US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 2.82 points or 0.08 per cent lower at 3,696.30, Dow Jones Industrial Average Index declined by 137.86 points or 0.46 per cent lower at 30,080.40, and the technology benchmark index Nasdaq Composite traded higher at 12,521.22, up by 56.98 points or 0.46 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The Wall Street opened on a mixed note with the Nasdaq touching all time highs with rising hopes of additional stimulus. However, mixed reaction were seen from the Dow Jones and S&P 500 index as both were in the red zone (at the time of writing) as virus cases increased and Sino-US tensions creeped in over Hong Kong. Among the gainers, Kodak shares zoomed by around 70% after Department of Justice investigation found no guilty in the extension of government loan to the Company. Also, Pfizer stock accelerated by over 1.2% after the Group applied for emergency authorisation of its Covid-19 vaccine in India. Draftkings share surged by over 0.5% after the Company unveiled about the deal which will allow it to deliver access for online sports betting. Shares of Lyft expanded by around 2.4% after Piper Sandler, investment bank upgraded its rating on the Lyft. Among the decliners, shares of Ford dipped by around 1.5%, after the Company stated that they will delay the launch of its Bronco SUV. Goldman Sachs stock contracted by over 0.5% and Cisco shares too fall by over 0.4% as the Company launched a takeover bid for IMImobile. Facebook shares were too in the limelight as it may face lawsuits from federal and state government authorities.

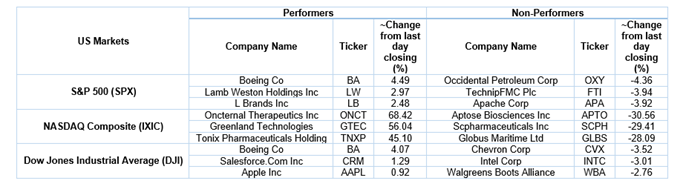

US Stocks Performance*

European News: British Equities traded on a mixed note, though European shares ended in red zone. Rising worries of a no deal Brexit worries kept traders on toes. FTSE 100 managed to capture marginal gains and ended marginally in green, up by 0.08%. Among the rising stocks, Micro Focus International stock surged by around 13% as Goldman Sachs upgraded its rating on the Company. ContourGlobal shares gained by over 2.5% as the Company stated that they will be buying a portfolio of gas fired power plants. British American Tobacco stock surged by over 4.5%; Imperial Brands, Smurfit Kappa, Polymetal International shares accelerated by over 2.5%, respectively. With Brexit concerns, homebuilders stocks were among the beaten down stocks with Berkeley, Persimmon, Barratt developments, Land securities shares were all down by over 3% each.

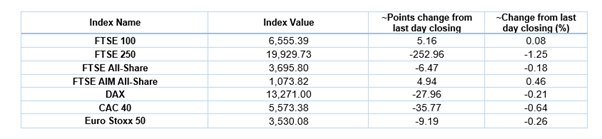

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 7 December 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Healthcare (+1.27%), Consumer Non-Cyclicals (+0.69%) and Industrials (+0.62%).

Top 3 Sectors traded in red*: Financials (-1.56%), Real Estate (-1.29%) and Consumer Non-Cyclicals (-1.06%).

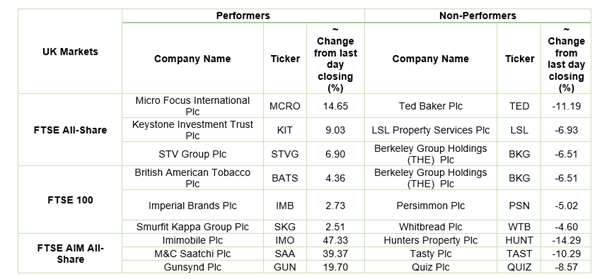

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $49.18/barrel and $46.27/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,865.06 per ounce, up by 1.36% against the prior day closing.

Currency Rates*: GBP to USD: 1.3327; EUR to GBP: 0.9096.

Bond Yields*: US 10-Year Treasury yield: 0.931%; UK 10-Year Government Bond yield: 0.283%.

*At the time of writing