US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 18.76 points or 0.43 per cent lower at 4,340.70, Dow Jones Industrial Average Index dipped by 285.22 points or 0.83 per cent lower at 34,105.50, and the technology benchmark index Nasdaq Composite traded higher at 14,519.00, up by 6.60 points or 0.05 per cent against the previous day close (at the time of writing – 11:45 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note after US jobless claims demonstrated an increase last week. Among the gaining stocks, Perrigo Company (PRGO) shares climbed by around 11.84% after it had resolved a tax dispute with Ireland. FuboTV (FUBO) shares grew by around 1.70% as Company’s gaming unit would collaborate with payments platform Paysafe for the interactive wagering operation. Among the declining stocks, CarMax (KMX) shares plunged by around 11.18% after the auto retailer Company missed the quarterly earnings estimates. Herman Miller (MLHR) shares dropped by around 1.45% after the Company provided upbeat earnings forecast for the current quarter.

UK Market News: The London markets traded in a red zone after investors digested the recent quarterly UK GDP data. According to the latest figures from the Office for National Statistics, the UK GDP expanded by around 5.50% during Q2 2021 when compared with the prior quarter.

Boohoo Group shares plunged by about 15.59% after the Company had reduced the full-year adjusted EBITDA margin guidance due to the freight inflation in the supply chain. However, the first-half sales witnessed a healthy growth of around 20%.

Delta Variant fear looms large on Global Markets

Diageo shares went up by around 1.33% after the Company kickstarted FY22 on a brighter note as it gained organic sales momentum across all regions.

South32 had exercised pre-emptive rights to acquire an additional 25% shareholding and related rights in Mozal Aluminium. Meanwhile, the shares grew by around 2.74%.

Virgin Money UK shares fell by around 3.28% after it had decided to close 31 out of 162 branches because of the digital transformation.

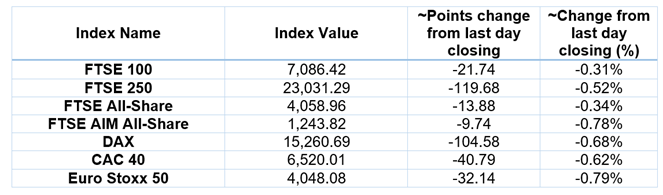

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 30 September 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group PLC (LLOY); Rolls-Royce Holdings PLC (RR); Barclays PLC (BARC).

Top 3 Sectors traded in green*: Basic Materials (+1.33%), Healthcare (+0.89%), Financials (+0.18%).

Top 3 Sectors traded in red*: Utilities (-1.07%), Consumer Non-Cyclicals (-0.82%), Consumer Cyclicals (-0.79%).

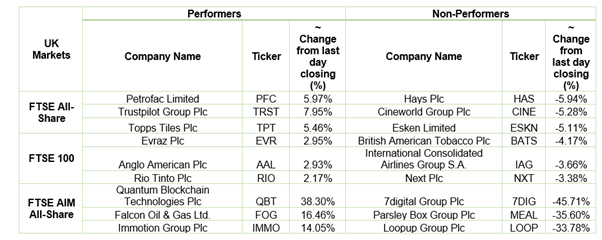

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $78.33/barrel and $75.03/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,756.75 per ounce, up by 1.96% against the prior day closing.

Currency Rates*: GBP to USD: 1.3466; EUR to USD: 1.1566.

Bond Yields*: US 10-Year Treasury yield: 1.522%; UK 10-Year Government Bond yield: 1.0170%.

*At the time of writing