UK Market: The UK stock market traded cautiously on Friday, with the blue-chip FTSE 100 index showing a flat trade after surging in the previous two sessions on PM Boris Johnson’s announcement of his departure. The index underperformed as compared to its global peers due to weakness in mining and banking stocks. Also, UK Report on Jobs from the Recruitment and Employment Confederation (REC) and KPMG, that the UK job market was losing steam weighed on the sentiments. In June, vacancies increased at the weakest rate in over a year due to increasing costs, concern over the economic recession and a shortage of candidates. Sterling also fell against the dollar on Friday as news of the resignation of Boris Johnson and fears of the possible recession took their toll.

The Watches of Switzerland Group Plc (LON: WOSG): The shares of the British retailer of Swiss watches, Watches of Switzerland were down by around 4%, with a day’s low of GBX 759.50. The company reported a strong rise in revenue driven by an increase in demand for both watches and jewellery but provided guidance for a decline in sales growth.

JD Sports Fashion Plc (LON: JD.): The share of British sports-fashion retail company JD Sports Fashion Plc increased by around 1%, with a day’s high of GBX 126.20. The company reported the appointment of Andy Higginson as Chair of the Group, effective 11th July 2022.

Vistry Group Plc (LON: VTY): The shares of British house-building company Vistry Group Plc were up by around 1%, with a day’s high of GBX 836.00. The company reported that its first-half performance beat its initial expectations at the start of the year, and it expects to meet the top-end of market forecasts for 2022.

US Markets: The US market is likely to get a soft start, as indicated by the futures indices. S&P 500 future was down by 19.92 points or 0.56% at 3,880.70, while the Dow Jones 30 futures was down by 0.28% or 89.25 points at 31,295.30. The technology-heavy index Nasdaq Composite future was down by 1.07% at 11,973.63 (At the time of writing – 9:50 AM ET).

US Market News:

The shares of the American clothing company Levi Strauss (LEVI) rallied 3.9% in the premarket trading session after reporting better-than-expected sales and profit for its latest quarter. This was driven by higher prices and strong demand for its denim offerings.

The share of an American electronics retail company, GameStop (GME), fell by 5.6% in the premarket trading session after the company fired Chief Financial Officer Mike Recupero. As it tries to turn its business around, it also told its employees in an internal memo that it is cutting staff.

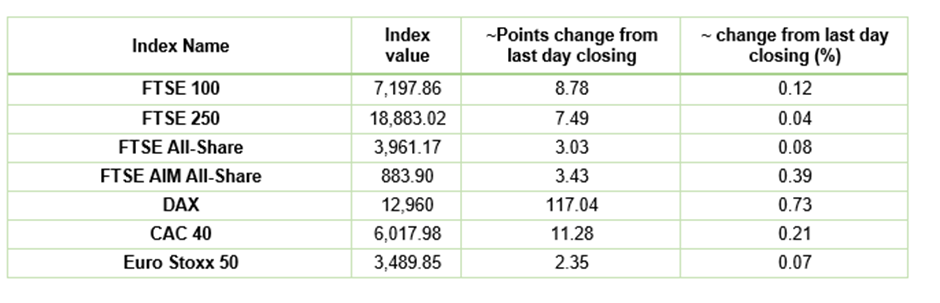

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 8 June 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Barclays Plc (BARC) and Glencore Plc (GLEN).

Top 3 Sectors traded in green*: Energy (1.45%), Technology (0.40%) and Consumer Cyclicals (0.25%).

Top 3 Sectors traded in red*: Healthcare (-1.36%), Utilities (-0.72%), Financials (-0.57%)

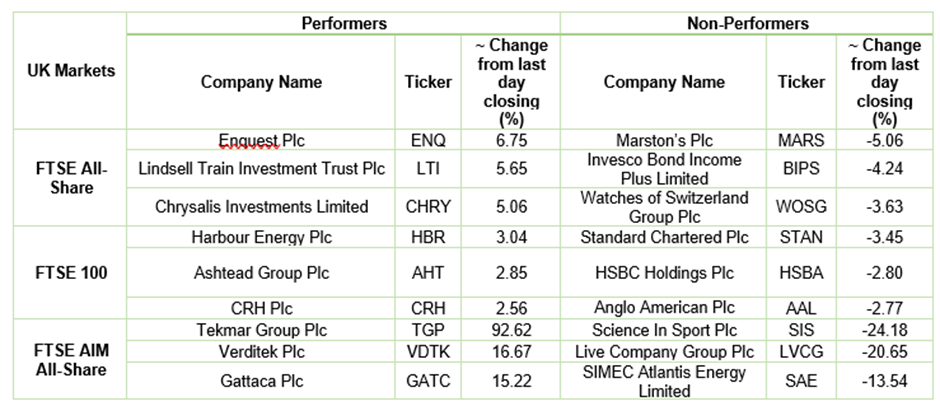

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $104.99/barrel and $102.92/barrel, respectively.

Gold Price*: Gold price hovered at around US$ 1,740.90 per ounce, up by 0.07% against the prior day's closing.

Currency Rates*: GBP to USD: 1.1994; EUR to USD: 1.0148.

Bond Yields*: US 10-Year Treasury yield: 2.993%; UK 10-Year Government Bond yield: 2.1555%.

*At the time of writing