US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 4.43 points or 0.10 per cent lower at 4,532.52, Dow Jones Industrial Average Index dipped by 87.26 points or 0.25 per cent lower at 35,356.56, and the technology benchmark index Nasdaq Composite traded higher at 15,352.40, up by 21.20 points or 0.14 per cent against the previous day close (at the time of writing – 11:50 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note as nonfarm payrolls remained short of expectations. Among the gaining stocks, DocuSign (DOCU) shares rose by around 5.44% after the Company’s latest quarterly earnings had managed to beat consensus estimates by 7 cents. MicroStrategy (MSTR) shares increased by around 3.49%, boosted by the Bitcoin price. Broadcom (AVGO) shares went up by around 1.56% after the Company had provided an encouraging outlook for the current quarter, boosted by strong demand in the 5G mobile market. Aurora Cannabis (ACB) shares grew by about 0.60% after the Company got upgraded by Jefferies from “underperform” to “hold”.

UK Market News: The London markets traded in a red zone after the release of disappointing UK services data. According to the latest data from the IHS Markit/CIPS, the UK services PMI had shown a reading of 55.0 during August 2021, while it was 59.6 for the prior month.

Ashmore Group shares went down by about 3.46%, even after the Company reported a 13% growth in Assets under Management and a 28% increase in pre-tax profit during FY21.

Sage Group shares went up by around 0.08% after the Company planned to begin a share buyback programme of up to £300 million.

Petrofac had secured a contract worth approximately USD 100 million with Zallaf Libya Oil & Gas Exploration and Production Company. Furthermore, the shares grew by around 0.65%.

Berkeley Group Holdings shares went down by around 0.27% after the Company remained on track to meet full-year profit guidance. Moreover, the Company had expected FY22 profit to remain ahead of FY21 levels.

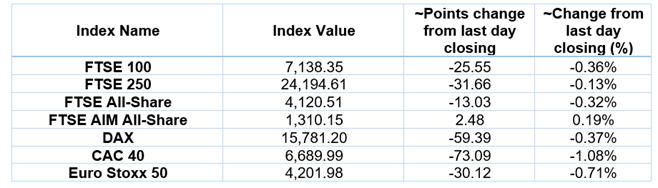

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 3 September 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group PLC (LLOY); Vodafone Group PLC (VOD); Glencore PLC (GLEN).

Top 2 Sectors traded in green*: Basic Materials (+0.48%), Consumer Non-Cyclicals (+0.12%).

Top 3 Sectors traded in red*: Healthcare (-0.81%), Industrials (-0.73%) and Energy (-0.66%).

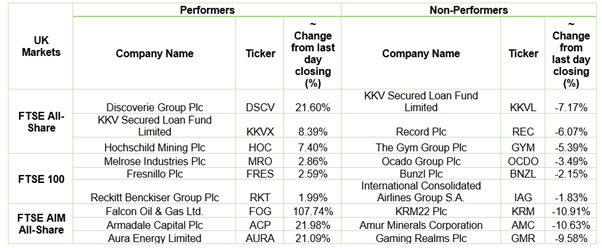

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $72.87/barrel and $69.56/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,833.25 per ounce, up by 1.20% against the prior day closing.

Currency Rates*: GBP to USD: 1.3888; EUR to USD: 1.1894.

Bond Yields*: US 10-Year Treasury yield: 1.326%; UK 10-Year Government Bond yield: 0.7125%.

*At the time of writing