As the deadline of PPI claim passed on 29 August 2019, the rush among affected consumers with claims had increased manifold at the counters of banks. The three banks discussed here, Lloyds Banking Group Plc, Barclays Plc and HSBC Holdings Plc, also witnessed the said huge increase in claims volume and accordingly will have to increase their provisioning to deal with those increased claims.

Lloyds Banking Group Plc

Lloyds Banking Group Plc (LLOY) is a British banking company with operations in the United Kingdom, Europe, United States of America, Asia and the Middle East. The bankâs offerings include retail banking- mortgage and sole traders and commercial- life, pension & insurance and wealth management.

The company has its registered office in Edinburgh in Scotland and is headquartered in London In the United Kingdom. The bankâs shares are listed for trading both at the London Stock exchange and the New York Stock Exchange. At the London Stock Exchange, they trade with the ticker name LLOY, and at the New York Stock Exchange they trade with the ticker name LYG. The companyâs shares are part of the FTSE 100 index.

Financial Updates (LLOY)

The bank on 15 March 2019 came out with its annual report for the financial year 2018.

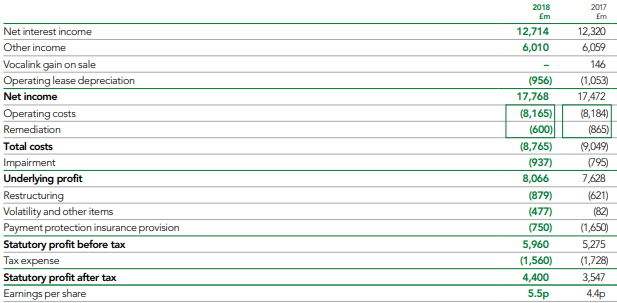

The Net interest income declared by the company for the financial year ended 31 December 2018 was £12.714 billion while for the financial year ended 31 December 2017 the Net interest income was £12.320 billion.

The net income of the company for the year ended 31 December 2018 was £17.768 billion while net income of the company for the year ended 31 December 2017 was £17.472 billion.

The Underlying profit for the financial year ended 31 December 2018 was £8.066 billion whereas the Underlying profit for the financial year ended 31 December 2017 was £7.628 billion.

The statutory profit after tax of the company for the year ended 31 December 2018 was £4.4 billion against statutory profit after tax of the company for the year ended 31 December 2017 of £3.547 billion.

The earnings per share of the company for the year ended 31 December 2018 was 5.5 pence whereas for the year ended 31 December 2017 the earnings per share of the company was 4.4 pence per share.

Source â Companyâs Annual report published on 15 March 2019

Source â Companyâs Annual report published on 15 March 2019

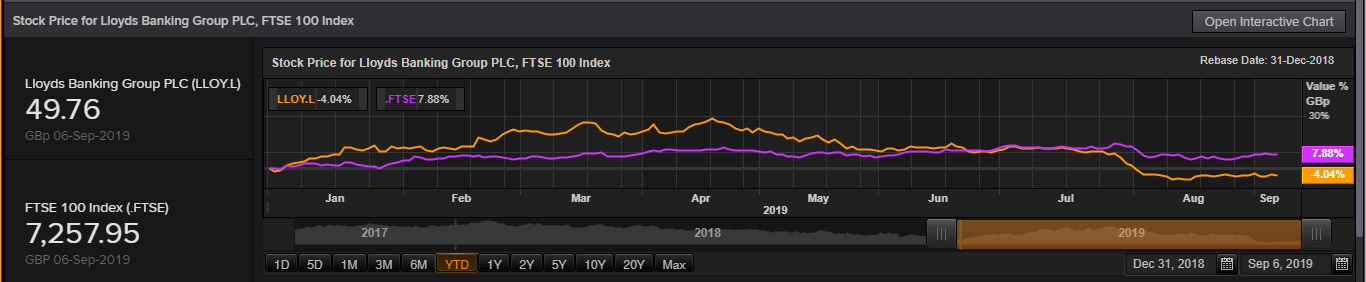

Stock Price performance of (LLOY) at the London Stock Exchange (YTD)

Comparative chart of LLOY with the FTSE 100 index, Source â Thomson Reuters)

Comparative chart of LLOY with the FTSE 100 index, Source â Thomson Reuters)

Stock performance of (LLOY) at the London Stock Exchange over the past 5 days

Price Chart as on 06 September 2019, before the market close (Source: Thomson Reuters)

Price Chart as on 06 September 2019, before the market close (Source: Thomson Reuters)

On 06 September 2019, at the time of writing of the report (before the market close, GMT 11.20 AM), LLOY shares were trading on the London Stock Exchange at GBX 49.80.

