US Markets: Wall Street indices started on a lower-to-moderately higher note on Thursday, 11 November, as investors continue to absorb the inflationary hurdles and contemplate the cumulative impact of higher-than-expected corporate earnings for the July-September quarter.

The technology leader Nasdaq Composite advanced nearly 1%, partly recovering the losses incurred on Wednesday when the market index inched way lower from the all-time high. The Dow Industrials traded marginally lower on Thursday as shares of Walt Disney lost close to 8% after the entertainment and media conglomerate missed the street expectations for earnings, as well as revenues.

The broader share indicator S&P 500 added slightly as the positive points provided by gainers comfortably counterbalanced the collective negative points due to the falling components. American equities were largely lacklustre on Thursday with no major macroeconomic data scheduled to be released during the day as the Treasury market remained closed on the account of Veterans Day holiday.

Global Markets traded on a mixed note

The tech-driven sell-off dragged Nasdaq Composite on Wednesday as market participants feared about the rising input costs after the the CPI based inflation rate in the United States rose to a 31-year high, triggering worries the businesses aiming to maximise the profitability as they resume full-scale operations for the first time in the pandemic era.

With higher inflation, the enterprises will be forced to pass on the burden of extra costs to the consumers, a move that will be intended to maintain the operating margins. On the contrary, it can potentially impact the sales volume in the upcoming months, forcing the customers to reduce the frequency of purchases of some non-essential goods.

This becomes even more crucial as businesses are planning to resurrect the pre-Covid level of commercial operations ahead of the festivities of Christmas. As the rate of inflation continues to make newer highs, deviating away from central banks’ narrative of a momentary impact, the US Federal Reserve will be obligated to take necessary measures that can countermand the factors driving up the inflation in the country before it shoots up further from here.

Dow Jones Industrial Average slipped below the psychological mark of 36,000 for the first time since 5 November. In a first, the market index breached the level on 1 November. The NYSE-controlled Dow Industrials shed 105.15 points, or 0.28% to 35,979.08, lowest since 3 November, the tech heavy barometer Nasdaq Composite gained 93.34 points, or 0.60% to 15,716.16, after hitting an intraday peak of 15,768.02, while the wider share average S&P 500 moved up by 5.64 points, or 0.12% to 4,652.60.

US Market News: Shares of Walt Disney Co crashed as much as 9.24% to an intraday bottom of $158.33 from the previous closing price of $174.45. This has been the lowest market price for Walt Disney Co in the present calendar year. The stock was the worst performer amid the 30-share pack of Dow Industrials on Thursday, effectively providing the biggest negative points to the market index.

Other major losers on Dow include Visa, Cisco Systems and Honeywell International, cracked 1-3%. On the other hand, the shares of Dow, Salesforce.com, Caterpillar, Walgreens Boots Alliance, Boeing, IBM, Goldman Sachs and Microsoft emerged as the top gainers.

Shares of Tesla tip-toed the market after rising more than 3% in the pre-market deals on Thursday as Co-founder and CEO Elon Musk offloads $5 billion worth of Tesla stock. Earlier yesterday, the stock managed to recover partly, registering a gain of more than 4%, somehow managing to counterbalance the two-day loss of more than 16%.

Among the Nasdaq Composite constituents, shares of JD.com, NetEase, Pinduoduo, Baidu, NXP Semiconductors, Electronic Arts, Xilinx, Qualcomm, Microchip Technology, Marvell Technology, ASML, KLA-Tencor, eBay, Nvidia, Netflix, Applied Materials and Advanced Micro Devices were the lead gainers, contributing majorly to the upsurge in the market index.

UK Markets: London equities were on a roll on Thursday with the headline FTSE 100 registering fresh 20-month highs, nearing the psychological level of 7,400 for the first time since 24 February, 2020. The market index recorded an intraday peak of 7,394.41, up 0.74% from the previous close of 7,340.15, while the mid-cap barometer FTSE 250 rose 142.67 points, or 0.61% to 23,575.26. FTSE 100 ended 45.76 points, or 0.63% higher at 7,386.52.

FTSE 100 (One-year performance)

Source: REFINITIV

Shares of Auto Trader Group were the biggest gainers among the 101-component pack of FTSE 100, followed by Anglo American, Antofagasta, BHP Group, 3I, Polymetal International, Evraz, Glencore and Rio Tinto. Interestingly, all the three shares by market capitalisation ended in the positive territory with the stock of alcoholic beverage maker Diageo gaining more than 1%.

Shares of AstraZeneca and HSBC Holdings added 0.60-0.80%, while the stocks of Unilever and GSK managed to close in green. On the contrary, shares of Johnson Matthey collapsed more than 18%, followed by the drops in stock of B&M European Value Retail, Burberry Group, International Consolidated Airlines, Flutter Entertainment, Next and Associated British Foods.

Market Snapshot

Top 3 volume leaders: Lloyds Banking Group, Rolls-Royce Holdings and Barclays

Top 3 sectoral indices: Software and Computing, Industrial Metals and Precious Metals

Bottom 3 sectoral indices: Automotive, Industrial Chemicals and Personal Goods

Crude oil prices: Brent crude up 0.11% at $82.73/barrel; US WTI crude up 0.23% at $81.53/barrel

Gold prices: An ounce of gold traded at $1,863.85, up 0.84%

Exchange rate: GBP vs USD - 1.3380, down 0.16% | GBP vs EUR - 1.1676, up 0.04%

Bond yields: US 10-Year Treasury yield - 1.570% | UK 10-Year Government Bond yield - 0.9255%

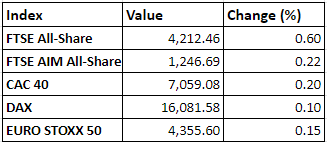

Markets @ 16:30 GMT