US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 0.99 points or 0.02 per cent higher at 4,370.20, Dow Jones Industrial Average Index dipped by 12.10 points or 0.03 per cent lower at 34,876.69, and the technology benchmark index Nasdaq Composite traded higher at 14,679.00, up by 1.40 points or 0.01 per cent against the previous day close (at the time of writing – 11:45 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note as investors digested the latest US inflation data. Among the gaining stocks, American Airlines Group (AAL) shares rose by about 3.57% after it expects to report positive cash flow for the second quarter. Among the declining stocks, Bank of America (BAC) shares fell by about 4.62% after its quarterly revenue had missed the consensus estimates. Peloton Interactive (PTON) shares went down by about 4.37% after Wedbush Securities had downgraded the stock from “outperform” to “neutral”. Delta Air Lines (DAL) shares dropped by about 1.88% after the Company reported a loss of USD 1.07 per share for the second quarter.

UK Market News: The London markets traded in a red zone after the release of the critical UK inflation data. Moreover, the Office for National Statistics had shown consumer price inflation rose to 2.5% annually during June 2021 as compared to 2.1% for the prior month.

FTSE 250 listed Dunelm Group shares plunged by around 5.35%, although it had raised the full-year guidance due to the impressive fourth-quarter sales helped by strong pent up demand after the reopening of stores.

Coats Group shares rose by around 2.31% after the Company increased the full-year guidance driven by strong business performance during the first half of the current fiscal year.

Barratt Developments had lifted the expectations of full-year profitability driven by solid demand. Furthermore, the shares went up by around 1.89%

International Consolidated Airlines Group shares went down by around 0.87% after Raymond James had downgraded the stock to “market perform”.

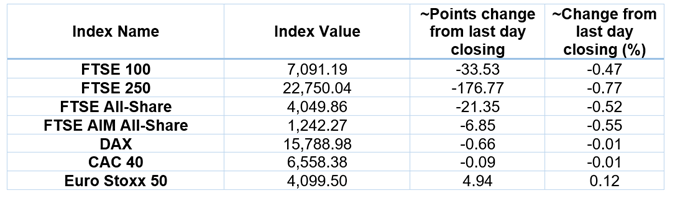

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 14 July 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Vodafone Group Plc (VOD); Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.).

Top 2 Sectors traded in green*: Energy (+0.05%) and Basic Materials (+0.00%).

Top 3 Sectors traded in red*: Utilities (-1.08%), Real Estate (-1.03%) and Industrials (-0.94%).

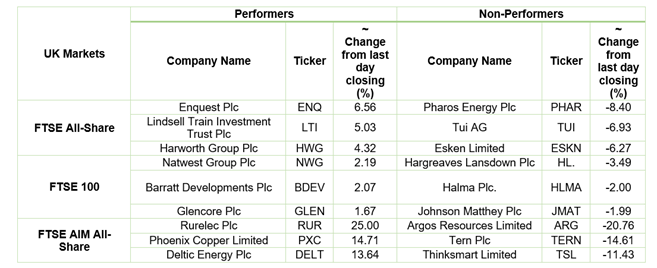

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $74.69/barrel and $73.06/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,824.85 per ounce, up by 0.83% against the prior day closing.

Currency Rates*: GBP to USD: 1.3857; EUR to GBP: 0.8537.

Bond Yields*: US 10-Year Treasury yield: 1.364%; UK 10-Year Government Bond yield: 0.6330%.

*At the time of writing