US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 1.81 points or 0.04 per cent higher at 4,530.60, Dow Jones Industrial Average Index surged by 43.36 points or 0.12 per cent higher at 35,443.20, and the technology benchmark index Nasdaq Composite traded lower at 15,256.00, down by 9.90 points or 0.06 per cent against the previous day close (at the time of writing – 11:50 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note, with Nasdaq slipped due to heavyweight technology shares. Among the gaining stocks, NetEase (NTES) shares rose by around 4.42% after Company had reported better-than-expected earnings for the latest quarter. Textron (TXT) shares went up by around 1.21% after Cowen had upgraded the stock from “market perform” to “outperform”. Among the declining stocks, Zoom Video Communications (ZM) shares fell by about 15.78% after the Company’s full-year sales forecast fell short of analysts’ expectations. Designer Brands (DBI) shares plunged by around 10.12%, even after the footwear retailer’s quarterly top-line revenue and bottom-line profitability came out to be more than the consensus estimates.

UK Market News: The London markets traded on a mixed note after the release of weak Chinese factory data. According to the latest figures from the Bank of England, the mortgage approvals had dropped from 80,272 in June 2021 to 75,152 during July 2021.

Computacenter shares went up by about 3.80% after the Company stated in an unscheduled trading update that the FY21 adjusted pre-tax profit would remain around 10% ahead of the prior year.

FTSE 100 listed Bunzl shares dropped by around 2.09%, even after the Company had reported a significant growth in top-line revenue and adjusted pre-tax profit during the first half.

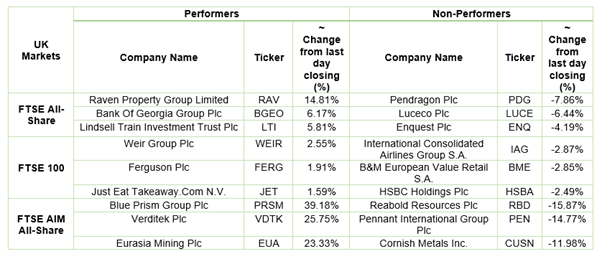

Weir Group got upgraded by Peel Hunt to “buy”. Moreover, the shares grew by around 3.23% and remained the top performer on FTSE 100 index.

Rolls-Royce Holdings shares fell by around 1.77 after the Company’s biggest shareholder Causeway Capital Management had called to refresh the Board.

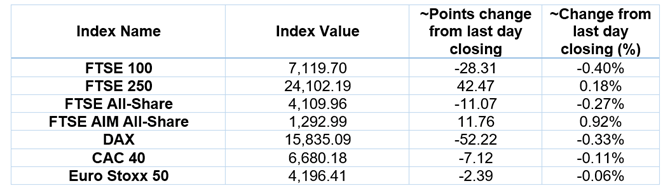

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 31 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group PLC (LLOY); Vodafone Group PLC (VOD); BP PLC (BP.).

Top Sector traded in green*: Utilities (+0.31%).

Top 3 Sectors traded in red*: Energy (-1.18%), Financials (-1.15%) and Healthcare (-1.01%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $71.93/barrel and $68.83/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,817.95 per ounce, up by 0.32% against the prior day closing.

Currency Rates*: GBP to USD: 1.3758; EUR to USD: 1.1810.

Bond Yields*: US 10-Year Treasury yield: 1.304%; UK 10-Year Government Bond yield: 0.6160%.

*At the time of writing