US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 17.89 points or 0.54 per cent higher at 3,324.40, Dow Jones Industrial Average Index expanded by 318.09 points or 1.19 per cent higher at 27,146.56, and the technology benchmark index Nasdaq Composite traded higher at 10,972.10, up by 30.93 points or 0.28 per cent against the previous day close (at the time of writing, before the US market close at 12:05 PM ET).

US Market News: The Wall Street opened in green as the key indices advanced. The Composite PMI and Services PMI were 50.3 and 50.0 in July 2020, respectively. Meanwhile, the private payroll in the US increased by 167,000 in July 2020 against markets expectation of 1 million. Among the gaining stocks, Walt Disney shares were up by about 9.3 percent after the company reported better than expected earnings. Johnson & Johnson shares were up by close to 0.7 percent after the company received orders worth USD 1 billion from the US government for manufacturing coronavirus doses. Facebook shares were up by about 0.4 percent after the company added feature similar to Tik Tok inside Instagram. Among the decliners, Moderna's shares were down by close to 5.3 percent the company announced that it would charge between USD 32 to USD 37 per dose for the coronavirus vaccine. Beyond Meat shares were down by about 3.9 percent after the company reported higher costs related to Covid-19.

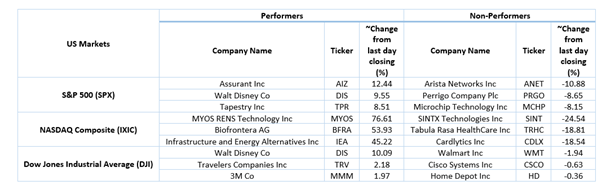

US Stocks Performance (at the time of writing)

European News: London and European markets opened in green. As per the industry data, the new car registration in the UK increased by approximately 11 percent year on year in July 2020. Meanwhile, the UK's composite PMI index increased to 57.0 in July 2020 from 47.7 in June 2020. Among the gaining stocks, William Hill was up by close to 7.9 percent after the company said that it would repay the furlough fund of £24.5 million to the UK government. Coca Cola was up by about 6.7 percent after the company announced that it witnessed improving cues after the markets reopened. WH Smith was up by close to 0.5 percent after the company said that it might slash close to 1,500 jobs as a part of the restructuring plan. Legal & General was up by about 1.5 percent although the company reported a lower profit after tax in H1 FY20 compared to the same period last year. Among the decliners, Metro Bank was down by close to 6.4 percent after the company reported a loss of £240 million for H1 FY2020. IP Group was down by about 1.0 percent, although the company reported net portfolio gains.

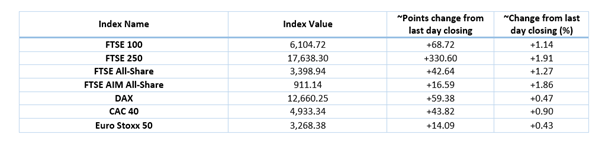

European Indices Performance (at the time of writing)

FTSE 100 Index Chart

1 Year FTSE 100 Index Performance (5 August 2020), before the market closed (Source: Refinitiv, Thomson Reuters)

Stocks traded with decent volume*: (LLOY) LLOYDS BANKING GROUP PLC; (BP.) BP PLC; (TSCO) TESCO PLC.

Sectors traded in the positive zone*: Basic Materials (+3.37%); Consumer Cyclicals (+2.16%), and Energy (+1.82%).

Sectors traded in the negative zone*: Utilities (-0.47%); Telecommunications Services (-0.46%), and Consumer Non-Cyclicals (-0.30%).

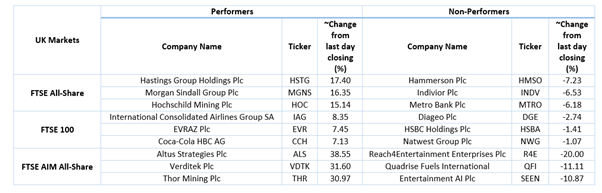

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: WTI crude oil (future) price and Brent future crude oil (future) price were hovering at $42.30 per barrel and $45.34 per barrel, respectively.

Gold Price*: Gold price was trading at USD 2,040.20 per ounce, up by 1.58% from previous day closing.

Currency Rates*: GBP to USD and EUR to GBP were hovering at 1.3117 and 0.9042, respectively.

Bond Yields*: U.S 10-Year Treasury yield and UK 10-Year Government Bond yield were trading at 0.544 per cent and 0.128 per cent, respectively.

*At the time of writing

_(1).jpg)