Highlights

- AstraZeneca secured a 1.9% year-on-year growth in its revenue in 9MFY23.

- Its earnings per share grew by approximately 109.1% YoY in 9MFY23.

- AZN will pay a quarterly interim dividend of 16 pence per share in April 2024.

FTSE 100 listed AstraZeneca PLC (LSE:AZN) is a science-led biopharmaceutical company involved in the development, commercialisation, and discovery of prescription medicines. In one of the recent announcements, AZN revealed that its Ionis' Wainua (eplontersen) has received approved in the United States for the treatment of the polyneuropathy of hereditary transthyretin-mediated amyloidosis in adults.

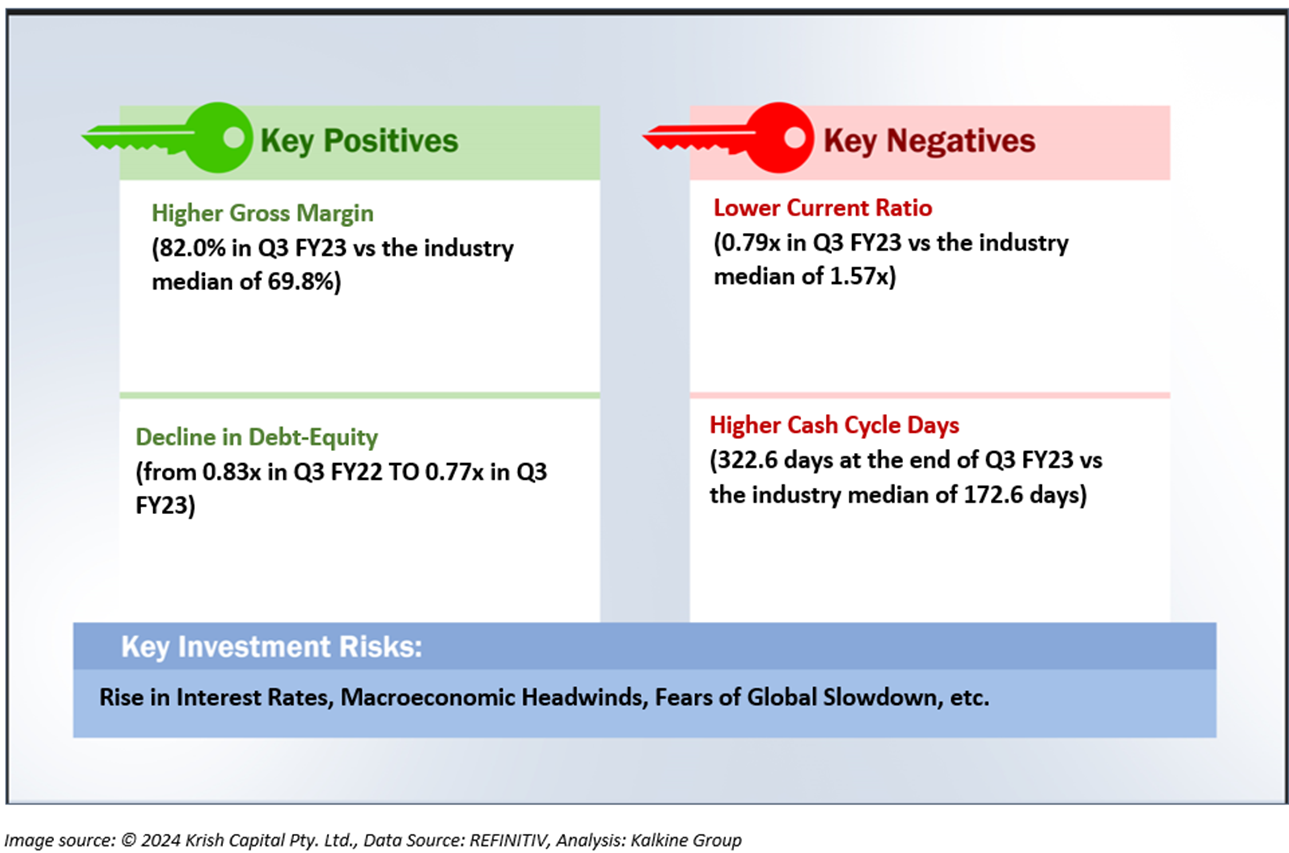

For the first nine months of FY23, the company secured a 1.9% year-on-year growth in its revenue. Notably, there has been an increase in AZN’s top-line business despite a USD 2,896 million loss from COVID-19 medicine in 9MFY23. Its earnings per share grew by approximately 109.1% YoY in 9MFY23.

Furthermore, AstraZeneca has announced to pay a quarterly interim dividend of 16 pence per share in April 2024, with an ex-dividend date of 22 February 2024.

