Summary

- The UK government is planning to introduce a feebate system to this effect, petrol and diesel cars could cost more by up to £1,500

- Higher pricing and lack of charging infrastructure is putting car buyers away from electric vehicles

- UK car manufacturers have invested heavily in electric / hybrid vehicles

- Stocks in focus - Aston Martin Lagonda Global Holdings and Pendragon

As the economies around the globe have gradually reopened after the coronavirus induced lockdowns, the countries are looking towards sustainable development. The world is looking towards a lesser carbon emission in the future. The major oil producing companies have announced plans to reduce carbon emissions and are chalking out strategies to achieve the zero carbon goals by 2050.

A significant amount of contribution to greenhouse gases comes from vehicular traffic. This means that the car industry should move away from conventional cars and emphasise on development of hybrid/electric cars.

According to a recent report by British Department for Transport (DfT), plans are being worked out to introduce a feebate system in UK to discourage vehicles with higher carbon emissions. In a feebate system, a fee is imposed on conventional cars and rebate is provided to hybrid/electric cars. Government could impose an additional charge up to £1,500 on purchase of conventional cars. Industry experts believe that government should roll out schemes to incentivise people for buying electric and hybrid car rather than penalising petrol and diesel car buyers.

The British government seems to be accelerating the transition towards hybrid/electric cars. All the government undertakings are encouraged to opt for electric vehicles in their fleet. According to the report, the existing infrastructure of petrol stations would be upgraded with electric car charge points.

Do read: New Car Registration Decline in August, Zero-Emission Vehicles Remain in Demand

According to the Society for Motor Manufacturers and Traders (SMMT), electric cars accounted for only 5 per cent of the total sales in August 2020. The car manufacturers have invested heavily in development of new age vehicles, but most of the car buyers are reluctant to make a switch from conventional cars, as they are costlier. For UK to become a mass EV (electric vehicle) market by 2035, the government would have to set up a public charging network that would cost around £16.7 billion.

After 11 years, the British government was all set to roll out a new scrappage scheme for cars in July 2020, as an initiative to boost the economy in the wake of the coronavirus pandemic, according to media reports. In 2009, the car scrappage scheme was introduced to encourage people to switch towards cleaner fuel emission standards. Nearly 400 thousand new cars were brought under the 2009 car scrappage scheme. The car buyers were supposed to be offered discounts of up to six thousand pounds on buying new hybrid and electric cars and scrapping their conventional liquid fuelled cars. However, the British government quickly poured water on these plans to stimulate post lockdown sales.

Do read: UK to Announce New Car Scrappage Scheme in Favour of New Technology Vehicles

What is stopping car buyers to switch to EV’s?

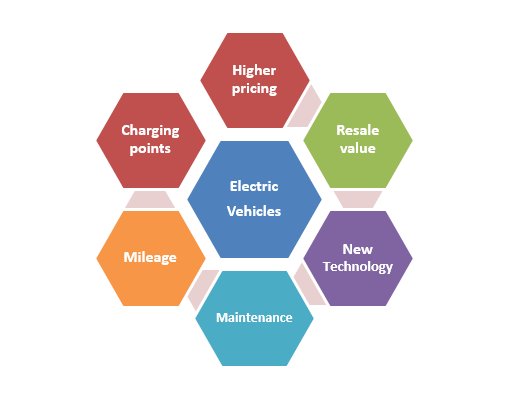

While deciding to buy a new car, users lack confidence when it comes to EVs. Electric vehicles are far more expensive than conventional cars. It is important to note that the pandemic has affected the consumer behaviour and people are now buying only tried and tested things. Due to the contagious nature of the virus, people need safer commuting options, which means that there is demand for new/used cars. But which type of fuelled vehicle they choose, especially the electric ones, is dependent on many factors.

As of now, UK lacks the infrastructure required to gain the confidence of car buyers. Mileage is another important factor to look at when buying electric cars. Since UK lacks the infrastructure, buyer would not be confident to travel long distances as they may not have any other option than to complete their journey in a single charge. Another important factor which car buyers look at is maintenance/ service costs. Will it be similar to conventional cars or would they cost more? There is no clarity on servicing costs, which can certainly burn a big hole in one’s pocket.

Further, it takes time for people to come out of their comfort zones. Conventional engines have evolved through centuries. For instance, stick shifts are replaced by automatic transmissions. People have gradually moved on to automatic transmission engines. Now, since EVs are an altogether different ball game, car buyers would take some time to adapt to the new age technology even if they are in favour of this change.

UK has a considerably large used car market. Therefore, car buyers always look for a brand that fetches them some amount of resale value. EVs are a relatively new market, and it is difficult to assess the demand for used EV cars right now, as the market is at a nascent stage of development.

In 2019, Jaguar Land Rover announced to invest heavily in the electric vehicles production segment, which also came as good news for new job opportunities. Last year, British luxury car maker Aston Martin Lagonda Holdings Plc (LON: AML) also showcased its first ever electric car, Rapide E.

Given the prevalent conditions in the sector, investors might consider tweaking their portfolio a bit. With the Brexit deadline nearing (31 December 2020) and rapid changes taking place in the regulatory environment, this could impact the performance of businesses in the UK automobile sector. Let us put our lens on two auto stocks listed on the LSE – AML and PDG.

Aston Martin Lagonda Global Holdings Plc

The British luxury car maker climbed to losses as sales tumbled. During the first half of 2020, the revenue plunged by 64 per cent to £146 million against H1 2019, due to lower sales volume recorded in the wake of Covid-19 disruption.

During H1 FY20, sales tumbled significantly in both retail and wholesale divisions while the operating losses worsened. The uncertainty surrounding the impact and duration of Covid-19 pandemic continues. Therefore, the trading remains challenging in many markets, and the pace of consumer recovery is still unpredictable. Aston Martin Lagonda Global Holdings’ shares were trading at GBX 59.9 on 10 September 2020, up by 1.27 per cent at 2.57 PM against the previous day’s close of GBX 59.15.

Pendragon Plc

Pendragon Plc (LON:PDG) is a leading automotive retailer, which operates in used cars, new cars, and after-sales segments. During the second half of 2020, the company is expecting a recovery in profitability due to increased demand for cars. However, the company should make informed decisions with respect to the technological advancements happening across the industry to deliver growth in the long term for all its stakeholders. Pendragon’s shares were trading at GBX 9.24 on 10 September 2020 at 2.59 PM down by 0.27 per cent against the last day closing price OF GBX 9.27.

1-year Comparative chart: AML, and PDG

(Source: Refinitiv, Thomson Reuters)

The automotive sector has been severely impacted due to coronavirus induced lockdown. To comply with new emission norms, the car manufactures are burdened with significant amount of additional costs as it is entirely a new technology. This transition requires time, both to create better products and also to gain consumer confidence. Also, the setting up of required infrastructure would also take some time. In the near term, taxing car buyers for buying conventional cars would be a little harsh on them given the prevalent conditions in the economy, with car being a necessity to ensure safety. Instead, government could focus on incentivising both car manufacturers and buyers for opting electric machines. Electric car manufacturers would definitely benefit from this government move though.