US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 65.31 points or 1.97 per cent lower at 3,244.80, Dow Jones Industrial Average Index plunged by 444.65 points or 1.67 per cent lower at 26,214.46, and the technology benchmark index Nasdaq Composite traded lower at 10,860.09, down by 325.51 points or 2.91 per cent against the previous day close (at the time of writing, before the US market close at 11:45 AM ET).

US Market News: The Wall Street traded in the red as the pandemic fears continue to weigh down on the investors. The household spending in the US increased by 1.4% month on month in September 2020. The personal income increased by 0.9% month on month. Among the gaining stocks, Colgate-Palmolive was up by nearly 1.7% after the company reported quarterly earnings of 79 USD cents. Chevron gained around 0.4% after it posted a profit against an expected loss. Under Armour rose by close to 0.1% after it forecasts full-year revenue above consensus estimates. Among the downward trending stocks, shares of Exxon Mobil were down by around 2.2% after it reported a loss of 18 USD cents in the third quarter. Honeywell was down by nearly 0.7% after the company witnessed increased demand for warehouse automation.

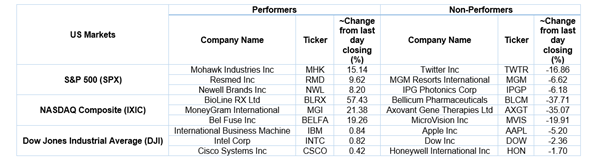

US Stocks Performance*

European News: The London and European markets traded in the red as the UK’s business confidence declines. As reported by Lloyds Bank, the business index fell to -18, mainly affected by the services sector. Meanwhile, the Nationwide House Price Index increased by 5.8% year on year in October 2020 that was above the expected increase of 5.2%. Among the gaining stocks, NatWest gained by around 6.3% after it posted earnings better than the estimates and lowered the loan loss provision. Royal Dutch Shell rose by nearly 2.0% after it stated that it would ramp up its production unit in the Gulf of Mexico. IAG was up by around 1.8% after it said that it would bring down its cost base. Among the decliners, 4Imprint declined by close to 3.7%, although the company reported improvement in weekly order intake. Glencore was slipped by nearly 1.4% after the downgraded its coal production outlook due to an extended Cerrejon JV. AstraZeneca was down by close to 0.6% as the company agreed to sell the commercial rights of two medicines. Computacenter fell by about 0.3% after the company said it had a strong backlog of orders.

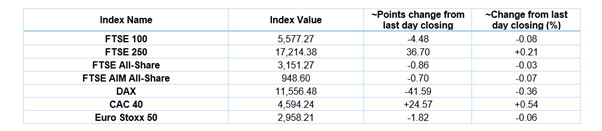

European Indices Performance (at the time of writing)

FTSE 100 Index One Year Performance (as on 30 October 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Rolls-Royce Holdings Plc (RR.); Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in green*: Energy (+2.34%), Real Estate (+0.35%) and Financials (+0.31%).

Top 3 Sectors traded in red*: Consumer Non-Cyclicals (-0.94%), Healthcare (-0.76%), and Industrials (-0.67%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $37.63/barrel and $35.37/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,878.45 per ounce, up by 0.56% against the prior day closing.

Currency Rates*: GBP to USD: 1.2948; EUR to GBP: 0.8992.

Bond Yields*: US 10-Year Treasury yield: 0.855%; UK 10-Year Government Bond yield: 0.259%.

*At the time of writing