US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 12.47 points or 0.28 per cent higher at 4,498.70, Dow Jones Industrial Average Index surged by 99.65 points or 0.28 per cent higher at 35,465.91, and the technology benchmark index Nasdaq Composite traded higher at 15,042.40, up by 22.60 points or 0.15 per cent against the previous day close (at the time of writing – 11:50 AM ET).

US Market News: The major indices of Wall Street traded in a green zone, with Nasdaq touching new highs boosted by the technology stocks. Among the gaining stocks, Toll Brothers (TOL) shares grew by around 3.33% after the Company reported quarterly earnings more than the consensus estimates. Among the declining stocks, Cassava Sciences (SAVA) shares plunged by around 19.89% after the Company stated all claims posted online as false and misleading. Express (EXPR) shares dropped by about 10.47%, even after the Company reported a surprise profit for the latest quarter. Shoe Carnival (SCVL) shares went down by about 5.60%, although the quarterly top-line revenue and bottom-line profitability had exceeded the Wall Street expectations.

UK Market News: The London markets traded in a green zone supported by healthcare and consumer stocks.

Grafton Group shares went up by about 3.97% after the Company had reported record interim profits and subsequently reinstated the dividend payments boosted by the Woodies business in Ireland.

FTSE 250 listed Rank Group shares rose by around 3.24% after it stated that HM Revenue and Customs would not appeal regarding VAT paid on slot machine income in the period from April 2006 to January 2013.

Augean had agreed to be taken over by Eleia Limited in a lucrative deal worth approximately 325 pence per share in cash. Moreover, the shares climbed by around 17.54%.

Aviva shares grew by around 0.48% after Cevian Capital has increased its stake in the company to more than 5%.

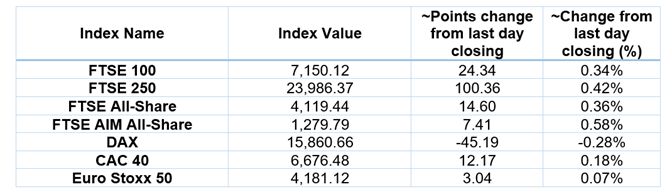

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 25 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings PLC (RR.) and International Consolidated Airlines Group S.A. (IAG).

Top 3 Sector traded in green*: Consumer Cyclicals (+1.07%), Financials (+1.00%) and Basic Materials (+0.56%).

Top 3 Sectors traded in red*: Utilities (-0.86%), Industrials (-0.51%) and Consumer Non-Cyclicals (-0.29%).

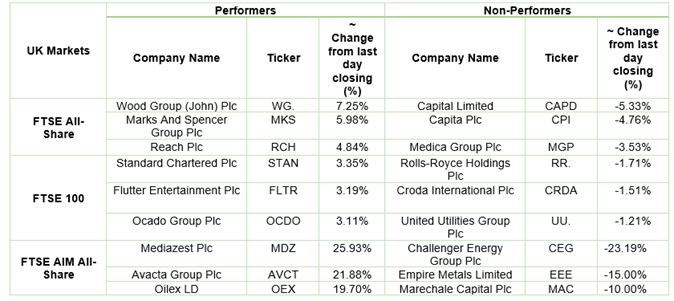

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $71.12/barrel and $68.14/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,794.00 per ounce, down by 0.80% against the prior day closing.

Currency Rates*: GBP to USD: 1.3763; EUR to USD: 1.1772.

Bond Yields*: US 10-Year Treasury yield: 1.344%; UK 10-Year Government Bond yield: 0.5970%.

*At the time of writing