US Markets: When it comes to Wall Street hovering near fresh record highs, the key indices remain in a position to make and break newer records over a couple of sessions. All the three major stock indices registering new all-time highs on Tuesday, 2 November, just a day before the policy action by the Federal Open Market Committee (FOMC) certainly replicates the confidence of investors with the ongoing quarterly earnings season.

With the US Federal Reserve beginning the two-day policy meeting from today, market participants will be waiting for the potential cues on tapering the bond purchases in the upcoming term, as well as any indication on the interest rate hike.

The rate of inflation lingering much over the estimates of the central bank, the US Fed could surprise with an interest rate hike for the first time since slashing the rates to record low during the onset of the coronavirus pandemic.

Global Markets scaled a new peak on Tuesday

The Dow Jones Industrial Average rose 136.94 points, or 0.38% to 36,050.78, the broader share index S&P 500 advanced 19.51 points, or 0.42% to 4,633.18, whereas the tech-heavy barometer Nasdaq Composite surged 52.01 points, or 0.33% to 15,647.92, from the respective previous closing marks of 35,913.84, 4,613.67 and 15,595.92, respectively.

US Market News: Shares of Merck & Co, Cisco Systems, Goldman Sachs, Johnson & Johnson, Apple, 3M, Microsoft, Procter & Gamble and Amgen emerged as the lead gainers among the 30-component heavy Dow Industrials on Tuesday. On the other hand, shares of Visa, Boeing, IBM, Chevron, American Express and McDonald’s lost up to 2%, partly offsetting the positive point contribution made by the lead gainers. The July-September earnings from Pfizer, KKR & Co and DuPont have beaten the street estimates.

UK Markets: London equities traded in the negative region throughout the day with the headline FTSE 100 and mid-cap indicator FTSE 250 oscillating slightly lower from the previous closing levels in the terminal trade. This is one of the rare sessions when the shares of the market cap leader AstraZeneca have gained nearly 2.5% and the leading stock index is hovering in red.

A considerable plunge in the heavyweight shares of HSBC Holdings, BP, Royal Dutch Shell, British American Tobacco, Rio Tinto, Glencore, BHP Group, Anglo American and Barclays effectively counterbalanced the cumulative positive points provided by a handful of shares.

FTSE 100 traded 0.26% lower at 7,269.84, while FTSE 250 shed 0.19% to 23,167.99.

FTSE 100 (2 November)

Source: REFINITIV

Market Snapshot

Top 3 volume leaders: Lloyds Banking Group, Vodafone Group, BP

Top 3 sectoral indices: Construction, Medicine and Biotech, and Industrial Transportation

Bottom 3 sectoral indices: Insurance, Fossil Fuels and Travel

Crude oil prices: Brent crude down 0.41% at $84.36/barrel; US WTI crude down 0.95% at $83.25/barrel

Gold prices: An ounce of gold traded at $1,790.45, down 0.30%

Exchange rate: GBP vs USD - 1.3615, down 0.42% | GBP vs EUR - 1.1755, down 0.13%

Bond yields: US 10-Year Treasury yield - 1.542% | UK 10-Year Government Bond yield - 1.0360%

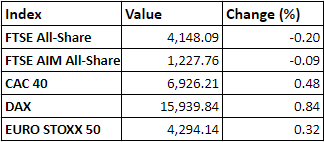

Markets @ 16:20 GMT