US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 6.51 points or 0.19 per cent higher at 3,388.50, Dow Jones Industrial Average Index contracted by 30.51 points or 0.11 per cent lower at 27,814.40, and the technology benchmark index Nasdaq Composite traded higher at 11,182.47, up by 52.74 points or 0.47 per cent against the previous day close (at the time of writing, before the US market close at 12:05 PM ET).

US Market News: The US markets opened in the green on Tuesday. The US housing starts were up by 22.6 percent in July 2020 to 1.496 million against expected 1.240 million housing starts. Among the gaining stocks, Oracle was up by around 2.6 percent after the company is looking to buy the business of TikTok in the US, Canada, Australia and New Zealand. Zoom Video Communication's shares were up by close to 2.3 percent after the company stated that it had opened a new data centre in Singapore. Among the decliners, Kohls was down by close to 16.7 percent after the company reported a quarterly loss. Walmart shares were down by about 1.4 percent, although the company reported increased online sales in the second quarter. Home Depot was down by around 1.1 percent, although the company reported an increase in same-store sales in the quarterly result.

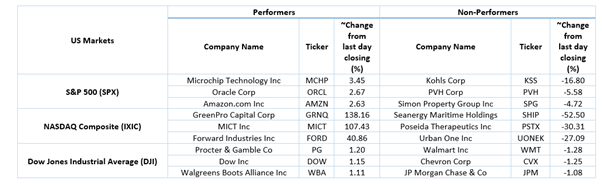

US Stocks Performance (at the time of writing)

European News: The key market indices of the UK market traded in the red, whereas the European market advanced. As per the UK's Finance ministry data, the British banks have lent close to £53 billion to businesses under the UK government's Covid related schemes. Among the gaining stocks, Persimmon was up by about 6.2 percent after the company stated that it had a strong H2 FY20 start. Mears Group was up by about 5.9 percent after the company reported a strong order book in H1 FY20. Wood Group's shares were up by about 4.6 percent although the company reported a loss in H1 FY20. Among the decliners, Capita plunged by close to 18.8 percent after the company reported a loss in the H1 FY20 results. Marks & Spencer was down by around 4.9 percent after the company plans to slash 7,000 jobs over the next three months.

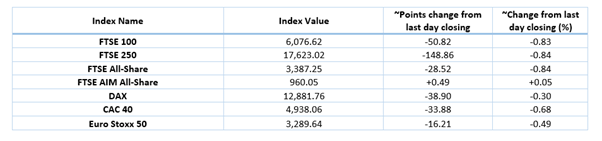

European Indices Performance (at the time of writing)

FTSE 100 Index Chart

1 Year FTSE 100 Index Performance (18 August 2020), before the market closed (Source: Refinitiv, Thomson Reuters)

Stocks traded with decent volume*: (LLOY) LLOYDS BANKING GROUP PLC; (IAG) International Consolidated Airlines Group SA; (BP.) BP PLC.

Sector traded in the positive zone*: Consumer Cyclicals (+0.02%).

Sectors traded in the negative zone*: Energy (-1.44%); Utilities (-1.26%), and Financials (-1.21%).

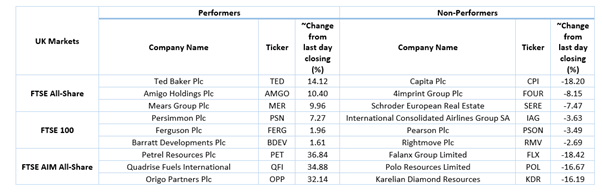

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: WTI crude oil (future) price and Brent future crude oil (future) price were hovering at $42.70 per barrel and $45.23 per barrel, respectively.

Gold Price*: Gold price was trading at USD 2,012.50 per ounce, up by 0.69% from previous day closing.

Currency Rates*: GBP to USD and EUR to GBP were hovering at 1.3240 and 0.9012, respectively.

Bond Yields*: U.S 10-Year Treasury yield and UK 10-Year Government Bond yield were trading at 0.670 per cent and 0.216 per cent, respectively.

*At the time of writing

.jpg)