US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 19.01 points or 0.44 per cent higher at 4,338.95, Dow Jones Industrial Average Index surged by 114.79 points or 0.33 per cent higher at 34,748.32, and the technology benchmark index Nasdaq Composite traded higher at 14,585.80, up by 63.50 points or 0.44 per cent against the previous day close (at the time of writing – 12:10 PM ET).

US Market News: The major indices of Wall Street traded in a green zone after a strong June jobs report. Among the gaining stocks, Virgin Galactic (SPCE) shares surged by about 5.21% after Richard Branson planned to aboard a flight to space on 11 July 2021. Apollo Global (APO) shares rose by about 0.95% after the private equity firm announced a purchase of stake up to 24.9% in Motive Partners. Raytheon Technologies (RTX) shares went up by about 0.86% after the defence contractor had won an Air Force contract worth around USD 2.0 billion. Among the declining stocks, Didi (DIDI) shares went down by around 6.16% after the news that the Cyberspace Administration will conduct a cybersecurity administration.

UK Market News: The London markets traded in a green zone after the release of US non-farm payrolls data.

Housebuilders Bellway and Barratt Development shares went up by about 0.82% and around 0.37%, respectively, after Jefferies upgraded the stocks to a “Buy” stance.

FTSE 250 listed Qinetiq Group stated that the Chief Financial Officer would step down with effect from 30 November 2021. Moreover, the shares went up by approximately 0.12%.

Grafton Group shares rose by around 2.39% after the Company had completed the acquisition of Isojoen Konehalli Oy and Jokapaikka Oy ("IKH") on 1 July 2021.

Bidstack Group shares plunged by around 28.46% after the Company raised 10.9 million pounds to develop a standardised in-game ad platform.

Team17 Group shares went up by around 4.45% after the Company announced the acquisition of StoryToys worth approximately USD 26.5 million.

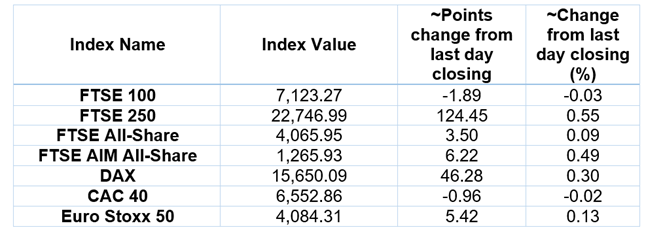

European Indices Performance (at the time of writing):

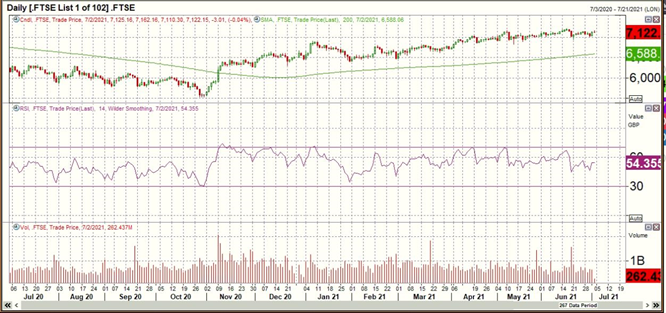

FTSE 100 Index One Year Performance (as on 2 July 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Vodafone Group Plc (VOD); Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc. (RR.).

Top 3 Sectors traded in green*: Real Estate (+1.26%), Basic Materials (+0.43%) and Consumer Cyclicals (+0.42%).

Top 3 Sectors traded in red*: Financials (-0.82%), Energy (-0.52%) and Consumer Non-Cyclicals (-0.04%).

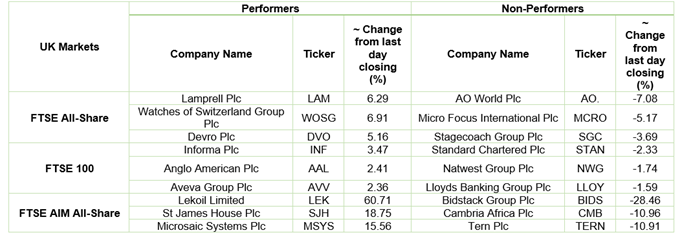

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $76.03/barrel and $74.98/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,791.05 per ounce, up by 0.80% against the prior day closing.

Currency Rates*: GBP to USD: 1.3844; EUR to GBP: 0.8577.

Bond Yields*: US 10-Year Treasury yield: 1.429%; UK 10-Year Government Bond yield: 0.6990%.

*At the time of writing