Source:Copyright © 2021 Kalkine Media Pty Ltd.

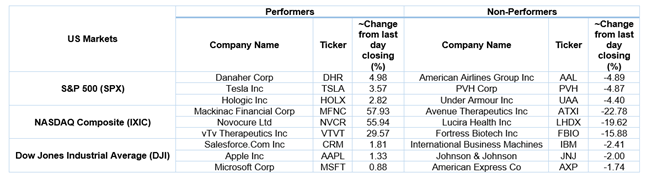

US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 3.05 points or 0.07 per cent higher at 4,132.08, Dow Jones Industrial Average Index dipped by 117.33 points or 0.35 per cent lower at 33,628.07, and the technology benchmark index Nasdaq Composite traded higher at 13,915.96, up by 65.96 points or 0.48 per cent against the previous day close (at the time of writing - 11:30 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note after the U.S. would suspend the distribution of Johnson & Johnson’s Covid-19 vaccine. Also, bitcoin hits all-time high in today’s trading session, and surged significantly by around 5.89% at $63,531.40. Among the gaining stocks, Bristol-Myers Squibb shares rose by about 0.66% after Truist Securities raised its investment stance from “Hold” to “Buy”. Among the declining stocks, Altimeter Growth Corp shares dropped by approximately 5.42% after it had plans to make Singapore-based Grab Holdings public in the U.S. Johnson & Johnson shares went down by about 2.75% after the U.S. medical authorities had halted the use of the Covid-19 vaccine due to blood clotting issues.

US Stocks Performance*

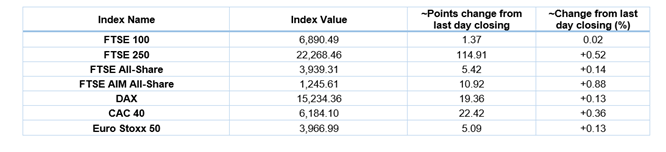

UK Market News: The London markets traded on a mixed note after the release of the UK GDP data. FTSE 100 traded marginally higher by around 0.02% as the weak investor sentiments regarding the strengthening of the pound were partially offset by the reopening of the UK economy. According to the Office for National Statistics (“ONS”), the UK GDP had shown a marginal growth of 0.4% during February 2021 as compared to a 2.2% decline for January 2021. Meanwhile, the UK construction output grew by around 1.6% month-on-month during February 2021. However, it remained lower by 4.3% on a yearly basis.

FTSE 250 listed Babcock International Group had updated investors regarding impairment charges worth 1.7 billion pounds for the year ending 31 March 2021 after the balance sheet and profitability review. Meanwhile, the shares surged by around 35.79%.

Just Eat Takeaway.com had reported an increase of around 79% in the first quarter orders. Furthermore, the shares climbed by approximately 5.89%.

JD Sports Fashion shares grew by about 3.20% after it had resumed dividend payments and forecasted higher earnings for the current year due to the increased demand for sports and casualwear driven by the Covid-19 pandemic.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 13 April 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Real Estate (+0.99%), Technology (0.90%) and Basic Materials (+0.67%).

Top 3 Sectors traded in red*: Utilities (-0.86%), Energy (-0.39%) and Financials (-0.30%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $63.79/barrel and $60.28/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,746.55 per ounce, up by 0.80% against the prior day closing.

Currency Rates*: GBP to USD: 1.3750; EUR to GBP: 0.8687.

Bond Yields*: US 10-Year Treasury yield: 1.625%; UK 10-Year Government Bond yield: 0.771%.

*At the time of writing