Victoria Plc

Victoria Plc (VCP) is a Worcestershire, United Kingdom domiciled leading designer, manufacturer and distributor of innovative flooring products, including carpets, ceramic and porcelain tiles, flooring accessories, artificial grass and LVT (luxury vinyl tile). Â The company supplies these mid-to-high end products employing the method of selling directly to retailers. The origins of the company can be dated back to 1985 when it started out as a manufacturer of carpets and was admitted to the AIM segment of the London Stock Exchange in year 2013. The company has now become the largest manufacturer of carpet in the United Kingdom and the second-largest carpet manufacturer in Australia; the company has also diversified into a number of geographies and has added a number of other products to its portfolio and has now become a major player in wider flooring arena. The company has outlets across 20 sites around the world, employing approximately 2,600 people and has operations spread across the United Kingdom, Europe and Australia.

The shares of the company have their listing in the Alternative Investment Market (AIM) segment of the London Stock Exchange. There they trade with the ticker name VCP.

Trading Update

The company on 18 November 2019 came out with a trading update with the information that it will be coming out with its interim results for the six-month period ended on 28 September 2019, on 26 November 2019.

- The announcement also stated that Board of the company is satisfied in the way the company has been performing during this six-month period and is confident of meeting the market expectations for the full year of 2019-20.

- The company also announced that an analyst briefing will be held on the day of results declaration at 10.00 am.

Performance at the London Stock Exchange

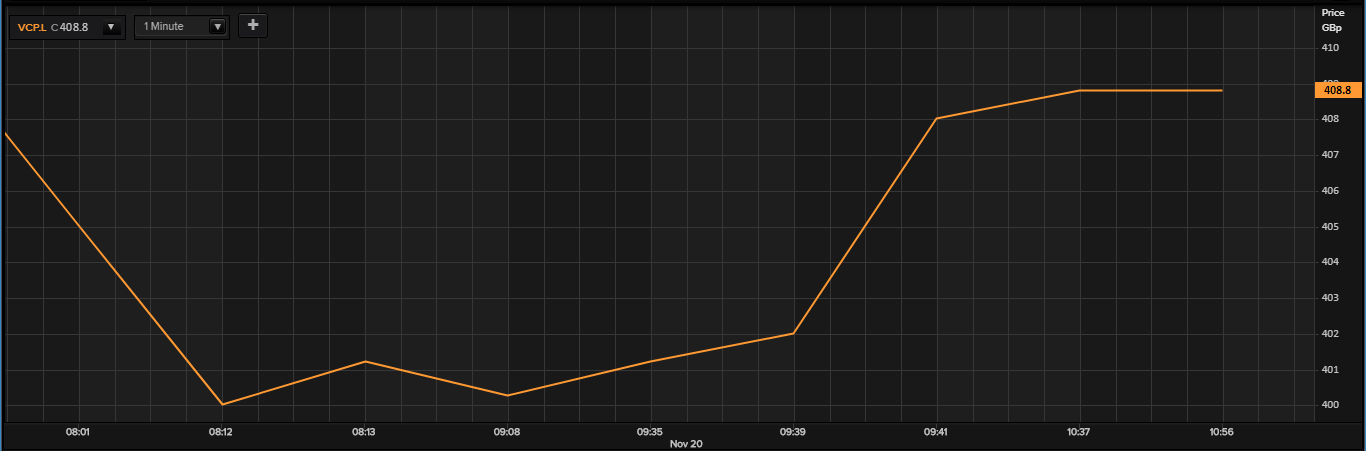

Price Chart as on 20 November 2019, before the market close (Source: Thomson Reuters)

On 20 November 2019, before the market close, VCP shares were trading on the London Stock Exchange at GBX 408.80. Over a period of one year, the companyâs shares clocked 52-week High of GBX 550.00 and a 52-week low of GBX 315.00. The total market capitalization (M-Cap) of the group stood at around £507.86 million.

Outlook

The company during previous-year results release had predicted a good financial year, and the results of the first six-month period of the financial year are expected to be in line with that prediction.

Boohoo Group Plc

Boohoo Group Plc (BOO) is a United Kingdom domiciled fashion apparel retailing company. The company is christened among the top online fashion retail company in the United Kingdom, including possession of a global footprint, outside of the United Kingdom in Europe, Australia and in The United States of America. The companyâs products are targeted towards customers in the age group of 16-30 years and some of its topline brands are Boohoo, PrettyLittleThing NastyGal, MissPap and boohooMAN.

The shares of the company have their listing in the Alternative Investment Market (AIM) segment of the London Stock Exchange. There they trade with the ticker name BOO.

Trading Update

The company on 1 November 2019 came out with an update on the granting of shares to the employees of the company who have opted for the same under the SAYE (Save as you earn) scheme announced by the company earlier this year.

- The scheme was announced in the month of October 2019 and was open to all employees of the company. The exercise price for each option under this scheme is 216.92 pence which is 20 per cent below the closing average middle market price of an ordinary share on 4 October 2019, the day before the offer was made.

- A total of 791 employees decided to purchase options under this scheme, electing to convert a total of 2,017,468 options into ordinary shares, which was granted to them on 30 October 2019.

