US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 49.33 points or 1.48 per cent higher at 3,384.80, Dow Jones Industrial Average Index expanded by 492.45 points or 1.79 per cent higher at 27,945.11, and the technology benchmark index Nasdaq Composite traded higher at 11,256.76, up by 171.51 points or 1.55 per cent against the previous day close (at the time of writing, before the US market close at 12:30 PM ET).

US Market News: The Wall Street traded in the green amid the hopes of a stimulus package. The US GDP plummeted 31.4 percent quarter on quarter for the three months ended June 2020; however, it was slightly better than the expected decline of 31.7 percent. Among the gaining stocks, Caesars Entertainment was up by close to 5.2 percent after the proposal to buy William Hill was accepted. General Motors gained around 3.2 percent after it plans not to buy a stake in Nikola as per the reports. Dow was trading up by about 3.1 percent after it plans to cut jobs to reduce costs. Shares of Moderna popped up by nearly 2.3 percent after the New England Journal of Medicine published that the experimental covid-19 vaccine appears safe. Among the decliners, Nike declined by approximately 0.7 percent on the Nasdaq. Walt Disney was down by around 0.5 percent as it slashing 28,000 roles in its theme park division.

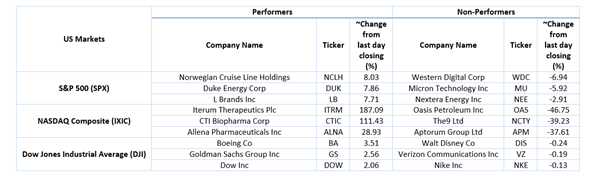

US Stocks Performance*

European News: The London and European markets traded in the red as the UK reports weak GDP data. As per the Office for National Statistics report, the UK GDP contracted by 19.8 percent quarter on quarter in the second quarter ended June 2020. Meanwhile, the Nationwide House Price index in the UK improved by 0.9 percent month on month in September 2020. Among the gaining stocks, 888 Holdings skyrocketed by close to 20.5 percent after its revenue grew by 37 percent in H1 FY20. Shares of City Pub Group were up by about 7.6 percent as it highlighted improved performance since reopening in July 2020. Hammerson moved up by around 7.0 percent after it announced the appointment of Rita Rose Gagné as the CEO. Morrison gained by around 0.4 percent after the reports that it would create 1,000 roles to fulfil its order from Amazon. Among the decliners, Boohoo shed around 2.9 percent, although the company reported improved sales during the six months ended 31 August 2020. Shares of Compass Group declined by approximately 2.5 percent after it expects a fall in annual organic revenue. Shell slipped by about 1.4 percent after its plans to cut jobs.

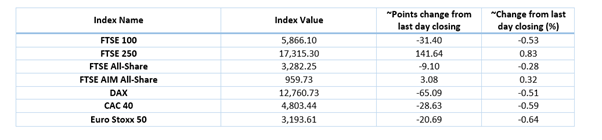

European Index Performance*:

FTSE 100 Index One Year Performance (as on 30 September 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); Barclays Plc (BARC).

Top 3 Sectors traded in green*: Financials (+1.24%), Real Estate (+0.85%) and Utilities (+0.77%).

Top 3 Sectors traded in red*: Consumer Cyclicals (-0.53%), Industrials (-0.08%) and Energy (-0.06%).

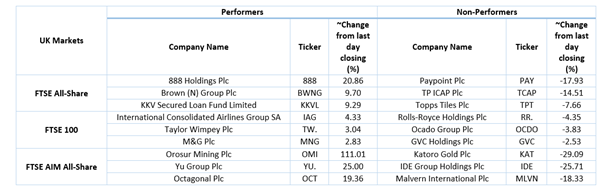

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $42.20/barrel and $40.12/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,898.10 per ounce, down by 0.27% against the prior day closing.

Currency Rates*: GBP to USD: 1.2912; EUR to GBP: 0.9074.

Bond Yields*: US 10-Year Treasury yield: 0.682%; UK 10-Year Government Bond yield: 0.224%.

*At the time of writing