Source: isak55, Shutterstock

Summary

- FTSE 100 is likely to make a flat-to-positive start supported by positive global cues.

- The British pound was trading marginally in red, though the currency regained momentum in the last session.

- Investors will be eyeing the meeting of OPEC and its allies for further cues.

FTSE 100, the benchmark index of London, is likely to make a rebound with a modestly positive start on 1 April, taking cues from the Asian peers and the development in the US markets. Traders would be reacting to the reports of a rise in consumer confidence across the regions.

The FTSE 100 futures were also trading modestly in the green, up by 0.07 per cent at 06:41 HRS GMT, after making a firm start at 6,726.00 this morning.

The FTSE 100 index though, had closed lower in the last session, down by 0.86 per cent at 6,713.63. Traders’ sentiments were weighed down by the dismal debut of the Deliveroo IPO, which closed at a much lower price of GBX 287.45 from its IPO price of GBX 390, over 26 per cent lower.

In its intraday trade, the stock was once down by around 31 per cent. Investors were also apprehensive of an interest rate hike as indicted by the bond market.

(Source: Refinitiv, Thomson Reuters)

Asian markets rebound

Asian indices have rebounded on Thursday, and all the major indices were trading in the green, taking cues from the US markets with President Joe Biden’s infrastructure plan.

Japanese Nikkei 225 was up by 0.75 per cent, Shanghai Composite was up by 0.27 per cent, Hong Kong’s Hang Seng added 1.01 per cent, Kospi Composite was higher by 0.72 per cent, while the Australia’s ASX 200 ended higher by 0.56 per cent, on Thursday.

Oil gains ahead of OPEC+ meeting

Oil gained ahead of the highly anticipated OPEC+ meeting later in the day that will discuss extending supply curbs. There were some reports of Saudi Arabia willing to extend its own voluntary cuts, which could flare up the prices.

Brent crude oil June 2021 futures contract was at US$ 63.08 per barrel, up by 0.53 per cent at 06:02 AM GMT, while West Texas Intermediate crude oil May futures were at USD 59.54 per barrel, up by 0.63 per cent.

Mixed sentiments

The US markets made a mixed closing on Wednesday, though there was a sense of optimism among the traders after the US president unveiled a $2.25 trillion infrastructure plan and as the US employers reportedly added the maximum number of jobs in the past six months. There was some concern regarding the rise in inflation and big corporate tax plans.

The Dow Jones Industrial Average ended lower by 0.26 per cent, while Nasdaq ended higher by 1.54 per cent, and the S&P 500 added 0.36 per cent for the day.

However, the month of March proved a strong month of trade for the Dow, as it outperformed the Nasdaq by a great margin, surging by 6.62 per cent against 0.41 per cent gain for the latter.

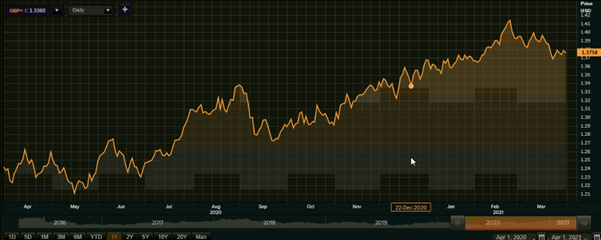

Pound Sterling trades lower

(Source: Refinitiv, Thomson Reuters)

The British pound was trading marginally in red, though the currency regained momentum in the last session and hit a fresh one year high after the GDP data of the nation came better than expected.

The data from the Office for National Statistics revealed faster recovery in the output in the second half of the year.

The GBP/USD currency pair was down by 0.15 per cent, trading at 1.3764 at around 0610 AM GMT on Thursday. The pair’s previous close was at 1.3784, and it started the day’s trade at 1.3787. The pair’s trading range was between a low of 1.3761 and a high of 1.3791, during the session so far.

Meanwhile, the reference spot exchange rate fixed by the UK central bank was at 1.3711 USD and 1.1691 EUR against 1 GBP on 30 March.

Upcoming cues

Ahead of the long weekend, traders from the economic releases would be eying Manufacturing PMI for March, slated to be released today. There will be some important earnings announcements to keep the markets buzzing; Carnival Plc, Next Plc, Equiniti Group etc. will announce their numbers along with others.

On the global front, investors will be eyeing the meeting of OPEC and its allies, not only the oil prices but the stock market direction could be influenced by the decision, which also includes pronouncement on the output roll-over and a gradual output increase.