Summary

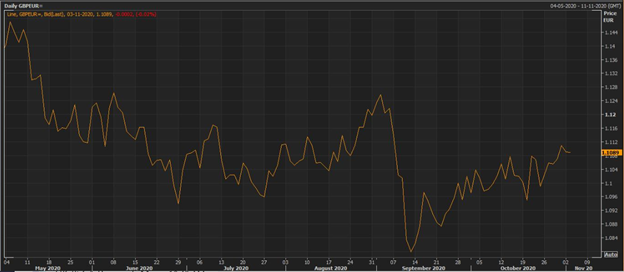

- GBP/EUR spot rate going strong at 1.11, but could drop in the coming days despite positive developments over Brexit

- GBP/USD dropped marginally over past few days

Pressure is mounting over the pound sterling after the UK government announced a month-long lockdown across the nation beginning 5 November, according to foreign exchange experts. They predicted a tough November for the GBP against the euro and the American dollar.

However, as far as the outlook with respect to euro is concerned, there could be a cushioning effect coming forth in terms of a favourable post Brexit deal.

The British Prime Minister recently announced that the country would be going in for a month long lockdown to prevent an NHS (National Health Service) disaster as the Covid-19 cases multiply fast alarmingly across the UK, despite stricter local restrictions in place.

In fact, media reports said that the government is contemplating on extending the lockdown further by yet another month. Sources told that government could find it very difficult to abruptly end the lockdown after a month if the infection rate was not under control.

According to latest government estimates, the daily reported cases of coronavirus infections across the nation dropped to a value of 18,950 on 2 November 2020 from a high of 23,254 reported on the previous day.

Economy

The UK economy is forecasted to enter a double dip recession, as the growth could slow down once again due to the second lockdown in place.

The odds of a shrinking economic output are particularly raised with many large sectors such as travel, hospitality, and non-essential retail completely shutting down for operations during the entire month of November.

Closing down the non-essential retail could contract Britain’s GDP (gross domestic product) by roughly 3 per cent in the last quarter of the year, according to Andrew Goodwin, Chief UK Economist, Oxford Macroeconomics.

The government decision to allow the education sector to operate would contribute not just directly to the economic output, but in an indirect way as well as it would allow the parents to work.

A downgrade of Britain’s GDP growth numbers for Q4 2020 is expected soon by leading global agencies. The UK unemployment rate is also expected to shoot up. The current rate is 4.5 per cent, according to official statistics.

The overall deterioration in the economic fundamentals of the UK is likely to weaken the value of the British pound Sterling at least in the medium term, lament leading economists.

Trend in the GBP/USD exchange rate

(Source: Thomson Reuters)

Bank of England’s meet

The BoE’s scheduled meeting for this week is expected to announce a quantitative easing worth £100 billion. This would raise the size of the total asset purchases by the central bank to £845 billion.

The BoE members are yet to arrive at a consensus for pulling down the interest rates below the zero level. In case the monetary policy committee (MPC) decides to go in for negative interest rates, the pound could slump against the euro and the dollar, according to market experts.

The next meeting of the MPC is due on Thursday, 5 November 2020.

Trend in the GBP/EUR exchange rate

(Source: Thomson Reuters)

US election results

Till the time the results of the presential elections are out, the USD is likely to experience higher volatility. Stock markets fear the situation of a political upset until the scenario stabilises.

Unless there is political stability, the USD exchange rates would continue to fluctuate at a higher pace than usual, explain forex experts.

Things would settle in once a clear outcome is out, which is neither challenged nor contested any further.

On the other hand, some analysts were of the view that in uncertain times, dollar tends to benefit as investors consider it as a safe haven to park their money. Therefore, GBP to USD ratio could decline in the coming few days, according to them.

Going forward, if the newly elected US government announces an expansionary fiscal policy, the value of the dollar might drop.

The GBP/USD rate was hovering around a value of 1.29 on 3 November 2020.

Ongoing Brexit negotiations

Sources from both sides revelated that the UK and the European Union are continuing with their last- minute talks to avoid any damage to either side. A new partnership agreement is expected soon as the Brexit transition period comes to an end soon.

The annual bilateral trade between both the sides is valued at $900 billion that would be at stake in case a favourable deal is not worked out.

There are media reports citing that both parties are now ready to compromise slightly on the politically sensitive issues of fisheries and state aid. None of the sides would want more business disruptions as a result of a no-deal, point out the market experts.

Carolyn Fairbairn, director general, CBI (Confederation of British Industries) said that it was a painful fact for the UK industry that the Brexit negotiations have not concluded till now. At the same time, despite the delay, she was hopeful of a positive outcome.

However, Lee Hardman, Currency Analyst, MUFG cautioned that the second lockdown might put a dampener on the hopes of concluding a Brexit trade deal between Britain and the EU by the end of November 2020.

The potential gamechanger

The timely availability of a coronavirus vaccine could be a gamechanger for reviving the British economy.

Astra Zeneca and Pfizer are nearing their final stages of clinical trials. The next step in line would be the review by the UK healthcare authorities.

Sources revealed that the process is slated for a rolling review that would significantly shorten the approval time.

If that be the case, then a good news would be coming forth before the end of this month itself.