US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 42.28 points or 0.95 per cent higher at 4,483.95, Dow Jones Industrial Average Index surged by 257.25 points or 0.73 per cent higher at 35,377.33, and the technology benchmark index Nasdaq Composite traded higher at 14,927.20, up by 212.60 points or 1.44 per cent against the previous day close (at the time of writing – 11:50 AM ET).

US Market News: The major indices of Wall Street traded in a green zone amid rising investors’ hopes regarding a delay in tapering due to the latest global Covid-19 wave. Among the gaining stocks, Pfizer (PFE) shares went up by about 5.68% after US FDA had granted completed approval for the Company’s Covid-19 vaccine. PayPal Holdings (PYPL) shares grew by around 0.59% after it would allow UK customers to make cryptocurrency-related transactions. Coinbase (COIN) shares rose by about 0.50% after Bitcoin traded at the highest levels since early May 2021. Among the declining stocks, General Motors (GM) shares went down by around 3.03% after the Company had decided to expand the recall of its Chevy Bolt electric car to include newer models.

UK Market News: The London markets traded in a green zone after the release of PMI data. According to the latest figures from IHS Markit, the manufacturing PMI came out to be better-than-expectations at ~60.1 during July 2021. Moreover, the services PMI stood at ~55.5 during July 2021, while it was ~59.6 during June 2021.

J Sainsbury shares climbed by about 15.37%, boosted by the press speculation that US private equity firm Apollo would consider a takeover bid for the UK supermarket giant.

FTSE 100 listed Pearson shares rose by around 2.11% after JP Morgan had upgraded the Company from “neutral” to “overweight”.

Shaftesbury had posted a recovery in rent collection and showed significant improvements in footfall as UK shoppers returned after the relaxation of the Covid-19 related restrictions. Moreover, the shares went up by around 0.92%.

WPP shares grew by around 0.29% after the Company had completed the acquisition of an artificial intelligence solution provider technology firm, Satalia, for an undisclosed amount.

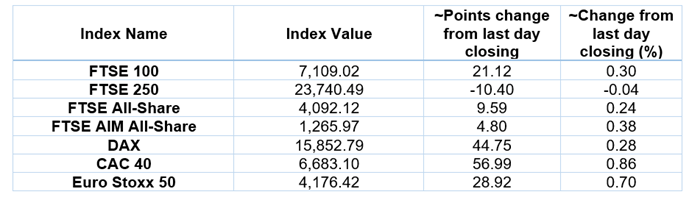

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 23 August 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Rolls-Royce Holdings Plc (RR.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Energy (+2.13%), Basic Materials (+0.91%) and Industrials (+0.46%).

Top 3 Sectors traded in red*: Healthcare (-1.10%), Utilities (-1.00%) and Technology (-0.36%).

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $68.30/barrel and $65.61/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,807.05 per ounce, up by 1.29% against the prior day closing.

Currency Rates*: GBP to USD: 1.3728; EUR to USD: 1.1745.

Bond Yields*: US 10-Year Treasury yield: 1.257%; UK 10-Year Government Bond yield: 0.5320%.

*At the time of writing