AstraZeneca expects to complete the acquisition deal of Gracell Biotechnologies Inc. by Q1 FY24. Through the acquisition of Gracell, AZN is anticipating an expansion in its pipeline of cell therapies with GC012F. As per the agreed terms, Gracell will operate as a wholly owned subsidiary of AstraZeneca, with operations across China and the United States.

For the full fiscal year 2023, AZN is expecting its revenue to increase by a mid-single-digit percentage. It is expecting its Core EPS to amplify by a low double-digit to low-teens percentage for FY23. Also, it is looking forward to fast pace progress for its cardiometabolic and obesity pipeline with licensing agreement for ECC5004.

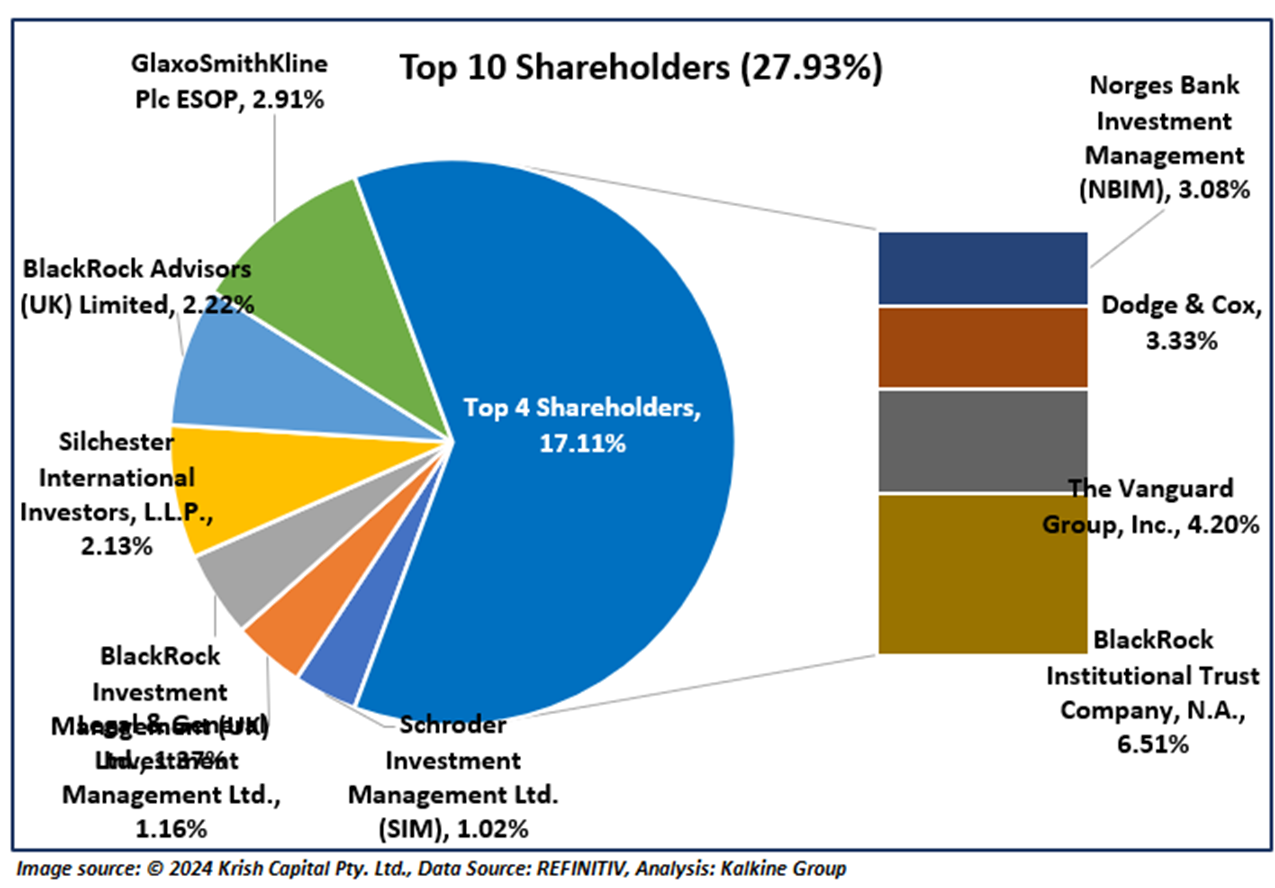

Top 10 Shareholders:

Approximately 27.93% of the total shareholdings is held by its top ten shareholders. While BlackRock Institutional Trust Company, N.A. is the biggest shareholder with the maximum number of shares with over 6.5% shareholding, Vanguard Group, Inc. owns 4.20% shareholding in the firm.

Stock Price Performance

AZN’s stock price has dropped by around 3.42% in the last one month. It has fallen by approximately 4.29% in the past six months. The stock’s 52-week low and high price stand at GBX 9,778.00 and GBX 12,828.45, respectively.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is 02 February 2024. The reference data in this report has been partly sourced from REFINITIV.

_08_02_2023_11_21_17_866226.jpg)