US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 43.39 points or 1.29 per cent higher at 3,404.34, Dow Jones Industrial Average Index expanded by 402.84 points or 1.45 per cent higher at 28,175.60, and the technology benchmark index Nasdaq Composite traded higher at 11,326.06, up by 171.46 points or 1.54 per cent against the previous day close (at the time of writing, before the US market close at 12:20 PM ET).

US Market News: The Wall Street opened in the green as the US President tweeted for stimulus measures. The US President asks the House and Senate to approve USD 25 billion for the airline payroll and USD 135 billion for the paycheck protection programme. Among the gaining stocks, Levi Strauss jumped by close to 9.6% after it posted a quarterly profit. United Airlines and Delta Airlines jolted by nearly 4.3% and 2.2%, respectively after the announcement for airline industry aid. Royal Caribbean gained by around 0.4% after it extended the cruise cancellation until 30 November. Among the decliners, DraftKings declined by approximately 6.9% after it priced the secondary share offering at USD 52 per share. Chevron on DOW 30 was down by around 0.7%.

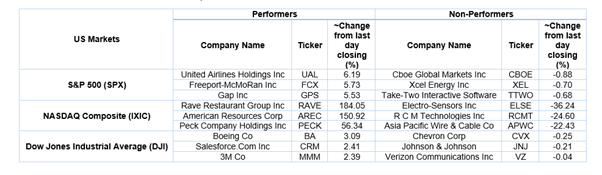

US Stocks Performance*

European News: The London market traded in the green, whereas the European market trended downwards on Wednesday. The National Audit Office highlighted that the covid-19 scheme launched by the UK government could lose close to £26 billion due to fraud and default. Adjacently, the UK House Price index increased by around 1.6% month on month in September 2020. Among the gaining stocks, shares of Helios Underwriting surged by about 17.1% after it announced fundraising of £20.0 million. PureTech Health gained by nearly 3.0% after its founded entity, Akili appointed Meghan Rivera as the chief marketing officer. Intercontinental Hotels was up by close to 1.2% after it published the final terms related to €500 million and £400 million notes. Shares of G4S moved up by around 0.1% after it rejected the takeover offer from GardaWorld. Tesco nudged up by close to 0.1% after it reported better revenue in H1 FY20 compared to last year. Among the falling stocks, BT Group was down by about 3.2% on the FTSE-100. TUI declined by approximately 3.0% after it appointed Sebastian Ebel as the new CFO of the company.

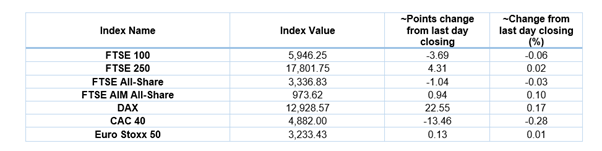

European Indices Performance (at the time of writing)

FTSE 100 Index One Year Performance (as on 7 October 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Basic Materials (+1.40%), Utilities (+1.23%) and Consumer Cyclicals (+0.53%).

Top 3 Sectors traded in red*: Energy (-1.54%), Real Estate (-1.23%) and Technology (-1.03%).

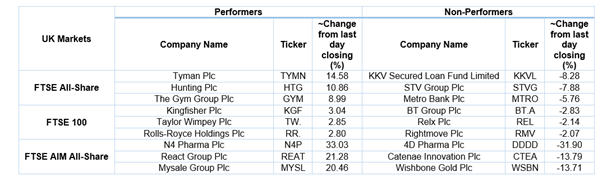

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $42.05/barrel and $40.01/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,889.45 per ounce, down by 1.01% against the prior day closing.

Currency Rates*: GBP to USD: 1.2910; EUR to GBP: 0.9113.

Bond Yields*: US 10-Year Treasury yield: 0.785%; UK 10-Year Government Bond yield: 0.298%.

*At the time of writing