- The options have a commencement date of 1 December 2019 and are exercisable between 1 December 2022 to 31 May 2023.

Performance at the London Stock Exchange

Price Chart as on 20 November 2019, before the market close (Source: Thomson Reuters)

On 20 November 2019, before the market close, BOO shares were trading on the London Stock Exchange at GBX 292.30. Over a period of one year, the companyâs shares clocked 52-week High of GBX 297.70 and a 52-week low of GBX 146.39. The total market capitalization (M-Cap) of the group stood at around £3.37 billion.

Outlook

Both the Chief Executive Officer of the company John Lyttle and Chief Financial Officer Neil Catto have been participants in this scheme and have been granted 8,297 and 17,434 shares under option in SAYE respectively.

Focusrite Plc

Focusrite Plc is a United Kingdom domiciled global music and audio products company  that develops and markets proprietary audio and music hardware and software products. The products of the company are preferred  by audio professionals and amateur musicians alike. The technological solutions provided by the company facilitate in the high-quality production of recorded and live audio and music products. The Focusrite Group has four established and rapidly growing brands under which it operates: Focusrite, Focusrite Pro, Novation & Ampify Music and ADAM Audio.

The shares of the company have their listing in the Alternative Investment Market (AIM) segment on the London Stock Exchange. There they trade with the ticker name TUNE.

Trading Update

The company on 19 November 2019 came out with the final results for the year ended on 31 August 2019.

- The revenues of the company for the year grew by 12.7 per cent to stand at £84.7 million, whereas for the financial year 2018 the revenues of the company were £75.1 million.

- In the North America the revenues of the company grew up by 11.1 per cent; in Europe, Middle East and African markets, revenues grew by 14.6 per cent; and for the Rest of World the revenues grew by 12.5 per cent.

- The EBITDA of the company for the year grew by 11.1 per cent to stand at £17.2 million, whereas for the financial year 2018 the EBITDA of the company stood at £15.5 million.

- The adjusted operating profit of the company for the year grew by 16.7 per cent to stand at £13.5 million, while for financial year 2018 the adjusted operating profit figure stood at £11.6 million.

- The adjusted diluted earnings per share of the company for the year grew by 21.6 per cent to stand at 21.4 pence, whereas for financial year 2018 the corresponding figure stood at 17.6 pence.

Performance at the London Stock Exchange

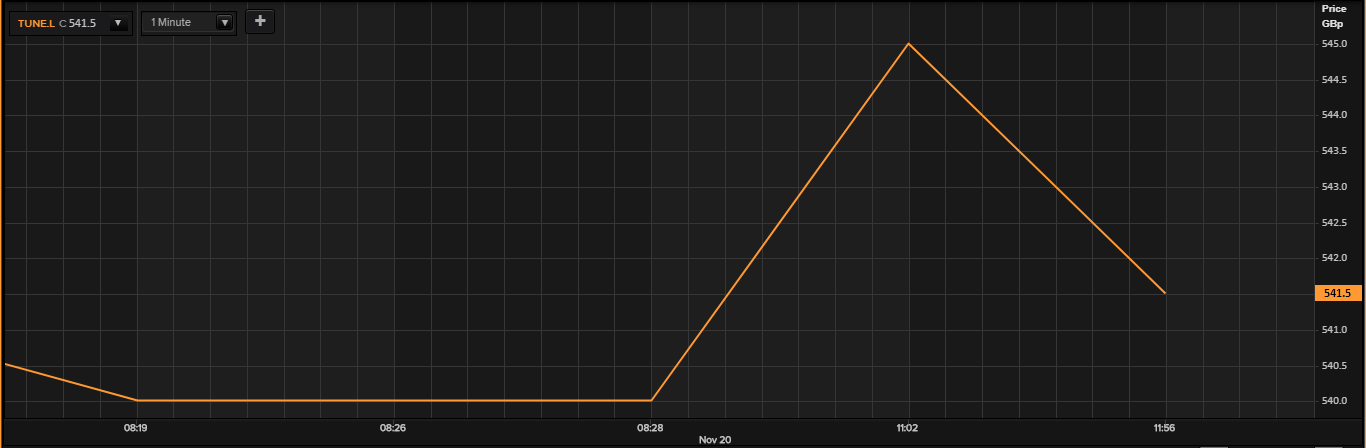

Price Chart as on 20 November 2019, before the market close (Source: Thomson Reuters)

On 20 November 2019, before the market close, TUNE shares were trading on the London Stock Exchange at GBX 541.50. Over a period of one year, the companyâs shares clocked 52-week High of GBX 600.00 and a 52-week low of GBX 420.00. The total market capitalization (M-Cap) of the group stood at around £316.71 million.

Outlook

The performance of the company for the year has been exceptional despite the various macro level challenges being faced by the company during the year. The company has also successfully completed its first acquisition during the year and is very comfortably placed when cash balances and debt level at the end of the year are concerned.

The company for the year has recommended a final dividend of 2.6 pence per share, making it a total of 3.8 pence per share for the full year, a 15.2 per cent increase over the previous year.