US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 8.37 points or 0.19 per cent higher at 4,451.42, Dow Jones Industrial Average Index surged by 76.05 points or 0.22 per cent higher at 34,653.62, and the technology benchmark index Nasdaq Composite traded lower at 15,021.00, down by 16.80 points or 0.11 per cent against the previous day close (at the time of writing – 11:35 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note amid fears of economic slowdown. Among the gaining stocks, Skillsoft (SKIL) shares jumped by around 3.50% after the Company raised full-year guidance driven by encouraging current quarter performance. Microsoft (MSFT) shares increased by around 1.17% after the Company announced an 11% dividend hike. Regeneron Pharmaceuticals (REGN) shares went up by about 0.96% after the US Government decided to purchase a significant amount of the Company’s Covid-19 antibody cocktail. Among the declining stocks, Yum China Holdings (YUMC) shares plunged by around 6.30% after the Company stated that around 500 restaurants got affected by the recent delta variant outbreak in China.

UK Market News: The London markets traded in a red zone after the release of the record UK inflation numbers. According to the IHS Markit/CIPS, the Consumer Price Index (“CPI”) rose around 3.2% during August 2021 on an annual basis. Moreover, on a monthly basis, it grew by approximately 0.7%.

Fever-Tee Drinks shares surged by about 9.54% after the Company had reported a robust increase in first-half revenue and subsequently declared an interim dividend. Moreover, the Company had reiterated the revenue guidance provided during July 2021.

Deliveroo shares went down by around 0.81% after the Company signed a deal with Amazon where Prime customers can get free delivery on the Company’s platform.

Redrow had shown tremendous growth in top-line revenue and bottom-line profitability during FY21. However, the shares dropped by around 0.61%.

Restaurant Group shares plunged by around 10.23% after it had reported a drop in first-half revenue and reported a considerable loss before tax. Moreover, the Company had raised FY21 EBITDA expectations benefited by the encouraging trading performance since the reopening of the UK economy.

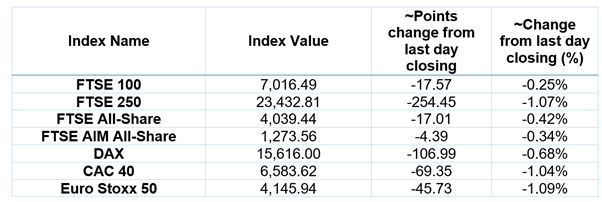

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 15 September 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group PLC (LLOY); BP PLC (BP.); Rolls Royce Holdings PLC (RR.).

Top 2 Sectors traded in green*: Energy (+2.13%), Basic Materials (+0.77%).

Top 3 Sectors traded in red*: Real Estate (-1.79%), Technology (-1.26%), Industrials (0.90%).

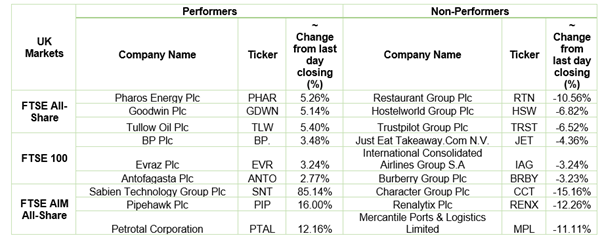

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $75.47/barrel and $72.58/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,793.35 per ounce, down by 0.76% against the prior day closing.

Currency Rates*: GBP to USD: 1.3836; EUR to USD: 1.1807.

Bond Yields*: US 10-Year Treasury yield: 1.311%; UK 10-Year Government Bond yield: 0.7760%.

*At the time of writing