Investment Trust Plcâs share price was reported to have been trading at GBX 958.75 per share on the London Stock Exchange, a decline in the value of 1.16 per cent or GBX 11.25 per share, in comparison to the previous dayâs closing price, which was reported at GBX 970.00 per share.

The beta of the stock of the company has been reported to be at a value of 0.99; it signifies that the movement in the price of the stock of Monks Investment Trust Plc, is almost as volatile, as the movement of the comparative benchmark index in the previous one year.

Safestore Holdings Plc

Safestore Holdings Plc (LON:SAFE) is a self-storage company based out of Borehamwood, the United Kingdom and was incorporated in the year 1998.

SAFE Latest News

On 27th November 2019, the company issued a press release, announcing the appointment of Mr. David Hearn as a non-Executive Director of the company, and as Chairman of the board, which would be effective as of 1st January 2020. It was highlighted that David would be replacing Alan Lewis, who will be retiring from the Board on 1st January 2020 as previously reported by the company.

SAFE Share Price Performance

As on 3rd January 2020, at 11:22 A.M GMT, by the time of writing, Safestore Holdings Plcâs share price was reported to have been trading at GBX 812.50 per share on the London Stock Exchange, no change in the price of the share, in comparison to the previous dayâs closing price.

The beta of the stock of the company has been reported to be at a value of 0.66; it signifies that the movement in the price of the stock of Safestore Holdings Plc, is less volatile, as opposed to the movement of the comparative benchmark index in the previous one year.

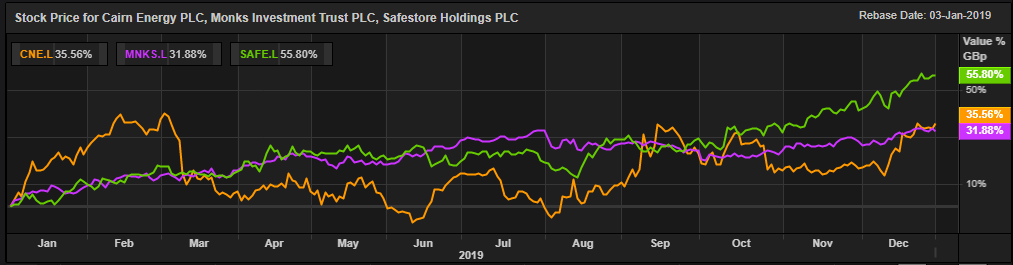

Comparative share price chart of CNE, MNKS and SAFE

(Source: Thomson Reuters) Daily Chart as on 03-January-20, prior to the closing of the London Stock Exchange