Source: Copyright © 2021 Kalkine Media Pty Ltd.

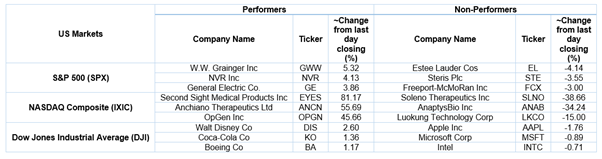

US Markets: : Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 35.66 points or 0.93 per cent higher at 3,877.60, Dow Jones Industrial Average Index surged by 618.60 points or 1.96 per cent higher at 32,114.90, and the technology benchmark index Nasdaq Composite traded lower at 12,848.29, down by 71.85 points or 0.56 per cent against the previous day close (at the time of writing, before the US market close at 1:10 PM ET).

US Market News: The major indices of Wall Street traded on a mixed note after the passage of the stimulus relief package. Among the gaining stocks, McAfee Corp shares jumped by approximately 10.85% after the cybersecurity company had sold enterprise business to Symphony Technology Group. Xpeng shares surged by about 6.72% after it had narrowed down the loss for its latest quarter. Shares of General Electric Co went up by about 3.40% after the Company is almost on the verge of completing the deal of merging its airline business with AerCap. Walt Disney shares jumped by approximately 2.87% following the news of opening theme parks and stadiums starting from 01 April 2021.

US Stocks Performance*

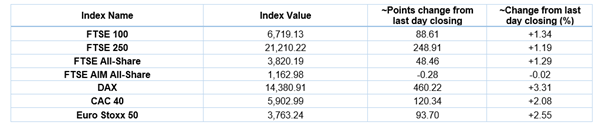

UK Market News: The London markets traded in a green zone after investors’ sentiment was lifted by the gradual easing of lockdown. FTSE 100 traded higher by around 1.34%, underpinned by strength in energy and travel & leisure stocks.

UK-listed diagnostics Company Avacta Group shares surged by approximately 6.53% after confirming that its AffiDX rapid antigen lateral flow test detects the B117 variant, the D614G variant, and the original strain of Coronavirus.

FTSE 100 listed Phoenix Group Holdings had reported a significant jump in operating profit during FY20. The Company had also declared the final dividend of 24.1 pence per share, taking the total FY20 dividend to around 47.5 pence per share. Meanwhile, the shares jumped by about 1.62%.

Educational Publisher Pearson shares went up by around 7.05% after the Company decided to reformulate the business strategy focusing primarily on the direct-to-consumer model. However, the underlying revenue was declined by around 10% during FY20.

Telecom giant BT Group had denied media reports of a fallout between CEO Philip Jansen and chair Jan du Plessis over the pace of strategic decisions. Moreover, the shares went down by approximately 2.79%.

Cryptocurrency miner Argo Blockchain shares jumped by around 14.77% after acquiring 320 acres of land in the USA and updated regarding the completion of the acquisition of DPN LLC.

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 8 March 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); Barclays Plc (BARC).

Top 3 Sectors traded in green*: Consumer Cyclicals (+1.62%), Financials (+1.22%) and Real Estate (+0.74%).

Top 3 Sectors traded in red*: Utilities (-1.30%), Consumer Non-Cyclicals (-1.09%) and Energy (-0.67%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $67.97/barrel and $64.73/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,678.20 per ounce, down by 1.20% against the prior day closing.

Currency Rates*: GBP to USD: 1.3845; EUR to GBP: 0.8569.

Bond Yields*: US 10-Year Treasury yield: 1.594%; UK 10-Year Government Bond yield: 0.758%.

*At the time of writing

_02_05_2025_05_53_40_418159.jpg)