US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 14.06 points or 0.40 per cent higher at 3,571.60, Dow Jones Industrial Average Index increased by 185.55 points or 0.63 per cent higher at 29,449.03, and the technology benchmark index Nasdaq Composite traded higher at 11,868.55, up by 13.58 points or 0.11 per cent against the previous day close (at the time of writing, before the US market close at 10:50 AM ET).

US Market News: The Wall Street traded in green, although the pandemic wave continues to weigh down on the market. The Manufacturing PMI in the US was reported at 55.2 for November 2020 above the expected PMI of 53.3. The Services PMI was 57.7 for November 2020. Among the gaining stocks, Pfizer rose by about 1.4% after the reports that its vaccine would get approval in the UK this week. Regeneron gained around 0.7% after it received emergency use authorization from the FDA for its covid-19 antibody cocktail. Merck was up by around 0.1% after reports that it is buying OncoImmune. Among the decliners, Western Union declined by about 2.9% after the reports that the company is buying 15% stake in STC Group. Korn Ferry was down by nearly 1.1% after it reported quarterly profits of 54 US cents.

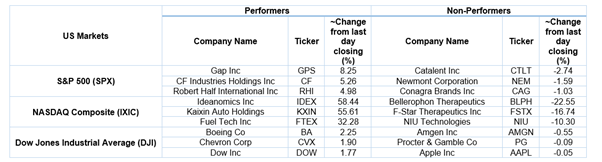

US Stocks Performance*

European News: The London market traded in the red, whereas the European market traded in the green. The Manufacturing PMI in the UK was 55.2 for November 2020, which was above the expected Manufacturing PMI of 53.3. The Services PMI was 45.8 against the expected number of 52.3. Among the gaining stocks, shares of Cineworld surged by approximately 19.7% after it reported that it secured additional liquidity. Rolls Royce rose by about 4.7% and gained the most on FTSE-100. Aviva was up by close to 1.4% after it reported the sale of its entire shareholding in Aviva Vita. Among the decliners, AstraZeneca shares declined by nearly 2.4% after it reported that its AZD1222 vaccine is effective against covid-19. Vodafone was down by around 1.5%; the company commits to net-zero carbon emission by 2040.

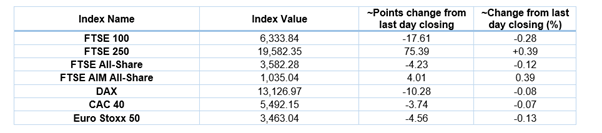

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 23 November 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group (IAG); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Energy (+3.19%), Basic Materials (+0.57%) and Financials (+0.33%).

Top 3 Sectors traded in red*: Healthcare (-2.07%), Consumer Non-Cyclicals (-1.46%) and Technology (-0.84%).

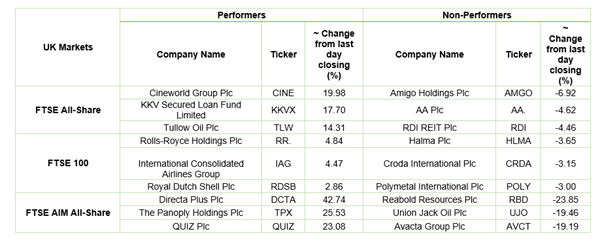

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $45.83/barrel and $42.94/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,837.35 per ounce, down by 1.88% against the prior day closing.

Currency Rates*: GBP to USD: 1.3312; EUR to GBP: 0.8896.

Bond Yields*: US 10-Year Treasury yield: 0.857%; UK 10-Year Government Bond yield: 0.317%.

*At the time of writing