US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 3.55 points or 0.08 per cent higher at 4,440.30, Dow Jones Industrial Average Index surged by 178.93 points or 0.51 per cent higher at 35,443.60, and the technology benchmark index Nasdaq Composite traded lower at 14,726.70, down by 61.30 points or 0.41 per cent against the previous day close (at the time of writing – 12:10 PM ET).

US Market News: The major indices of Wall Street traded on a mixed note after a slowdown experienced in inflation growth. Among the gaining stocks, NortonLifeLock (NLOK) shares rose by about 8.53% after the Company had agreed to buy Avast in a cash & stock deal worth around USD 8.60 billion. Wendy’s (WEN) shares grew by about 2.97% after the Company’s quarterly top-line revenue and bottom-line profitability came out to be more than the consensus estimates. Among the declining stocks, Perrigo (PRGO) shares dropped by about 13.30% after the Company’s quarterly earnings and revenue had missed the consensus estimates. Canada Goose Holdings (GOOS) shares plunged by around 12.69% after the Company had reported a quarterly loss due to the rising expenses.

UK Market News: The London markets traded in a green zone after the release of the US inflation data.

Cybersecurity firm Avast shares rose by about 3.10% after the Company had agreed to be taken over by US rival NortonLifeLock in a lucrative deal worth approximately 6.20 billion pounds. Moreover, the Company reported a jump in top-line revenue during the first half.

Admiral Group shares went up by around 3.91% after the Company had paid an increased interim dividend boosted by the disposal of Penguin Portals business. Furthermore, the Company had posted a healthy growth of around 76% in the first-half pre-tax profit.

Phoenix Group had reported a significant jump in first-half operating profit and increased cash generation by more than 100%. However, the shares slipped by around 2.20%.

4imprint shares surged by around 7.37% after the Company delivered substantial growth in the top-line revenue and bottom-line profitability during the first half of 2021.

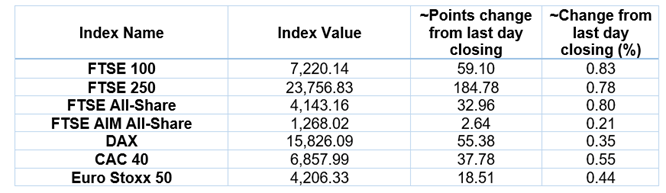

European Indices Performance (at the time of writing):

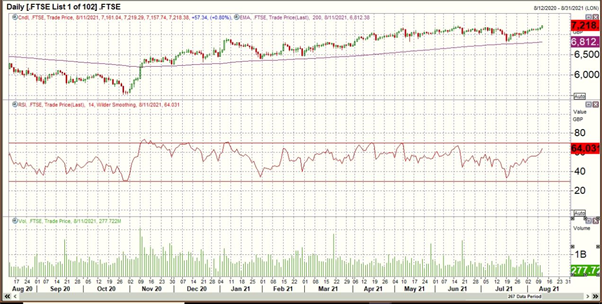

FTSE 100 Index One Year Performance (as on 11 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); Glencore Plc (GLEN).

Top 3 Sectors traded in green*: Energy (+1.24%), Industrials (+1.16%) and Financials (+1.01%).

Top Sector traded in red*: Utilities (-0.06%).

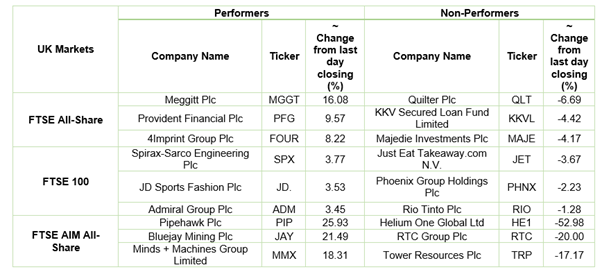

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $71.45/barrel and $69.25/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,754.75 per ounce, up by 1.33% against the prior day closing.

Currency Rates*: GBP to USD: 1.3870; EUR to GBP: 0.8466.

Bond Yields*: US 10-Year Treasury yield: 1.327%; UK 10-Year Government Bond yield: 0.5800%.

*At the time of writing