US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 59.54 points or 1.58 per cent higher at 3,833.40, Dow Jones Industrial Average Index expanded by 530.78 points or 1.76 per cent higher at 30,742.69, and the technology benchmark index Nasdaq Composite traded higher at 13,576.81, up by 173.42 points or 1.29 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in the green territory due to positive investor sentiments regarding the progress of a pandemic relief package. Among the gaining stocks, shares of Holicity grew by 43.82% after it had announced the plans to merge with Astra. Shares of United Parcel Service went up by 2.24% after it had reported better than expected earnings over the holiday season. Shares of Alphabet went up by 1.79% after it had agreed to settle the allegations. Among the declining stocks, GameStop shares went down by 58.36% after Reddit short squeeze began to fade. Shares of Harley-Davidson went down by 18.75% after it reported a loss in the fourth quarter.

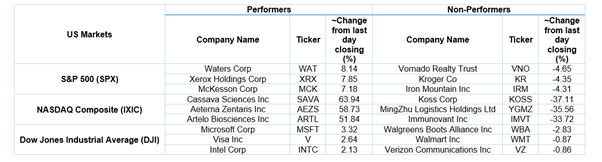

US Stocks Performance*

European News: The London and European markets traded in the green territory driven by the crumbling of Reddit trades and a surge in the Asian stocks. The UK Nationwide house price index went down by 0.3% in January 2021 compared to December 2020. Among the gaining stocks, Virgin Money UK shares jumped by 7.66% after it had reported a profit for the first quarter of 2021. DCC shares jumped by 1.55% after it reported robust growth in third-quarter operating profit. Shares of Whitbread had increased the most on FTSE 100. Among the decliners, Fresnillo shares went down by 5.95% after witnessing a rally in the previous trading session. BP shares went down by 4.96% after the company reported a full-year loss of negative USD 5.7 billion. Idox shares dropped by 0.56% although it had reported good FY20 results.

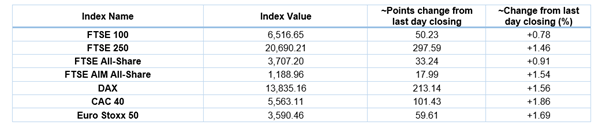

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 2 February 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Financials (+1.50%), Industrials (+1.30%) and Consumer Non-Cyclicals (+1.00%).

Top 2 Sectors traded in red*: Utilities (-0.53%) and Basic Materials (-0.39%).

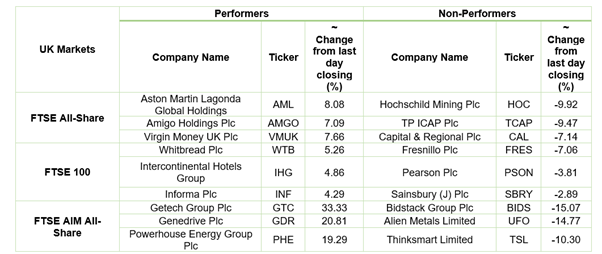

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $57.47/barrel and $54.70/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,836.55 per ounce, down by 1.47% against the prior day closing.

Currency Rates*: GBP to USD: 1.3645; EUR to GBP: 0.8806.

Bond Yields*: US 10-Year Treasury yield: 1.100%; UK 10-Year Government Bond yield: 0.346%.

*At the time of writing