Highlights

- In FY23, the company reported a higher gross profit of USD 13.81 million, compared to USD 5.85 million in pcp

- Based on the stock's closing price of May 17, 2024, Caledonia’s annualized dividend yield was around 5.41%

- Gold production at the company’s Blanket Mine reported an increment of 6% in Q1 FY24 compared to Q1 FY23

- The company is aiming gold production of 74,000 to 78,000 ounces at Blanket in FY24 and FY25

Caledonia Mining Corporation PLC (LSE: CMCL) is an FTSE AIM All-share-listed cash-generative gold producer, with its flagship asset, Blanket Mine in Zimbabwe. It has a market capitalization of GBP 167.62 mn.

In FY23, the company witnessed a revenue surge to USD 38.52 million from USD 29.43 million in FY22, attributed to increased gold sales volumes at higher average realized prices. Additionally, the group recorded a higher gross profit of USD 13.81 million in FY23 compared to USD 5.85 million in the prior corresponding period (pcp). Furthermore, management declared a quarterly dividend of USD 0.14 per share, paid on April 26, 2024, resulting in an annualized dividend yield of approximately 5.41% based on the stock's closing price of May 17, 2024.

Recent business update

Gold production at the company’s Blanket Mine reported an increment of 6% in Q1 FY24 compared to Q1 FY23. Additional update from the company’s latest mineral reserve estimates from Blanket Mine are as follows:

- 1300 S-K mineral reserves and resource ounces surged by 111% and 36%, respectively, with grades increasing by 7% and 23%.

- NI 43-101 mineral reserve and measured and indicated (M&I) resource ounces grew by 106% and 63%, respectively, with a 5% and 14% increase in grades.

- NI 43-101 inferred resource ounces rose by 26%, with a 28% increase in grade.

Company outlook

Caledonia is reviewing initial findings from updated feasibility studies for Bilboes, seeking to reduce initial capital expenditure and enhance project economics. The company’s current strategic objectives involve achieving gold production of 74,000 to 78,000 ounces at Blanket in FY24 and FY25, finalizing a revised resource statement to prolong the mine's lifespan, and ongoing exploration efforts at the Motapa project.

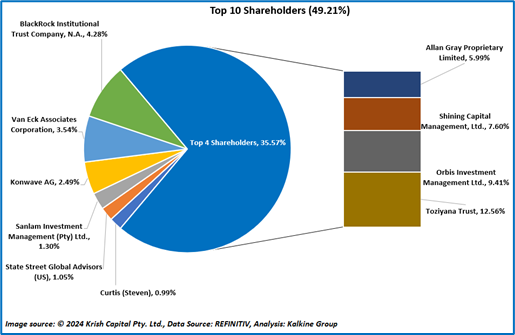

Top 10 Shareholders

The company's top 10 shareholders own approximately 49.21% of total shares. Toziyana Trust leads with around 12.56%, followed by Orbis Investment Management Ltd. with about 9.41%, as shown in the chart:

Stock performance

The stock price of CMCL has witnessed a drop of ~8.33% in the last six months. The stock has a 52-week low and 52-week high of GBX 600.00 & GBX 1,117.75, respectively. Currently, it is trading lower than the average of its 52-week high-low.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is 17 May 2024. The reference data in this report has been partly sourced from REFINITIV.

_08_03_2023_04_15_50_428859.jpg)