The stock has a 52-week High of GBX 67.90, and a 52-week low of GBX 48.16. The total market capitalization of the company was £34.84 billion.

PPI Outlook (LLOY)

The bank has been the hardest hit by the PPI scandal. Till date, the bank had to pay more than £20 billion in compensation over the PPI claims which are the highest among all banks hit by the scandal.

The bank has set aside additional £550 million to deal with the increased number of claims.

Barclays Plc

Barclays Plc is a British multinational bank with a global presence. The bankâs primary divisions are; corporate banking, wealth management, personal banking and investment management.

The Bank is amongst the oldest banking companies in the United Kingdom, as of 2019 it is 328 years old when it first started its operations in 1690. It is the bank that is credited to be the first in the world to deploy cash vending machines.

The bankâs shares are listed on the London Stock Exchange, where they trade with the ticker name BARC, it is also listed on the New York Stock Exchange, where its shares trades under the ticker name BCS. The bankâs shares are constituent of the FTSE 100 index, and its largest shareholding entity is Qatar Holdings the investment arm of the Government of Qatar.

Financial Update (BARC)

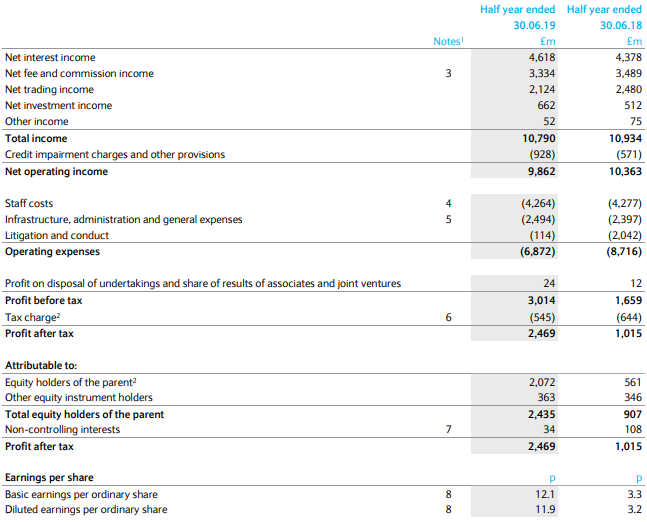

The company for the half-year ended 30 June 2019 reported net interest income of £4.618 billion compared to a net interest income of £4.378 billion for half-year ended 30 June 2018.

The total Income for the half-year ended 30 June 2019 was £10.790 billion, whereas it was a total income of £10.934 billion for the half-year ended 30 June 2018.

The profit before tax for the half-year ended 30 June 2019 was £3.014 billion, compared to a profit before tax of £1.659 billion for the half-year period ended 30 June 2018.

The profit after tax for the half-year ended 30 June 2019 was £2.469 billion, whereas it was a profit after tax of £1.015 billion for the half-year ended 30 June 2018.

The earnings per share (diluted) for the six-month period ended 30 June 2019 was 11.90 pence, whereas the earnings per share (diluted) for the six-month period ended 30 June 2018 was 3.20 pence per share.

Source â Companyâs half-yearly report publication on 1 August 2019

Stock Price performance of (BARC) at the London Stock Exchange (YTD)

Comparative chart of BARC with the FTSE 100 index, Source â Thomson Reuters)

Comparative chart of BARC with the FTSE 100 index, Source â Thomson Reuters)

Stock performance of (BARC) at the London Stock Exchange over the past 5 days

Price Chart as on 06 September 2019, before the market close (Source: Thomson Reuters)

Price Chart as on 06 September 2019, before the market close (Source: Thomson Reuters)

On 06 September 2019, at the time of writing of the report (before the market close, GMT 11.20 AM), BARC shares were trading on the London Stock Exchange at GBX 139.92.

The stock has a 52-week High of GBX 181.00, and a 52-week low of GBX 134.70. The total market capitalization of the company was £23.96 billion.

PPI Outlook (BARC)

Barclays Plc is the bank which had to foot the second-highest bill among all banks in the United Kingdom in compensation for the PPI claims. The bank had put aside £9.6 billion so far for this purpose and has left another £360 million on that account and has not yet announced any increase in the same.

HSBC Holdings Plc

HSBC Holdings Plc is a British investment banking and financial services holding company with a multinational presence. By the end of 2018, it was the worldâs seventh-largest bank and the largest in Europe. The banking company was incorporated 154 years ago in 1865 in the erstwhile British territory of Hong Kong, it has grown over the years to be present now across Asia, Oceania, Africa, Europe, North America and South America. Today it operates across 67 countries with 3,900 offices serving over 38 million customers.

