Source:Copyright © 2021 Kalkine Media Pty Ltd.

US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 29.71 points or 0.75 per cent higher at 3,988.26, Dow Jones Industrial Average Index surged by 53.10 points or 0.16 per cent higher at 33,120.06, and the technology benchmark index Nasdaq Composite traded higher at 13,274.65, up by 229.25 points or 1.76 per cent against the previous day close (at the time of writing - 2:15 PM ET).

US Market News: The major indices of Wall Street traded in a green zone after witnessing a jump in hiring during March 2021. Among the gaining stocks, Chewy shares went up by approximately 8.20% after the online pet supplier had reported a profit for the final quarter of the last year. Walgreens Boots Alliance shares jumped by around 6.12% after the Company raised its full-year guidance. Pfizer shares went up by approximately 0.32% after the drugmaker had announced 100% efficacy of its Covid-19 vaccine. Among the declining stocks, Blackberry shares fell by about 9.62% after the technology Company had missed fourth-quarter revenue estimates.

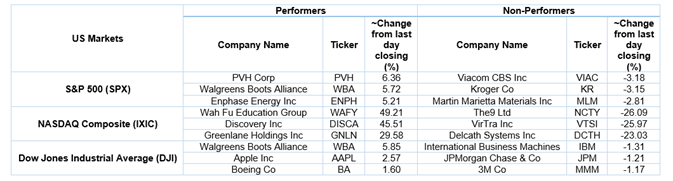

US Stocks Performance*

UK Market News: The London markets traded in a red zone illustrating weak investor sentiments regarding the UK GDP data. FTSE 100 traded lower by around 0.86% amid expectations of rising interest rates. The UK GDP had shown a growth of 1.3% during the fourth quarter of 2020. Moreover, the Office for National Statistics reported that Britain’s current account deficit had widened to 26.3 billion pounds during the fourth quarter of 2020, while it was 14.3 billion pounds for the third quarter of 2020. According to Nationwide’s latest house price index, the prices had increased by 5.7% annually in March 2021 as compared to a 6.9% year-on-year increase experienced during February 2021.

Gaming Developer Sumo Group had reported a remarkable jump in revenue and earnings during FY20, supported by Covid-19 related boom in the gaming industry. However, the shares dropped by around 4.14%.

SSE shares jumped by approximately 1.05% after Goldman Sachs raised its target price on the electricity business. Similarly, Hikma Pharmaceuticals shares went up by about 3.91% after Jefferies upgraded the investment stance from “Hold” to “Buy”.

Topps Tiles shares dropped by around 2.32% after the Company had reported a 2% decline in revenue for the 26 weeks ended 27 March 2021 as compared to the prior period.

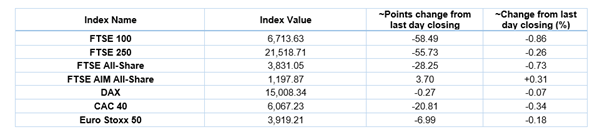

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 31 March 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); BT Group Plc (BT.A).

Top 2 Sectors traded in green*: Utilities (+0.87%) and Technology (+0.06%).

Top 3 Sectors traded in red*: Energy (-1.75%), Real Estate (-0.98%) and Consumer Cyclicals (-0.69%).

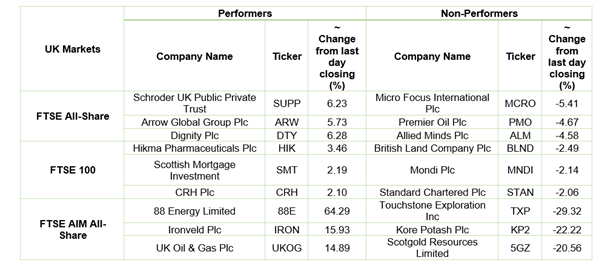

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $63.06/barrel and $59.59/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,709.75 per ounce, up by 1.41% against the prior day closing.

Currency Rates*: GBP to USD: 1.3790; EUR to GBP: 0.8512.

Bond Yields*: US 10-Year Treasury yield: 1.732%; UK 10-Year Government Bond yield: 0.855%.

*At the time of writing