Highlights

- ITV PLC (LSE:ITV) is an integrated producer broadcaster with its operations differentiated in two segments - Broadcast & Online and ITV Studios.

- In H1 FY23, ITV Studios secured a total revenue of GBP 1,964.00 million, 8% higher than the revenue reported in H1 FY22.

- The company saw a 29% surge in its monthly active users to 12.50 million in H1 FY23 from 9.70 million in H1 FY22.

FTSE 250 index listed ITV PLC (LSE:ITV) is an IPB (integrated producer broadcaster) company with its operations differentiated in two segments - ITV Studios and Broadcast & Online.

In the first half of FY23, ITV Studios secured a total revenue of GBP 1,964.00 million, 8% higher than the revenue reported in H1 FY22.

The company saw a 29% surge in its monthly active users to 12.50 million for H1 FY23 from 9.70 million during H1 FY22. The total streaming hours also increased by over 33% from 556 million hours in H1 FY22 to 737 million hours during H1 FY23. The company's cash conversion went up from 81% in H1 FY22 to 88% during the reporting period.

The firm has announced to pay an interim dividend of 1.70 pence per share in November 2023, with the ex-dividend date of 19 October 2023.

The company is expecting to achieve around 5% average organic revenue growth every year to 2026. So far, ITV Studios has been able to be on track with adjusted EBITA margin guidance of 13% to 15% to 2026. ITV believes that it will be able to secure a minimum digital revenue of £750 million by 2026, owing to the better ITVX performance.

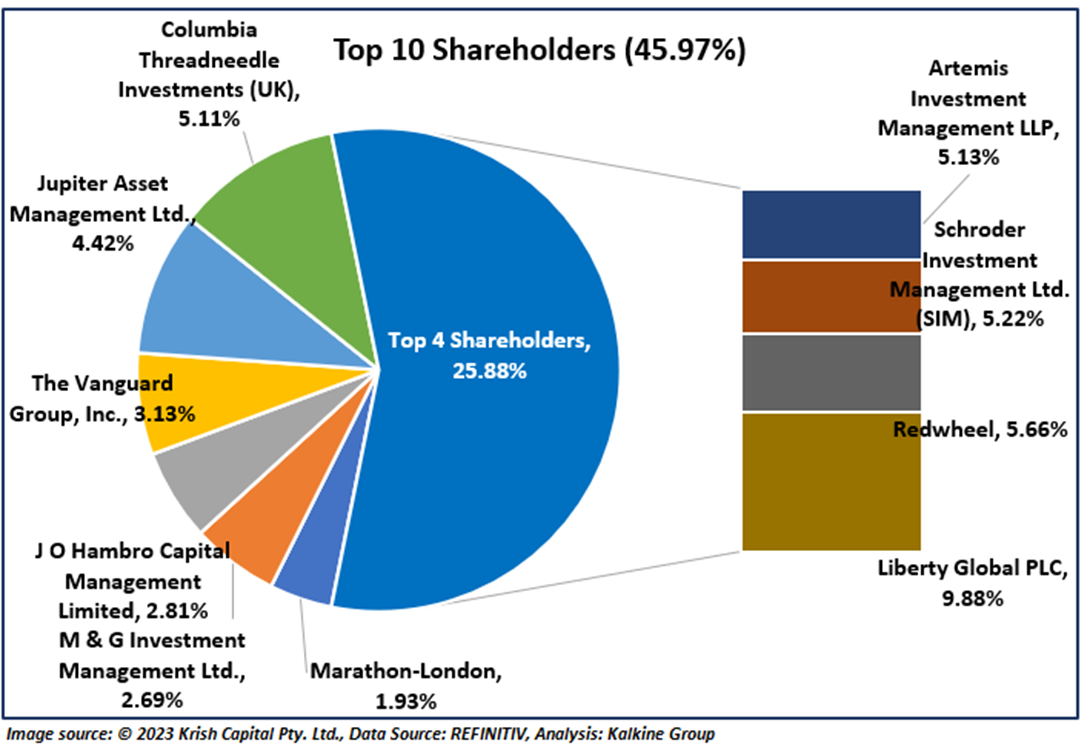

Top ten shareholders

Approximately 45.97% of the total shareholdings are owned by its top ten shareholders. While Liberty Global PLC holds the maximum number of shares with around 9.88% stake, Redwheel owns nearly 5.66% shares in the company.

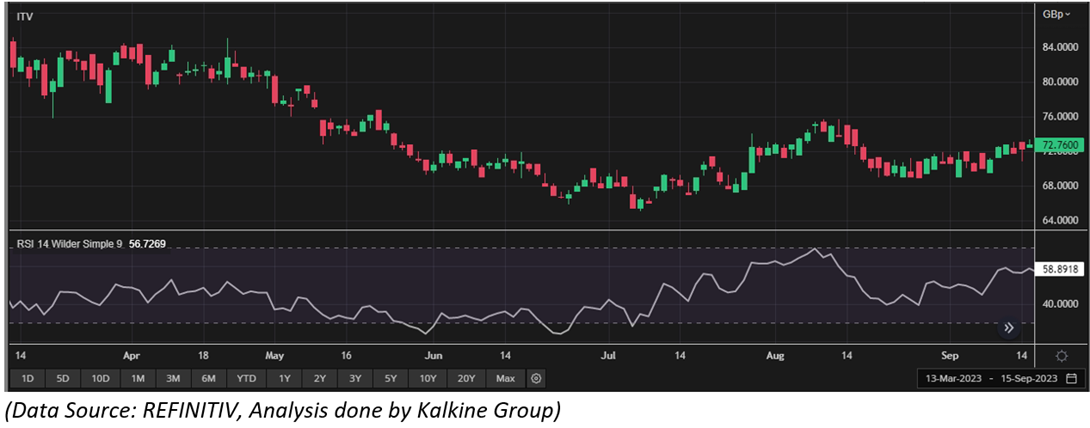

Stock Price Performance

The company’s stock has returned approximately 1.67% in the last one month. However, it has declined by more than 10% over the last six months. The stock’s 52-week low and high price stand at GBX 53.97 and GBX 96.62, respectively.

Please note markets are trading in a highly volatile zone currently due to certain macro-economic and geopolitical tensions prevailing. Therefore, it is prudent to follow a cautious approach while investing.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is 15 September 2023. The reference data in this report has been partly sourced from REFINITIV.