UK Market News: The UK stock market moved higher on Tuesday, with the blue-chip FTSE100 index gaining around a per cent. The investors responded positively to the quarterly UK unemployment data released by the Office for National Statistics (ONS), according to which the March unemployment rate declined to 3.7%. This has been the lowest unemployment level witnessed in the country in nearly 50 years. However, amid the spiralling cost-of-living crisis, real wages have been falling rapidly, and the interest rates may go up further due to the tightening of the job market.

Imperial Brands plc (LON: IMB): The shares of the British tobacco business, Imperial Brands plc, were up by 7.04%, with a day’s high of GBX 1,833.00. The adjusted net revenue of the company for the first half of the year has surged by 0.3%, owing to the robust sales of e-cigarettes and heated tobacco across Europe.

Antofagasta plc (LON: ANTO): The shares of the UK-based mining giant, Antofagasta plc, were up by 4.05%, with a day’s high of GBX 1,438.50. The company has recently priced US$500 million in senior unsecured notes at 5.625% due in 2032. The net proceeds from the same would be used by the company to pay off its debts.

Anglo American plc (LON: AAL): The shares of the UK-based mining firm, Anglo American plc, were up by 4.02%, with a day’s high of GBX 3,483.00. The company has recently announced that it would take over the majority control of Arc Minerals’ Zambia copper-cobalt license.

US Markets: The US market is expected to get a decent start, as suggested by the futures indices. S&P 500 future was up by 58 points or 1.45% at 4,062.75, while the Dow Jones 30 future was up by 1.13% or 365 points at 32,522.00. The technology-heavy index Nasdaq Composite future was also up by 1.85% or 226.10 points, at 12,470.75. (At the time of writing – 8:45 AM ET).

The shares of the leading US-based retailer, Walmart (WMT), went down by over 7.0% in the premarket trading session. This happened after the company declared less-than-expected revenues for the first quarter despite higher sales, mainly due to rising inflation.

The shares of the US-based home improvement retailer Home Depot (HD), surged by over 2.5% in the premarket trading session. This happened after the company declared higher-than-expected sales, revenues, and profits for the first quarter while raising its guidance for the annual results.

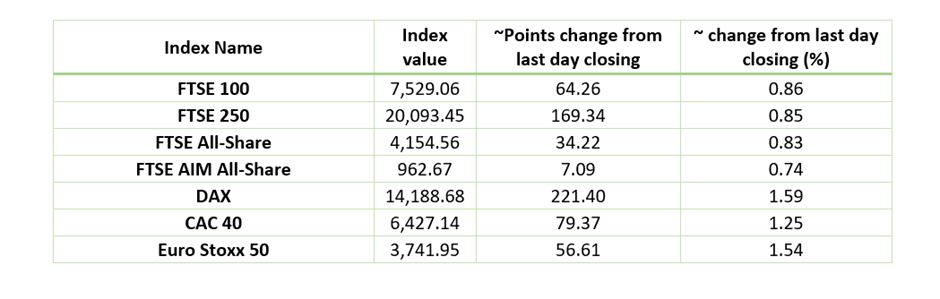

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 17 May 2022)

(Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group plc (LLOY), Vodafone Group Plc (VOD), BP plc (LON: BP.)

Top 3 Sectors traded in green*: Basic Materials (3.28%), Financials (1.77%), Consumer Cyclicals (0.83%)

Top 2 sectors traded in red*: Consumer Non-Cyclicals (-0.49%), Healthcare (-0.37%)

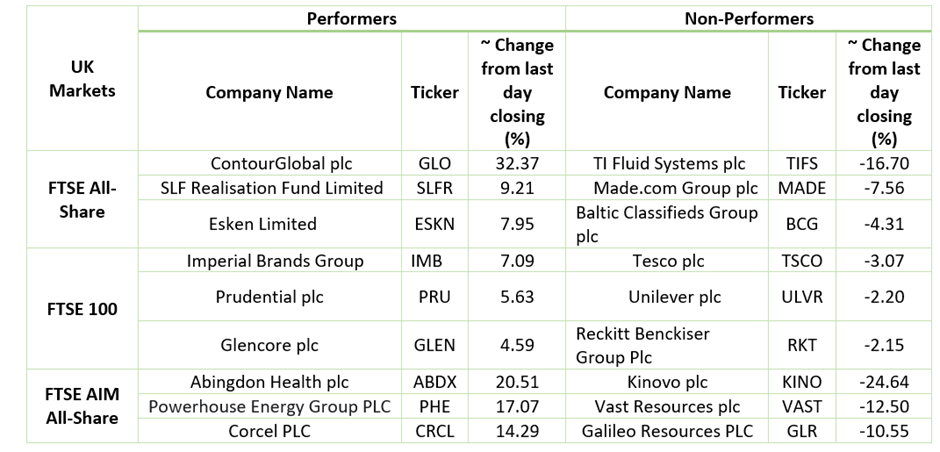

London Stock Exchange: Stocks Performance (at the time of writing):

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $114.90/barrel and $112.60/barrel, respectively.

Gold Price*: Gold price quoted at US$ 1,822.09 per ounce, up by 0.42% against the prior day’s closing.

Currency Rates*: GBP to USD: 1.2462; EUR to USD: 1.0532.

Bond Yields*: US 10-Year Treasury yield: 2.975%; UK 10-Year Government Bond yield: 1.8765%.

*At the time of writing

.jpg)