Summary

- Registrations for the new car in Britain declined by 5.8 per cent in August, in annual terms, as per SMMT data

- Registrations for private cars were down by 699 units in the month because of the decrease in the demand from businesses of all sizes.

- In order to keep pace with the customer demand, approximately 1.7 million new on-street charging points will be required to be constructed by 2030

Clouds of uncertainty are still hovering over the British automotive industry, and the coming months are expected to unleash a host of challenges to this sector, staring at shrinking sales and fast-evolving consumer preferences. According to industry experts, the future road is full of challenges amid a huge tide of unprecedented waves hitting the automotive shores

As per the latest data published by the Society of Motor Manufacturers and Traders (SMMT) on 4 September 2020, there was a decline of approximately 5.8 per cent in annual terms in the registration of the new car in the United Kingdom in the month of August. After the easing of the coronavirus restrictions, when car showrooms resumed their operations in July, the new car sales saw an increase of 11 per cent for the first time in 2020. Though, August is generally considered as the quietest month of the year for the sale of new cars. The SMMT was of the view that it could take the end of September to draw a clear picture of the trends in the car market as the economy recovers from the coronavirus lockdown.

SMMT data revealed that new car registrations accounted for approximately 87,000 vehicles for the month of August. Registrations for private cars were down by 699 units in the month because of the decrease in the demand. In August 2020, only 2,650 new cars were sold, which was down 5.5 per cent in comparison to that of August 2019. All segments except super-minis witnessed a decline in the demand, especially the mini and specialist sports, which saw the biggest decline of 64.2 per cent and 41.9 per cent, respectively.

August 2020 saw a surge in the sale of zero emission-capable vehicles by 221.1 per cent because of the introduction of new models coming to market, with an increase in the sales of plug-in hybrids although they still only accounted for 1 in 30 sales. Increase of 77.6 per cent in the registrations of battery-electric cars was recorded in the month of August, accounting for 6.4 per cent of the total sales.

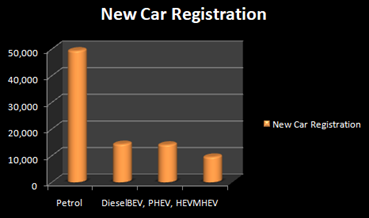

|

Types of Vehicle |

New Car Registration |

Year-On-Year Change |

Market Share |

|

Petrol |

49,376 |

-14.7% |

56.6% |

|

Diesel |

14,293 |

-39.5% |

16.4% |

|

BEV+ PHEV+HEV |

14,053 |

+74.2% |

16.1% |

|

MHEV (Petrol+Diesel) |

9,501 |

+218.3% |

10.9% |

(Data Source: Society of Motor Manufacturers and Traders)

The report was delivered by the SMMT amid the automotive industry’s call for restricting focus on charging infrastructure development and long-haul duties to boost the acquisition of zero-emission capable vehicles to fasten demand. The scope of zero-emission proficient vehicle models accessible in the UK has increased in the previous five years, approximately 1.7 million new on-street charging points will be required to be constructed by 2030, in order to keep pace with the customer demand.

The Chief Executive of SMMT, Mike Hawes, stated that in spite of the hopefulness of recovery in July, the decline has been disappointing. As the country bounces back to normalcy, it is hoped that the month of September will provide a better barometer. Looking at the overall registrations, it remained down by 39.7 per cent in the year to date, some 600,000 units behind this time in 2019.

A Brief Insight on the Automotive Sector of Britain

The automotive industry of the UK plays an important part in contributing to the economy with the turnover of more than £82 billion and adding £18.6 billion value to it. According to the SMMT, the automobile industry accounts for 14.4 per cent of total UK export of goods, worth £44 billion, with a workforce of 168,000 staff employed directly in manufacturing and 823,000 across various segments of the automotive industry. An amount of £3.75 billion is also invested each year in automotive R&D. The UK exports eight out of 10 cars produced in the country overseas to 160 different markets worldwide. The country witnessed manufacturing of over 1.3 million cars, 78,270 commercial vehicles, and 2.5 million engines in the year 2019.

July Had Witnessed Sharp Decline of Around 21 Per Cent In Production

On 27 August 2020, the Society of Motor Manufacturers and Traders had published statistical figures which indicated a decline in the car manufacturing output for the UK by 20.8 per cent in July as only 85,696 units were manufactured. During the month the production ramped up as global lockdown measures eased and nearly all factories reopened. However, the output was still down due to the social distancing measures and ongoing economic uncertainty.

There was an improvement in the production for the UK market compared to May and June, as all the UK car showrooms reopened and operated throughout July. However, it still declined by 37.1 per cent year-on-year, with just 13,434 units being sold. There was also a decline in the manufacturing for export.

Also Read: UK Car Manufacturing Show Signs of Recovery, Aston Martin And Rolls-Royce In Focus

Let’s discuss the stock performance of two of the listed automobile companies on the London Stock Exchange:

Aston Martin Lagonda Global Holdings PLC (LON:AML) stock was trading at GBX 55.60 on 4 September 2020, at 12:55 PM, up by 0.09 per cent from its previous close of GBX 55.55. The 52-week low/high price was GBX 30.70/630.00. It was having a market capitalisation (Mcap) of £1,013.24 million. The volume traded at the time of reporting was 2,966,210. The company recorded a negative return on price, which was 89.86 per cent on a YTD (Year to Date) basis.

Rolls-Royce Holdings PLC(LON: RR.) stock was trading at GBX 219.30 on 4 September 2020, at 12:58 PM, up by 0.73 per cent from its previous close of GBX 218.30. The 52-week low/high price was GBX 206.70/832.00. It was having a market capitalisation (Mcap) of £4,215.36 million. The volume traded at the time of reporting was 3,755,572. The company recorded a negative return on price, which was 67.95 per cent on a YTD (Year to Date) basis.

Conclusion

Companies are stepping up to the challenge created by the Covid-19 outbreak. It is also true that the impact of the pandemic has created new opportunities on other mobility verticals such as shared mobility, electric vehicles, connectivity solutions, aftermarket, and vehicle leasing. This crisis will prove to be helpful in changing the outlook for auto manufactures in the near future and shift the focus towards health and wellness solutions in vehicles.