UK Market News: The UK stock market oscillated in the negative territory for the most part of the day after a green start. The blue-chip index witnessed some profit booking after yesterday’s record close of above 7,600, a two-year high. The index though received some support from the oil & gas stocks such as Royal Dutch Shell Plc and BP Plc amid a surge in crude oil prices in the international market.

888 Holdings Plc (LON: 888): Shares of the online gaming and sports betting company were down by over 2.5%, with a day’s low of GBX 260.40 after the announcement of its full-year business update. The share price was down despite the company reporting a 14% growth in total revenue at USD 972 million, driven by significant growth in the B2C segment.

Just Group Plc (LON: JUST): Shares of the life insurance service provider were up by over 9.5%, with a day high of GBX 95.45 following the announcement of its business update for the financial year ended 31 December 2021. The company reported low double-digit growth in new business profits.

Gattaca Plc (LON: GATC): Shares of the recruitment service provider were down by over 36%, with a day low of GBX 83.50 after the company revised its business outlook for the financial year ending 31 July 2022. Its underlying profit before tax is expected to be below the market expectations due to slow recovery in the company’s contract business.

US Markets: The US market is likely to start in red following global market sell-off, as indicated by the futures index’s performance. S&P 500 future was down by 46 points or 0.96% at 4,609, while the Dow Jones 30 futures was down by 0.84% or 300 points at 35,496. The technology-heavy index Nasdaq Composite future was down by 1.43% at 15,373 (At the time of writing – 8:50 AM ET).

US Market News:

Shares of the financial service provider Goldman Sachs (GS) declined by over 2% in pre-market trading after announcing a mixed fourth-quarter business update. The company’s revenue was above the market expectations. However, its earnings per share were lower during the quarter.

Shares of Citrix Systems (CTXS) was trading upside in pre-market trading, up by 2.8% following a media report that the software company might receive an acquisition bid from a private equity firm.

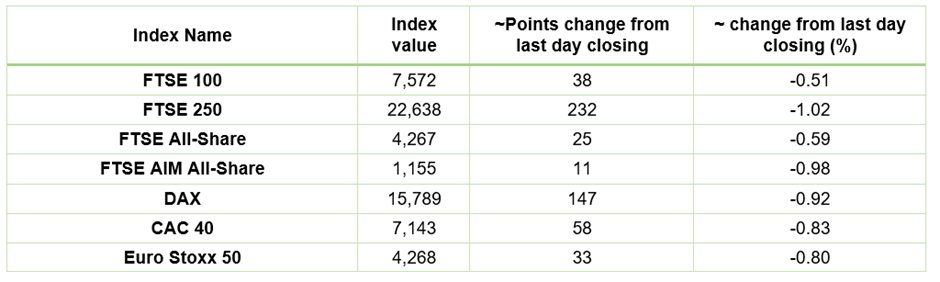

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 18 January 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), Glencore plc (GLEN).

Top 3 Sectors traded in green*: Energy (2.15%), Technology (0.83%), Utilities (0.23%)

Top 3 Sectors traded in red*: Industrials (-1.95%), Consumer Cyclicals (-1.27%), Real Estate (-1.24%)

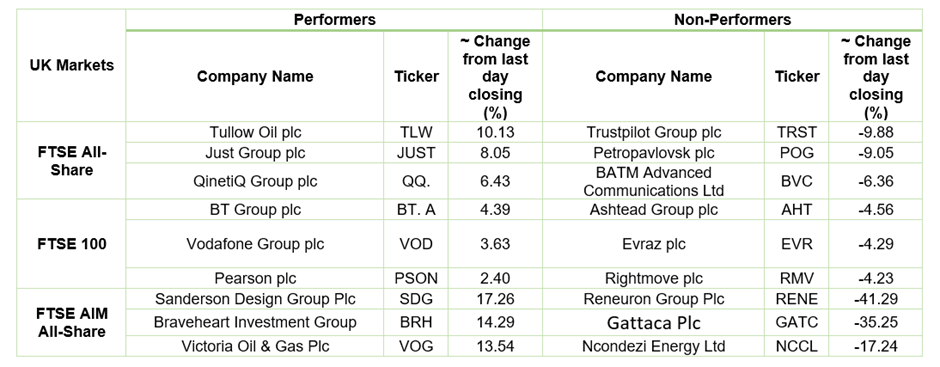

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $87.74/barrel and $84.88/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,819 per ounce, up by 0.15% against the prior day closing.

Currency Rates*: GBP to USD: 1.3599; EUR to USD: 1.1380.

Bond Yields*: US 10-Year Treasury yield: 1.814%; UK 10-Year Government Bond yield: 1.1945%.

*At the time of writing

.jpg)