US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 23.38 points or 0.56 per cent lower at 4,150.44, Dow Jones Industrial Average Index dipped by 170.67 points or 0.50 per cent lower at 34,211.46, and the technology benchmark index Nasdaq Composite traded lower at 13,316.03, down by 113.95 points or 0.85 per cent against the previous day close (at the time of writing - 11:30 AM ET).

US Market News: The major indices of Wall Street traded in a red zone after the weakness witnessed in the crypto assets over the weekend. Among the gaining stocks, AT&T (T) shares jumped by around 2.14% after the Company announced a deal with Discovery. ViacomCBS (VIAC) shares went up by about 0.19% after the Company had resolved a dispute with former CEO Les Moonves. Among the declining stocks, MicroStrategy (MSTR) shares plunged by about 6.80% after Bitcoin slipped to its lowest levels in the last three months. Tesla (TSLA) shares went down by about 2.05% after CEO Elon Musk had denied the rumours and confirmed that the Company had not sold any bitcoin.

UK Market News: The London markets traded in a red zone as investors’ worries related to the Indian variant of coronavirus had outweighed the positive sentiments regarding the further reopening of the UK economy.

Budget Airlines Ryanair Holdings shares dropped by about 1.96% after the Company had reported an annual post-tax loss of 815 million euros due to the reduction in passenger numbers as a result of the Covid-19 pandemic. However, the Company had hinted at signs of recovery.

Drax Group was upgraded from “Neutral” to “Buy” by Citi. Moreover, the shares went up by around 1.81%.

Housebuilder Vistry Group shares went down by around 0.66% even after the Company had lifted the full-year profit expectations driven by strong demand across the business.

FTSE 250 listed Diploma shares went up by about 8.36% after the Company had reported strong revenue growth of around 29% to £365.20 million during H1 FY21, led by strong contributions made by the acquisitions and positive trading across all sectors during the period.

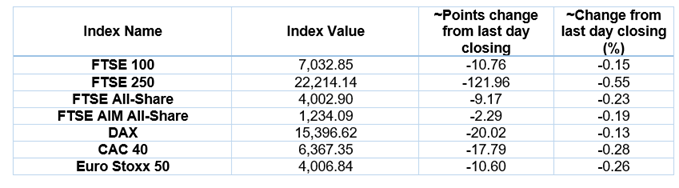

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 17 May 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BT Group Plc (BT.A); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Technology (+0.68%), Basic Materials (+0.65%) and Healthcare (+0.46%).

Top 3 Sectors traded in red*: Financials (-0.58%), Consumer Cyclicals (-0.55%) and Industrials (-0.48%).

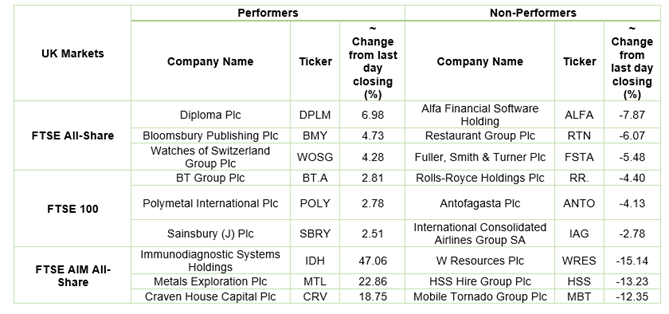

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $69.50/barrel and $66.28/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,868.75 per ounce, up by 1.67% against the prior day closing.

Currency Rates*: GBP to USD: 1.4144; EUR to GBP: 0.8597.

Bond Yields*: US 10-Year Treasury yield: 1.637%; UK 10-Year Government Bond yield: 0.8655%.

*At the time of writing

.jpg)