US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 43.91 points or 1.23 per cent lower at 3,528.75, Dow Jones Industrial Average Index contracted by 394.06 points or 1.34 per cent lower at 29,003.57, and the technology benchmark index Nasdaq Composite traded lower at 11,707.74, down by 78.69 points or 0.67 per cent against the previous day close (at the time of writing, before the US market close at 1:20 PM ET).

US Market News: The Wall Street traded in the red as the pandemic waves weighed down on the market. The Core CPI in the US increased by 1.6% year on year in October 2020. The US reported jobless claims of 6.786 million for the week ended 7 November 2020 that was below the expected claim of 6.9 million. Among the gaining stocks, Moderna gained by approximately 5.7% after it stated that it had enough data to start the planned interim analysis of covid-19 vaccine. Jaws Acquisition rose by nearly 4.6% after the company neared merger with Cano Health. Edgewell Personal Care was up by around 1.8% after it highlighted improved sales in FY21. Alibaba moved up by about 0.6% after it reported Single Day sales of USD 75 billion. Among the decliners, Energizer Holdings shares plunged by nearly 11.1% after it reported a quarterly profit of 59 USD cents. Walgreens Boots Alliance was down by around 1.8% on DOW 30.

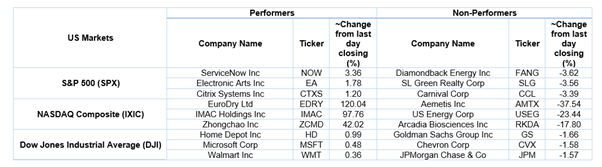

US Stocks Performance*

European News: The London and European markets traded in the red as the covid-19 infections continue to rise in the UK. The UK’s GDP grew by 15.5% quarter on quarter in Q3 2020. The industrial production increased by 0.5% month on month in September 2020. Among the gaining stocks, Qinetiq surged by about 11.5% after it reported an increase in orders. PureTech Health was up by approximately 8.2% after its entity launched a self-serve API that detects symptoms of respiratory disease from voice changes. 3I Group was up by around 3.3% after it generated a return of 15% on opening shareholder’s funds. Among the decliners, Burberry was down by close to 2.9% after it reported lower revenue. Shares of B&M European Value Retail fell by nearly 1.9%, although it reported an increase in group revenue. National Grid slipped by around 0.6% after it reported a decline in underlying operating profit.

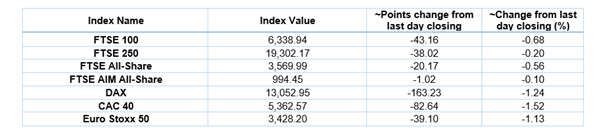

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 12 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in red*: Energy (-2.78%), Financials (-2.19%) and Healthcare (-1.66%).

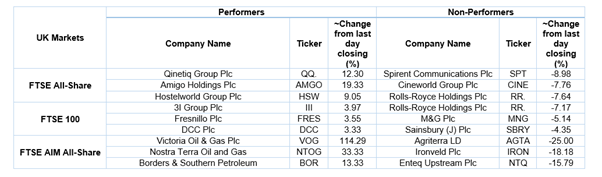

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $44.07/barrel and $41.81/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,873.20 per ounce, up by 0.62% against the prior day closing.

Currency Rates*: GBP to USD: 1.3115; EUR to GBP: 0.9001.

Bond Yields*: US 10-Year Treasury yield: 0.898%; UK 10-Year Government Bond yield: 0.342%.

*At the time of writing