The banking corporation has two primary listings, one at the Hong Kong Stock Exchange where its shares trade with the ticket number 5 and at the London Stock Exchange where its shares trade with the ticker name HSBA. The corporation has three secondary listings, one at the New York Stock Exchange, where its shares trade with the ticker name HSBC, in Bermuda Stock Exchange where its shares trade with the ticker name HSBC.BH and at Euronext Paris where the shares trade with the ticker name HSB.

At the London Stock Exchange, the shares of HSBC Holdings Plc are part of the FTSE 100 index.

Financial Update (HSBA)

The company on 28 August 2019 came out with its half-yearly results for the period ending 30 June 2019.

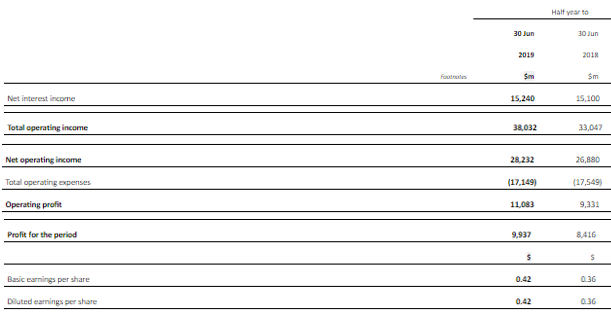

The Net interest income declared by the company for the half-year period ending 30 June 2019 was $15.240 billion whereas for the half-year period ending 30 June 2018 the Net interest income was $15.1 billion.

The operating profit declared by the company for the half-year period ending 30 June 2019 was $11.083 billion whereas for the half-year period ending 30 June 2018 the operating profit was $9.331 billion.

The profit for the period declared by the company for the half-year period ending 30 June 2019 was $9.937 billion whereas for the half-year period ending 30 June 2018 the profit was $8.416 billion.

The diluted earnings per share declared by the company for the half-year period ending 30 June 2019 was 0.42 cents per share whereas for the half-year ending period 30 June 2018 the diluted earnings per share was 0.36 cents per share.

Source â Company half-yearly report publication dated 28 August 2019

Source â Company half-yearly report publication dated 28 August 2019

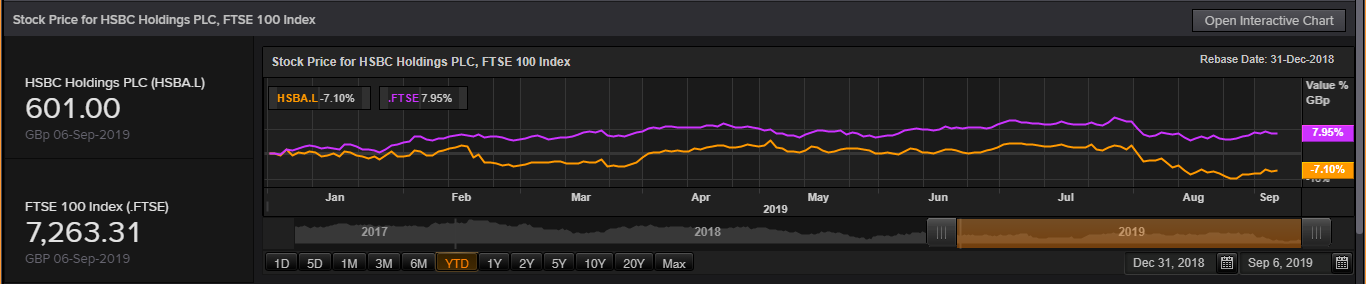

Stock Price performance of (HSBA)at the London Stock Exchange (YTD)

Comparative chart of HSBA with the FTSE 100 index, Source â Thomson Reuters)

Comparative chart of HSBA with the FTSE 100 index, Source â Thomson Reuters)

Stock performance of (HSBA) at the London Stock Exchange over the past 5 days

Price Chart as on 06 September 2019, before the market close (Source: Thomson Reuters)

Price Chart as on 06 September 2019, before the market close (Source: Thomson Reuters)

On 06 September 2019, at the time of writing of the report (before the market close, GMT 11.25 AM), HSBA shares were trading on the London Stock Exchange at GBX 600.9.

The stock has a 52-week High of GBX 687.7 and a 52-week low of GBX 578.2. The total market capitalization of the company was £120.01 billion.

PPI Outlook (HSBA)

The bank had provisioning of £2.1 billion set aside for this purpose, and as of 6 September 2019 has not made any announcement of additional provisioning.