Highlights

- In FY23, the company’s revenue surged by 14.4% compared to FY22

- The company’s gross profit and adjusted EBITDA increased by 38% and 1.7%, respectively

- Backed by a combination of increased volumes and prices, IDHC aims for double-digit revenue growth in 2024

Integrated Diagnostics Holdings PLC (LSE: IDHC) is a leading provider of integrated diagnostic services based in Egypt. It serves patients across Egypt, Sudan, and Jordan. Offering a comprehensive range of over 1,000 diagnostic services, including basic tests, molecular tests for hepatitis, and specialized DNA tests, the company operates through a network of approximately 310 branches. The company has a market cap of GBP 155.12 million.

In FY23, IDHC announced total revenues of Egyptian Pound (EGP)4,123 million, marking a notable year-over-year (YoY) growth of approximately 14.4%. Similarly, the company’s gross profit and adjusted EBITDA demonstrated YoY growth of 4% and 2%, respectively.

Further, IDHC exhibited promising operational metrics, with revenue per patient showing an approximately 17% YoY increment and test per patient rising by about 13%. This reflects a significant enhancement in operational efficiency.

The company surpassed industry medians in terms of the following metrics:

- Higher current ratio - 1.54x in FY23 compared to the industry median of 0.94x

- Lower debt-equity – 0.44x in FY23 compared to the industry median of 1.02x

Recent business update

On May 16, 2024, the company revealed its intention to delist from the Egyptian Exchange (EGX) due to persistently low liquidity and trading volumes. However, IDHC will uphold its current standard listing on the LSE.

Company outlook

In December 2023, IDHC started its operations in Saudi Arabia, a move strategically aligned with its priorities and value-creation strategies in current markets. Additionally, the company anticipates ongoing margin normalization throughout 2024 and aims for double-digit revenue growth backed by a combination of increased volumes and prices.

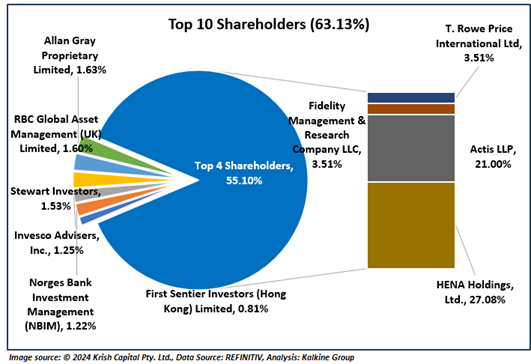

Top 10 Shareholders

The top 10 shareholders of IDHC collectively form around ~63.13% of the total shareholdings in the company. HENA Holdings, Ltd. holds the maximum number of shares with ~27.08% shareholding, followed by Actis LLP with ~21.00% shareholding, as depicted in the chart below:

Stock performance

IDHC's stock price has dropped approximately 8.61% in the past one month and about 0.51% in the last six months. With a 52-week low of USD 0.29 and a high of USD 0.63, it's presently trading below the average of this range.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is 15 May 2024. The reference data in this report has been partly sourced from REFINITIV.