Highlights

- Beowulf Mining completed the Kallak North Mining Study, which demonstrates Kallak mine’s potential to produce nearly 2.7 million tonnes per year of concentrate.

- Pendragon increased its underlying profit before tax guidance for the full year ended 31 December 2021 from approximately £70.0 million to £80.0 million.

- Sound Energy made progress towards fulfilling the outstanding conditions for a 10-year Phase 1 LNG Gas sales agreement with Afriquia Gaz SA from its Morocco-based Tendrara project.

In the past, most investors were drawn to blue-chip stocks and other big company stocks that offered stable dividend payments to shareholders. However, this trend changed; now investors are investing in high-risk, high-return stocks. They are closely monitoring stocks and their performance on the exchange.

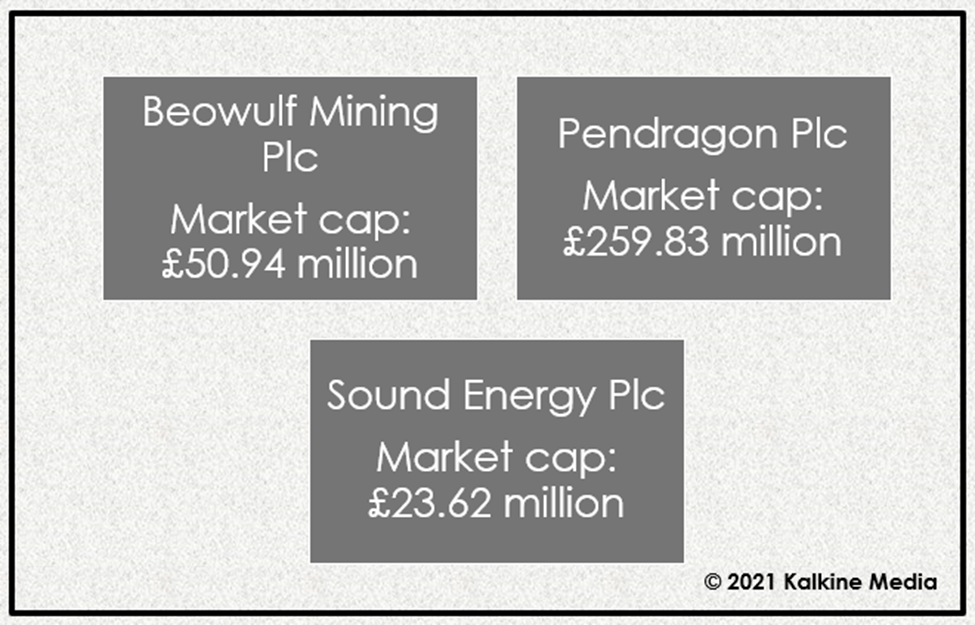

Investors are being driven towards stocks that offer attractive returns on investment. Keeping this in view, let us review in detail the investment opportunity in three stocks - Beowulf Mining, Pendragon and Sound Energy.

(Data source: Refinitiv)

Beowulf Mining Plc (LON:BEM)

Beowulf Mining is a mineral exploration and development firm. In November, Beowulf Mining completed the Kallak North Mining Study, which demonstrates Kallak mine’s potential to produce nearly 2.7 million tonnes per year of concentrate. Its wholly-owned subsidiary – Grafintec, inked a memorandum of understanding (MoU) with Epsilon Advance Materials Limited to develop an anode materials production facility in Finland.

Beowulf Mining’s consolidated loss increased from £706,374 in Q3 2020 to £1.22 million in Q3 2021.

The shares of Beowulf Mining are trading at GBX 7.50, up by 22.45% at 11:03 AM BST on 1 December 2021. The market cap of the company is £50.94 million, and the shares of the company returned 35.58% to shareholders in the last one year.

Pendragon Plc (LON: PDG)

Pendragon is a leading auto retailer in the UK. Pendragon increased its underlying profit before tax guidance for the full year ended 31 December 2021 from approximately £70.0 million to £80.0 million.

Pendragon continued to register strong growth during October and November FY21. Despite the shortage in supply of new vehicles, customer demand continued to remain higher in Q4 FY21 than the comparable period in 2020. Although the demand for new vehicles surpassed deliveries, new vehicle shortage in October and November was lower than expected, and the company’s performance was supported by solid gross profit per unit sale.

The shares of Pendragon are trading at GBX 19.65, up by 5.65% at 11:05 AM BST on 1 December 2021. The market cap of the company is £259.83 million, and the shares of the company returned 53.27% to shareholders in the last one year.

Sound Energy Plc (LON:SOU)

Sound Energy is an AIM-listed gas development firm focused on operations in Europe and Africa. On 1 December 2021, the company announced that it had made progress towards fulfilling the outstanding conditions for a 10-year Phase 1 LNG Gas sales agreement with Afriquia Gaz SA from its Morocco-based Tendrara project.

Sound Energy inked a binding gas sale and purchase agreement with respect to the Phase 2 development of the Tendrara project with Morocco state-owned ONEE for selling natural gas.

The shares of Sound Energy are trading at GBX 1.68, up by 15.52% at 11:06 AM BST on 1 December 2021. The market cap of the company is £23.62 million, and the shares of the company returned 31.22% to shareholders in the last one year.

.jpg)