US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 12.63 points or 0.30 per cent higher at 4,192.80, Dow Jones Industrial Average Index surged by 48.55 points or 0.14 per cent higher at 34,092.04, and the technology benchmark index Nasdaq Composite traded higher at 14,103.15, up by 86.34 points or 0.62 per cent against the previous day close (at the time of writing - 11:30 AM ET).

US Market News: The major indices of Wall Street traded in a green zone ahead of the Federal Reserve's latest policy meeting. Among the gaining stocks, Otis Worldwide Corp shares surged by around 6.64% after the Company had produced impressive quarterly results and raised its full-year forecast. Discover Financial Services shares went up by approximately 3.45% after the Bank of America had raised its investment stance from “Neutral” to “Buy”. Check Point Software Technologies shares rose by about 1.09% after the cyber-security solution provider had delivered strong first-quarter earnings. Among the declining stocks, Albertsons shares fell by about 1.98% after the Company had forecasted comparable sales growth for the current financial year to be ranging from 6% to 7.5%.

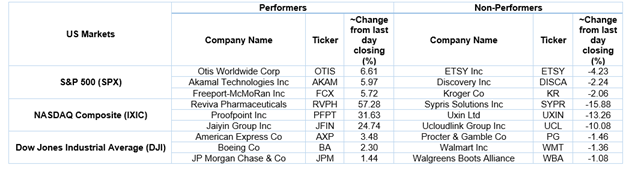

US Stocks Performance*

UK Market News: The London markets traded in a green zone after the preliminary media reports of reopening international travel to all vaccinated visitors. FTSE 100 advanced higher by around 0.35%, driven by the good performance of travel & leisure shares like International Consolidated Airlines Group and Rolls-Royce Holdings. According to Springboard, the number of people shopping across Britain dropped by around 3.4% for the week ended on 24 April 2021 as compared to the prior week.

Educational publisher Pearson shares rose by about 3.02% after the Company had shown a 5% underlying revenue growth during Q1 FY21 driven by increased demand for global online learning. Moreover, the online division revenue rose by around 25% due to robust growth in Virtual Schools.

Food ingredients maker Tate & Lyle had confirmed regarding the process of exploring the potential to separate its Food & Beverage Solutions and Primary Products businesses. Furthermore, the shares climbed by around 6.08%.

FTSE 250 listed IMI shares surged by about 10.95% after the Company had raised its guidance for the full-year earnings driven by the improved business performance during the first quarter. Moreover, the Company had announced a share buyback of around 200 million pounds.

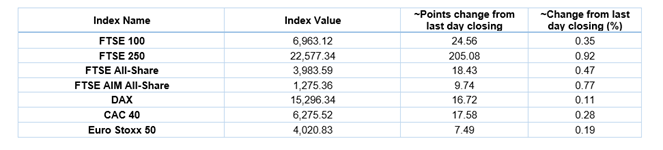

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 26 April 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Basic Materials (+1.48%), Energy (+1.46%) and Real Estate (+1.23%).

Top 3 Sectors traded in red*: Consumer Non-Cyclicals (-0.84%), Utilities (-0.61%) and Healthcare (-0.41%).

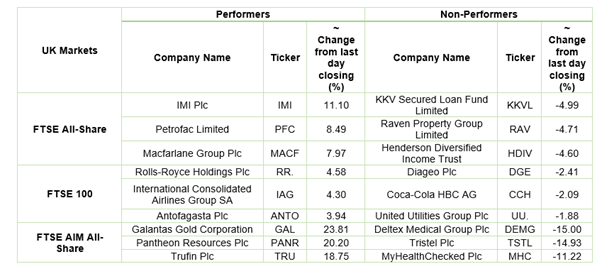

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $65.30/barrel and $62.14/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,779.85 per ounce, up by 0.12% against the prior day closing.

Currency Rates*: GBP to USD: 1.3897; EUR to GBP: 0.8699.

Bond Yields*: US 10-Year Treasury yield: 1.5667%; UK 10-Year Government Bond yield: 0.7600%.

*At the time of writing