Highlights

- Reabold to increase its interest in Corallian’s assets, except for the Victory Gas discovery to 100%.

- The Company will shell out GBP250,000 to increase its stake from 49.99% to 100%.

- The acquisition will represent a combined estimated net NPV10 of GBP776 million.

- RBD being familiar with the acquired portfolio will help it to progress the work program quickly.

Upstream oil and gas investment firm Reabold Resources PLC (LON:RBD) recently announced that it would acquire all assets of its investee company (Corallian Energy) except for the Victory Gas Discovery. This investment strategy augurs well for the Company as it continues to increase its exposure to under-appreciated oil and gas assets in the UK offshore.

Related read: Reabold’s (LON:RBD) subsidiary Corallian receives acquisition offer

The announcement came after Corallian received a conditional and non-binding offer from a credible third party for the acquisition of all its issued share capital. Reabold currently holds a 49.99% interest in Corallian and has a seat on Corallian’s Board.

Recently, Reabold released a presentation providing additional details on the assets it will acquire from Corallian for consideration of GBP250,000.

Reabold’s investment strategy

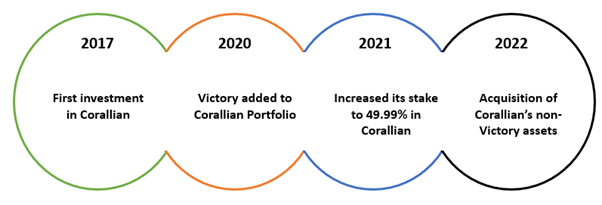

Reabold first invested in Corallian in 2017 to support the company’s efforts to explore and appraise the assets located in the UK offshore. Corallian acquired Victory during the 32nd licensing round held in 2020. In the year 2021, RBD increased its stake in Corallian to 49.99%. Reabold’s investment allowed Corallian to achieve key milestones, including the submission of key drafts for the Field Development Plan and Environmental Survey.

Timeline of RBD’s investment in Corallian (Data source: Company update, 24 May 2022)

At the time of completion of the Potential Sale Offer, Corallian will only have the Victory Project in its asset portfolio. Reabold is planning to redeploy the capital received from the disposal of Corallian to development activities of other projects.

Latest development: Reabold (LON:RBD) all set up to become major shareholder in California-based E&P company

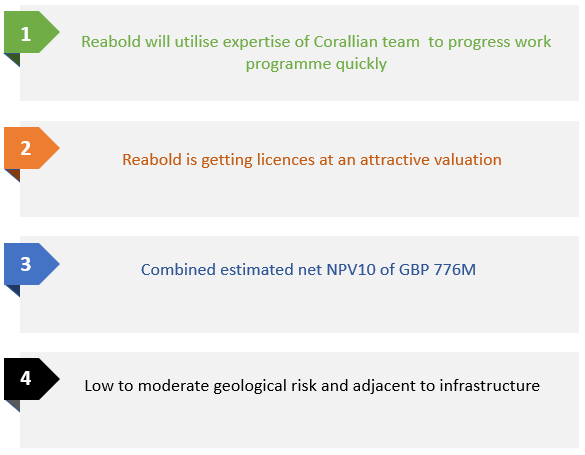

Rationale behind the asset acquisition from Corallian

Data source: Company update, 24 May 2022

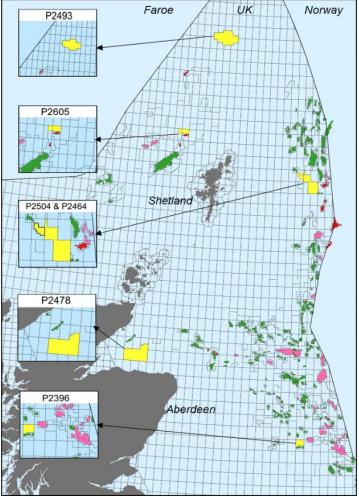

Reabold’s new UK offshore licence portfolio

The UK offshore licence portfolio consists of opportunities in three key areas, all of which are close to existing infrastructure and analogue fields. The licences hold significant prospective resources and opportunities to create value with a combined estimated net NPV10 of GBP776 million.

Related read: Reabold (LON:RBD) bolsters its management by appointing a new Chief Financial Officer

New licence portfolio of RBD in the UK’s offshore (Image source: Company update, 24 May 2022)

Reabold’s estimates (Data source: Company update, 24 May 2022)

Reabold’s new portfolio presents a new and exciting opportunity to grow UK offshore assets using a proven investment methodology. They represent a low-risk strategy with a low-acquisition cost. Reabold believes that its diverse portfolio with a low-cost initial work program will support future monetisation possibilities.